Stocks ended Monday’s session mixed, as Dow component Boeing (BA) weighed on sentiment in the wake of plans to curb production on its troubled flagship airplane.

As of market close, the Dow (^DJI) fell 83.97 points, or 0.32%, dragged lower by Boeing—which plunged more than 4%. The company announced plans to cut production of its 737 MAX airplanes by 20% after two recent deadly crashes. Beginning in mid-April, Boeing will cut production of the aircraft, from 52 per month, to 42. Boeing suppliers’ shares also took a hit on the announcement.

Meanwhile, the S&P 500 (^GSPC) rose 0.10%, or 3.03 points, and posted an eight-day winning streak. Energy and Consumer Staples were the best-performing sectors during the session, while Utilities and Real Estate were the worst-performing sectors. The Nasdaq (^IXIC) closed 0.19%, or 15.19 points, higher.

In addition, trade negotiations between the U.S. and China have taken a pause after a meeting between President Donald Trump and Chinese Vice Premier Liu He. Though there are no other immediate sit-downs scheduled between the two countries, the White House has said that the two nations, lumbering toward a new accord to lower trade barriers and remove tariffs, will remain in contact.

“The United States and China had productive meetings and made progress on numerous key issues. Significant work remains, and the principals, deputy ministers, and delegation members will be in continuous contact to resolve outstanding issues,” the White House said in a statement.

Investors will be shifting their focus to corporate earnings this week, when a couple of big banks kick off earnings season on Friday. This week, market participants can expect earnings reports from Delta Airlines (DAL) on Wednesday, JPMorgan Chase (JPM) and Wells Fargo (WFC) on Friday.

According to FactSet, the estimated earnings decline for the S&P 500 is about -4.2% during the first quarter.

Crude oil (CL=F) got a boost and settled at $64.44 on Monday, amid ongoing OPEC production cuts, U.S. sanctions on Venezuela and Iran, conflict in Libya and strong U.S. jobs data from Friday.

STOCKS: Pinterest kicks off roadshow, GE plunges on analyst downgrade

This week, Pinterest kicks off its roadshow and is planning on setting its IPO price between $15 and $17 per share. That would value the company at around $11 billion at the high end of the range, below its private valuation of $12 billion in 2017. Pinterest will list on the New York Stock Exchange under the ticker “PINS.”

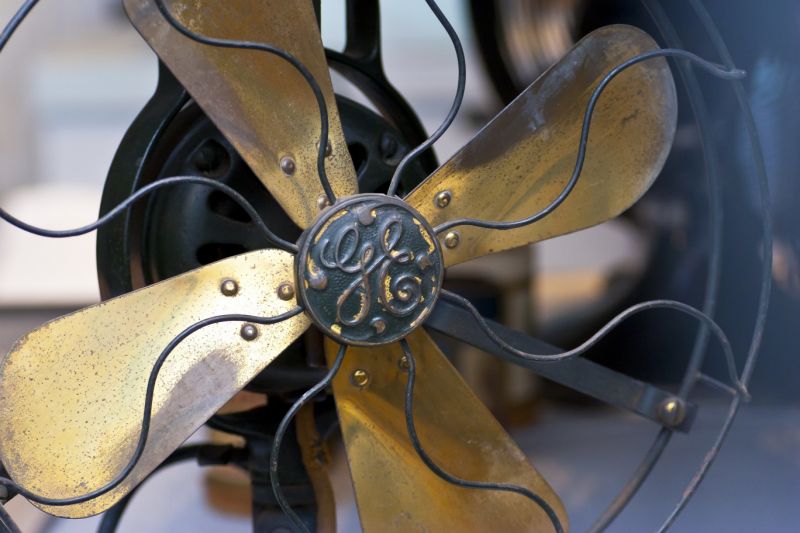

General Electric (GE) shares were under pressure, tumbling more than 5% after a big downgrade by JPMorgan. Analyst Stephen Tusa downgraded GE stock from ‘neutral’ to ‘underweight,’ and slashed his 12-month price target to $5 from $6.

Tusa argued that investors are underestimating the risks and challenges that have long plagued the beleaguered industrial giant, which was once a Dow component before being booted from the index last year.