Call it the semi struggle.

While the chips have rallied to an all-time high, with the VanEck Vectors Semiconductor ETF notching a record of $120.71 a share on Tuesday, some of the group’s best-known names have been left in the dust.

Nvidia, Micron, Applied Materials and Advanced Micro Devices are far off their 52-week highs, with Nvidia down about 34% from its peak last October.

The conflicting action comes as investors, and companies themselves, question how long the typically boom-and-bust cycle of the semiconductor business can last — and whether it will stay boom-bust over the long term as more and more companies use semiconductors in their products.

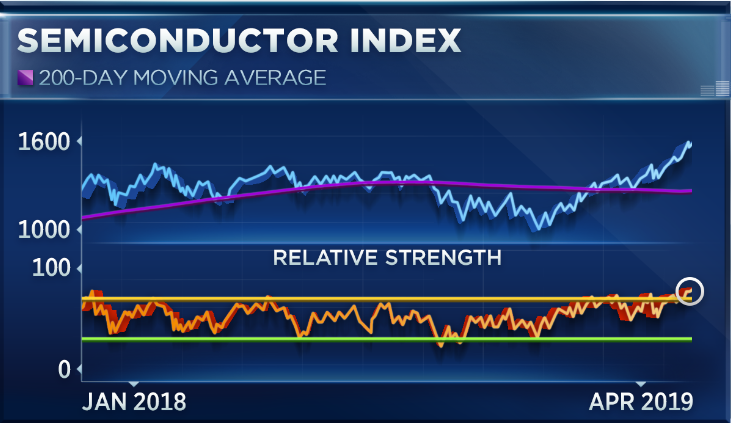

As earnings season heats up, some investors have their eyes on the estimates for companies in the iShares PHLX Semiconductor ETF, which include the likes of Qualcomm and Nvidia. The PHLX hit a fresh high on Wednesday, ending the day more than 1% higher at $1,596. The estimates are forecasting a peak in forward valuation for the group, meaning this round of earnings could be where the space tops out.

“Companies and investors continue to debate whether the semiconductor cycle is turning higher. Buyers of the group up here better hope so, given peak forward valuation,” CNBC markets commentator Mike Santoli said in a tweet.

But some market watchers aren’t getting bearish just yet. Matt Maley, managing director and equity strategist at Miller Tabak, said that while the semiconductor rally is “starting to get a little bit extended,” there’s still time to turn a profit.

“This rally’s been a fabulous one, and it shows that the tech rally in general has been much broader than it was the last time we came out of a correction when the FANG stocks were the only ones really taking us higher. So that’s positive,” he said Wednesday on CNBC’s “Trading Nation.” “But, you know, we have some negative news: Texas Instruments talking about weakening demand or soft demand; J.P. Morgan and Morgan Stanley [saying] things about DRAM pricing that are cautious. ”

But with chip stocks more than 50% higher since their December lows, their strong momentum should be taken into account, Maley said.

“You look at the [Relative Strength Index] chart on the [PHLX Semiconductor Sector Index], and it’s getting to levels where it’s usually followed by a pullback, ” he said. “So I’m just starting to think that it’s had this great run. Pullbacks … are normal and healthy, and therefore I’d want to be a buyer on weakness rather than … chase them way up at these levels.”

Joule Financial Managing Director Quint Tatro had a more specific pick in mind.

“Normally, I do not take that type of trade. I stay far away from laggards,” he admitted. “But, in this case, we believe that money is going to chase things that have not yet run but are still attractively valued.”

And, out of the semiconductor stocks still lagging the index, Micron was the one Tatro liked most.

“Last year was an anomaly with their incredible [earnings per share],” he said. “But if you look at 2017 versus 2019, that’s still about a 34% jump in EPS, and the stock is trading 7 times those forward earnings. That’s about a $30 per share book value. … Ultimately, we believe that this stock is not even close to being bought up to where it is and is going to produce some pretty good returns. So, we see money probably rotating out of the hot stocks and into a stock like Micron. We own it. We’d still be a buyer here.”