Check out the companies making headlines midday Monday:

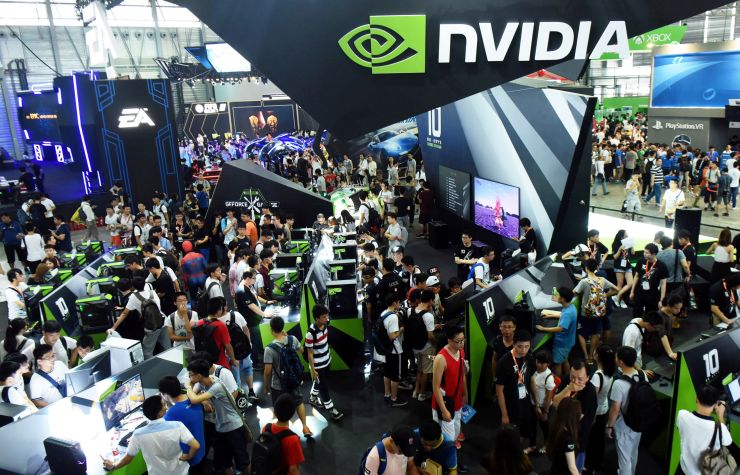

Nvidia, Micron Technology, Advanced Micro Devices — The chipmakers fell all at least 1.7% after President Donald Trump threatened to hike tariffs on Chinese goods, dimming hopes that a trade deal between the world’s economies could be reached.

Bausch Health — Shares of the pharmaceutical company formerly named Valeant gained more than 8.5% after raising its 2019 outlook. The company now expects full-year adjusted EBITDA to come in between $3.40 billion and $3.55 billion, up from a range of $3.35 billion to $3.50 billion. Bausch also reported better-than-expected quarterly earnings.

Sysco — The wholesale food company’s stock rose more than 3% on better-than-expected earnings for its fiscal third quarter. The company earned 79 cents a share last quarter, while analysts polled by Refinitiv expected a profit of 70 cents.

Tyson Foods — Tyson shares rose 2.6% after the company posted strong earnings for its second quarter. The food company reported earnings of $1.20 per share on revenues of $10.44 billion. Wall Street had forecast a profit of $1.14 per share on sales of $10.29 billion, according to Refinitiv.

Five Below — Five Below fell 2.6% after Barclays downgraded the discount retailer’s stock to equal weight from overweight. Despite raising their price target for the stock to “reflect continued business momentum,” the investment bank stated that at $140, they believe Five Below is “fully valued [and] therefore cannot warrant an Overweight rating.”

Pinterest — Shares of Pinterest rose 4% after Susquehanna initiated the social media company as with a neutral rating. In a note to clients, Susquehanna said Pinterest’s user base “is skewed toward women and especially mothers, and this should be attractive to advertisers as women tend to control household purchasing.”

Anadarko Petroleum — Anadarko Petroleum rose 3.8% after CNBC’s David Faber reported that the board of directors on Monday is likely to deem Occidental Petroleum’s buyout offer superior to Chevron’s bid from last month.