Wall Street is under pressure, but a handful of stocks are breaking out to new highs.

McDonald’s, Waste Management, Hershey, Visa and Costco have notched records this month, while ConEd has surged to 52-week highs.

Bill Baruch, president of Blue Line Futures, said these remain solid long-term investments, but under-the-surface indicators suggest they could be in for a near-term breather.

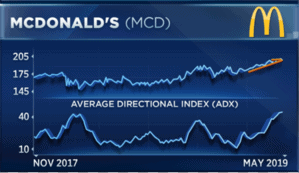

“There are some technicals that do worry me at these levels after such great rallies,” Baruch told CNBC’s “Trading Nation ” on Wednesday. “Take a look at McDonald’s here first. There is an ascending wedge and this ascending wedge can be a bearish pattern if it falls down below it. At the same time, you’re getting an ADX, a trending signal, that’s showing that the trend could be starting to peak.”

Costco and Visa, too, could be running out rope after a more than 20% rally for both so far this year, Baruch said.

Costco “still needs to make a weekly breakout here,” he said. “It’s also showing that the trend is somewhat exhausted here and then Visa, very similarly, hasn’t had the weekly breakout. The trend is a little bit exhausted or dying off.”

The average directional index, or ADX, for Costco and Visa each show a decline after a sharp move higher earlier this spring.

“Take a step back and as an investor, the best answer is always going to be maybe take a little off the table or protect your downside,” said Baruch. “I like the idea of going out to December, going out to the end of this year, and protect your downside with cheap insurance and then that way you can sleep at night.”

John Petrides, portfolio manager at Point View Wealth Management, said it makes sense that these type of names are breaking out given the broader market fundamentals.

“If you look at what’s worked over the past three weeks it’s been with the strong dollar you have U.S.-based companies; with the Fed sitting on the side, yield-oriented securities, high-dividend plays have worked; and since volatility has picked up in the market, low beta has worked as well,” he said during the same segment Wednesday.

However, there is one name that he says to avoid.

“It’s no surprise that ConEd is at a 52-week high and that’s the one that to me is the least attractive out of all of them. Trading at 19X, a premium to the market, for a regulated utility just doesn’t give you the warm and fuzzies,” he said.

ConEd is up 15% this year, and has risen for three quarters in a row, its longest winning streak since 2011.