The bad news: The opening of a second trade-war front along the U.S.-Mexico border last week dialed up fear of global economic stagnation and peaking corporate profits, further pressuring stocks and prompting an urgent rush into Treasury bonds.

The good news: The surprise tariff threat on Mexico pushed Wall Street toward extremes of pessimism and risk aversion that will probably require new and scarier headlines to generate much further selling in the short term.

In other words, to bet big on stocks here is to be a bad news bull: acknowledging that the economy and policy landscape have become tougher, but determining that stocks and bonds have sunk deep enough into a defensive crouch to price in most of it. Or at least that such a point is approaching.

This is not to minimize the damage to the market or underplay its precarious condition. The nearly 7% drop in the S&P 500 since its April 30 high has been swift, even if it is well within the band of a routine pullback after a strong four-month rally.

But the index performance somewhat masks the deterioration underneath. Close to one-fifth of all stocks are below their December lows, even though the S&P is up more than 15% since then. Over the past two weeks, on average close to 10% of S&P 500 stocks a day made a new 52-week low.

And this selling squall is striking the market at a consequential point, the benchmark in a disputed zone between continuing uptrend and breakdown.Multipeak top?

Not only has the S&P 500 slipped below its 200-day average — itself not much of a predictive event — but it has made no net progress for about 17 months, with some seeing a foreboding multipeak topping formation.

The market was showing signs last week of finding its footing, perhaps as investors made their peace with the ongoing U.S.-China trade stalemate. Then came the Mexico news — which pushed markets further in the direction they were leaning: raising probabilities of recession, aggressively pricing in a Federal Reserve rate cut or two in coming months and curtailing risky bets in credit and equities.

At this point, the story moves beyond the details of the trade tussles: After all, what beyond what has been imposed and threatened in these conflicts could further jar Wall Street in the immediate term?

Now it’s about how much more significantly profit forecasts might have to be trimmed, whether the Fed will move in the direction markets have set out for it, and whether sentiment is yet plumbing extremes of negativity that can mean the selling of stocks is running its course. And, most crucial of all, whether trade frictions can be the decisive force that ends the economic expansion at its 10th anniversary.‘Panic and capitulation’

“A reset of earnings expectations could help the equity market find a bottom, even without a final China trade deal, but that reset isn’t likely to happen until the next reporting season (mid July to mid August),” RBC Capital strategist Lori Calvasina said. “This waiting game, in the context of crowded conditions and expensive valuations in US equities, makes a 10% retracement (peak to trough) more likely.”

Tim Hayes, chief global investment strategist at Ned Davis Research, said: “The markets have been warning to an increasing extent that the ongoing trade war will perpetuate the global slowdown with an increasingly negative impact on U.S. growth, as excessive complacency has been replaced by increasing pessimism and doubt about the justification for current earnings multiples.”

He figures this process will culminate in a good opportunity to recommit to stocks in the second half of this year — but not until further signs of “panic and capitulation” arise, and some sort of policy response is in sight.

Panic and capitulation are conditions identifiable only in rough terms and rarely with much precision or deft timing. But it’s becoming possible that sentiment has soured enough to allow for bounces before too long on little more than an absence of further ugly headlines.

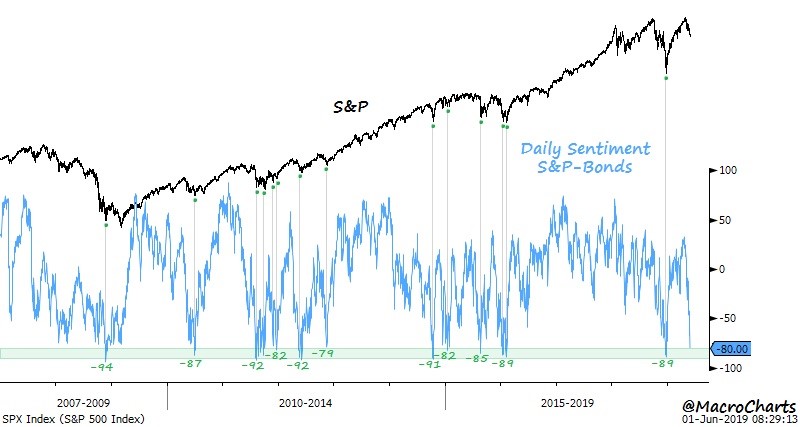

Here’s the S&P 500 plotted by MacroCharts against the difference between bullish readings on stocks and Treasurys in www.trading-futures.com’s widely followed Daily Sentiment Index of futures traders. This gap is on the verge of an extreme that’s coincided with decent trading lows since 2007, implying the massive outperformance of stocks versus bonds is growing spring-loaded for a reversal.

Earnings forecasts have stagnated, which means the S&P 500 is only a bit cheaper than it was eight months ago at the September market high. But the collapse in bond yields has begun to flatten equity valuations.Stocks vs. bonds

The gap between stocks “earnings yield” and the 10-year Treasury yield is at its widest since early January and before than September 2017. Corporate bond yields have refused to decline nearly as much as Treasurys, muting some of the message of stocks’ attractiveness, but it’s a broad glimpse of relative value.

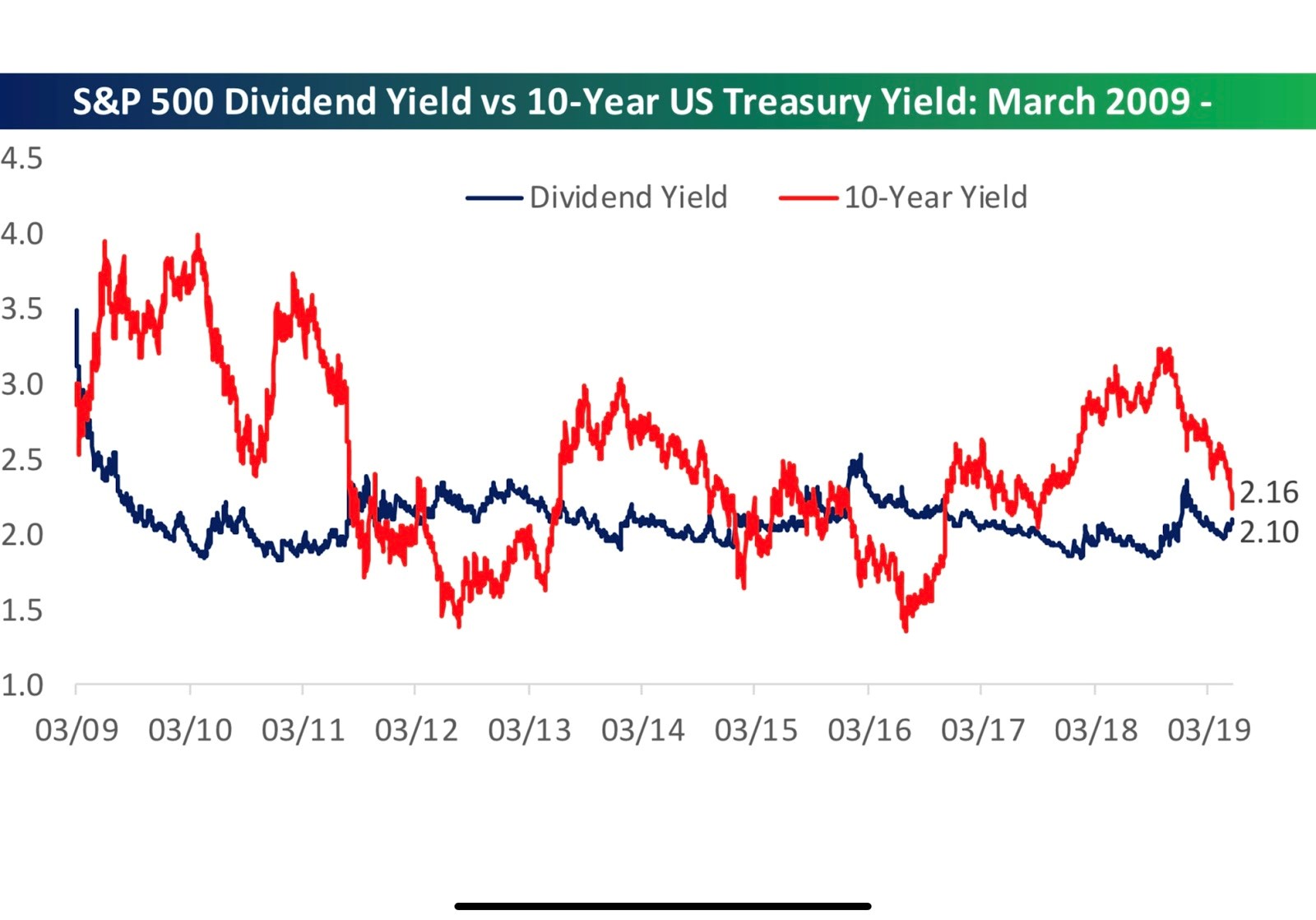

The analogy between the past year’s market and 2015-16 has been made here several times. One other echo is how stocks’ dividend yield now rivals that of Treasurys.

Yet another indicator that is “getting there” in terms of favoring some relief for stocks.

It’s a rough market when the bull case is that stocks have acted terribly, are becoming hated, look cheaper relative to Treasurys (which many view as expensive) and perhaps the inverted yield curve isn’t clearly sending a recession signal this time.

There are big questions to mull with no answers any time soon. Is this a new era of deglobalization, fragmented supply chains and more limited end markets for big companies? If the globalization era that began nearly 30 years ago helped lift average stock valuations, will the unwinding of this premium restrain equity performance in a structural way? Are these trends set to swing the pendulum back toward labor from capital in terms of the rewards of economic growth?

Crucial issues with momentous stakes in the long term.

For now, within the market’s immediate purview, what’s more relevant is whether stocks can make any kind of recovery attempt out of a dramatic buildup of investor fear and rapid cheapening of so many stocks.

![Chrome for Android redesign ditches Duet for dedicated ‘Explore’ tab [Gallery]](https://flyonwallstreet.com/wp-content/uploads/2019/08/chrome_explore_android_1.jpg)