Social Security and Medicare are essential to retirement, yet few near-retirees have a thorough understanding of how they work.

About a third of self-employed baby boomers and 2 of 10 workers in the same age group said they know a “great deal” about Social Security, according to a recent survey from the Transamerica Center for Retirement Studies.

The center polled 5,923 full-time and part-time workers online between Oct. 26 and Dec. 11.

Medicare, the federal government’s health insurance program for retirees, was also hard for survey participants to understand.

Just under 3 in 10 self-employed boomers said they knew a “great deal” about Medicare, while 19% of employees in that age range felt just as knowledgeable.

Here are three tips that can help boost your retirement IQ as well as put away a few more bucks toward retirement.

1. Take advantage of catch-up savings

Many participants age 50 and over were unaware of an opportunity to stash more cash in their retirement accounts, the center found.

Say hello to the catch-up contribution. In 2019, workers can put away up to $19,000 in their 401(k) and $6,000 in their individual retirement account.

If you’re 50 and over, you can stash an additional $6,000 in your workplace retirement plan and $1,000 more in your IRA.

Only 46% of self-employed participants who were in that age group were aware of this additional savings opportunity, according to the study.

Results were a little better among older employees: 6 in 10 knew about catch-up contributions.

2. Maximize Social Security

Nearly 70% of people age 50 or over incorrectly identified the age at which they’d be eligible for full retirement benefits from Social Security, according to a recent survey by the Nationwide Retirement Institute.

On average, these participants believed they would be eligible for full benefits at age 63.

If you were born between 1943 and 1954, your full retirement age is 66. That’s when you can start taking retirement benefits without a penalty.

Taking Social Security at 62 — the earliest age you can claim that income — can result in a permanent decrease in benefits of 25% to 30%.

A little planning can go a long way.

After you hit full retirement age, you gain an 8% increase in your income benefits for each year you delay claiming Social Security, up to your 70thbirthday.

3. Manage Medicare premiums

Here’s a surprise for Medicare beneficiaries: You still must shell out for premiums, deductibles and more.

Medicare Part A (hospital insurance) doesn’t have a monthly premium if you paid Medicare taxes while working.

In 2019, Part A beneficiaries still face a hospital inpatient deductible of $1,364 for each benefit period, plus coinsurance.

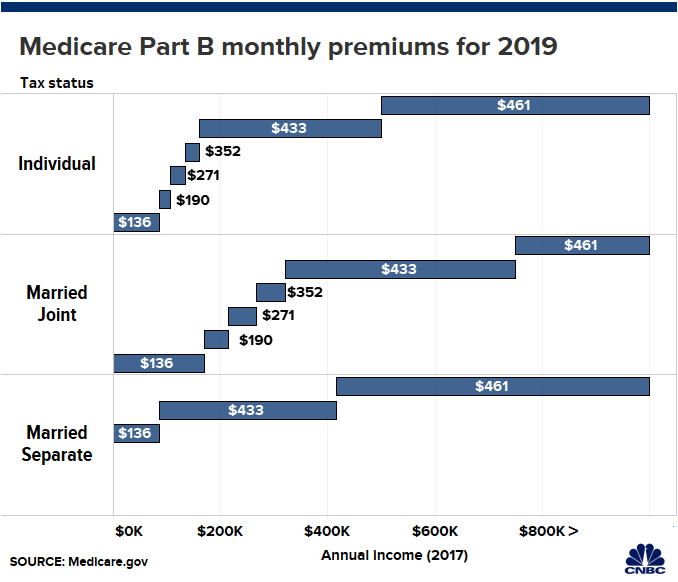

Medicare Part B (which covers doctor’s visits among other items) and Part D (drug coverage) come with premiums that vary based on your modified adjusted gross income from two years prior.

This year, premiums for Part B are $135.50 per month for single filers whose 2017 modified adjusted gross income was $85,000 or less ($170,000 or less for married and filing jointly).

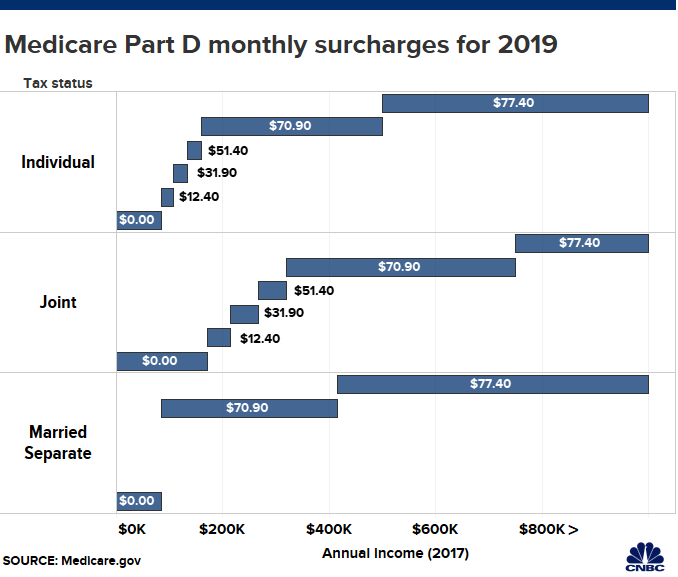

Single taxpayers with a 2017 MAGI over $85,000 ($170,000 for married and filing jointly) can expect to pay extra for their Part D monthly premiums.

By working with a CPA or a financial advisor, retirees can develop a strategy that will allow them to manage their income tax brackets by drawing down from a combination of taxable, tax-deferred and tax-free accounts.

In turn, this could help retirees reduce their premiums for Parts B and D.