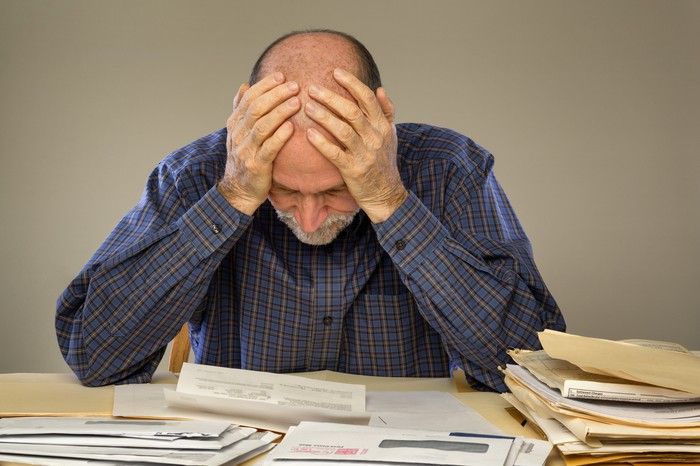

Americans aren’t exactly known as strong savers, which explains why so many live paycheck to paycheck. But in a survey by the CFP Board released earlier this year, 48% of U.S. adults aren’t saving any money for retirement. And that’s disturbing, because while Social Security will provide some income for bill-paying purposes, those benefits aren’t designed to sustain seniors by themselves.

Social Security will generally replace about 40% of the average earner’s pre-retirement income. Most seniors, however, need around twice that amount to live comfortably, and when we think about the expenses retirees face, that makes sense. Most common living expenses, from housing to transportation to food, don’t go away in retirement. Some expenses, like healthcare, can even increase. As such, seniors need more than Social Security to get by, and that’s where independent savings come in.

If you’ve been falling down on the retirement savings front, it’s imperative that you make an effort to improve. Otherwise, you risk struggling financially during your golden years when you deserve to be enjoying that time instead.

Eking out savings

If you’re not in the habit of saving for retirement, it can be tricky to change your ways. But if you don’t push yourself to save something, you’ll be sorry for it later on.

You can get started by creating a budget to follow. That way, you’ll see where your earnings go month after month, and you’ll be able to identify those living costs that perhaps prevent you from saving.

Imagine you set up a budget and find that you’re spending 15% of your earnings on a car payment and vehicle maintenance. That’s a big chunk. If you live in a city where a car technically isn’t necessary, you might decide to unload that vehicle and free up money for retirement savings instead. That’s just one example, but the key is to see where you have room to cut corners so you can carve out savings for your nest egg.

If you’re not willing to cut back substantially on expenses, or there’s really no room in your budget to do so, then a second job could be your ticket to retirement savings. If you’re able to work a few evenings or weekends a month, you might bank a few hundred dollars that can go into an IRA or a 401(k). And when you’re starting with nothing, every little bit helps.

How much money do you need to free up to build a decent amount of retirement savings? Well, it depends on what your goals are. But if you manage to bank $250 a month over a 25-year time frame, and you invest your savings at an average annual 7% return, which is doable if you go heavy on stocks, you’ll wind up with $190,000. Now, that’s not a ton of retirement savings, but it’s also not nothing.

On the other hand, if you manage to save $350 a month over 25 years, you’ll end up with $265,000, assuming that same 7% return. And if you’re able to squeeze out $500 a month, you’ll retire with $379,000.

If you’re younger, and therefore have more than 25 years left between now and retirement, you have an even greater opportunity to grow some wealth. The key, therefore, is to make savings a priority, even if that means working extra or cutting back on some expenses at present. The fact that nearly half of Americans aren’t saving for retirement is troubling on many levels, but if you make an effort to build your own nest egg, you’ll avoid being a part of that unfavorable statistic. More importantly, you won’t join the ranks of the many seniors who inevitably struggle during their golden years.