A decline in interest rates on long-term U.S. government bonds below the average stock dividend yield has received less attention than an inverted Treasury yield curve, but it could be a reason stocks find support after a bruising August.

After the S&P 500 .SPX suffered its first monthly drop since May, in part because the Treasury curve inversion is seen by many as a harbinger of recession, equities have gotten off to a solid start in September, historically their worst month of the year. The uncommon Treasury bond/dividend yield inversion is providing a level of support.

U.S. Treasury yields have fallen in step with a global bond market rally as the trade war between China and the United States has kept recession fears on the horizon. Negative yields on government debt in countries such as Germany and Japan have also helped to depress those on U.S. Treasuries.

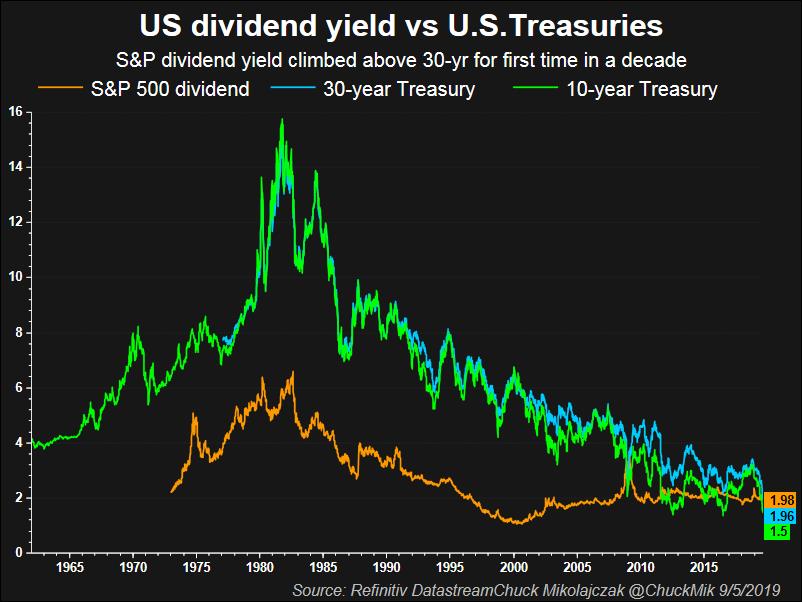

While yields on intermediate-term Treasuries have been below the S&P 500’s dividend yield for several months, the long-term 30-year yield US30YT=RR inverted at the end of August, the first time since March 2009, when stocks bottomed to mark the start of the current bull run.

“Whether it is the Federal Reserve signaling more cuts in the future or just in general this rally in the bond market, overall lower rates – you would think – put some sort of floor on the market as well,” said Mark Kepner, equity trader at Themis Trading in Chatham, New Jersey.

“It’s pretty clear that the $17 trillion in negative-yielding bonds have been a black hole that sucks yields lower and lower in the U.S.,” said Don Ellenberger, head of multi-sector strategies at Federated Investors in Pittsburgh.

With the dividend yield for the S&P 500 now above that of the 30-year, investors may look to stocks with high dividends for income.

After dropping 1.8% in August, the S&P has gotten off to a fast start in September to completely erase that decline, in part due to gains in sectors such as energy .SPNY and consumer discretionary .SPLRCD that contain stocks with high dividend yields.

“There’s a complete disconnect between the stock and bond markets,” said Terri Spath, chief investment officer at Sierra Mutual Funds in Los Angeles.

“Some people are buying stocks for their dividends and bonds for capital appreciation.”

With each of the three major Wall Street indexes coming off monthly declines in August, investors may be tempted to look elsewhere in the short-term as September has been the worst- performing month for each since 1950, according to the Stock Trader’s Almanac. The S&P has averaged a monthly decline of 0.5% and the Dow Industrials .DJI a 0.7% fall in the last month of the third quarter over that time.

But the higher dividend yields compared with government bonds could provide some incentive for stocks. Data from Sam Stovall, chief investment strategist at CFRA Research in New York, shows that there have been 31 instances since World War II when the S&P dividend yield exceeded that of the 10-year note. The benchmark index was higher a year later by an average of 22%, gaining in price 74% of the time.

Over the same time period, Stovall found 20 occurrences of the yield on the S&P topping that of the 30-year Treasury. In the following year, the index had risen by an average of 12% while climbing 80% of the time.

“At some point an absolute thing kicks in and you go ‘Well, where am I going to get my income from?’ and the income- producing stocks, the yielding stocks are an attractive place to go,” said Thomas Martin, senior portfolio manager at Globalt Investments in Atlanta, Georgia.

Of S&P 500 components, 310 held a dividend yield above that of the 10-year note US10YT=RR, while 333 stocks’ yields were above the 5-year US5YT=RR and 253 had yields higher than that of the 30-year bond through Wednesday’s close.

Recent inversions along the yield curve have triggered worries about an economic slowdown, as they have preceded each recession since 1970.

Should a recession take place, stocks will decline and companies could also begin to cut dividends in an effort to conserve cash, further denting their attractiveness to investors.

“If in fact Treasury yields are forecasting a recession, then you’d prefer to own Treasuries at lower yields because equities are likely to sell off,” said Erik Knutzen, CIO of Multi Asset Class at Neuberger Berman in New York.

However, a recent note from Bank of America-Merrill Lynch Global Research’s Savita Subramanian recommended investors stick with stocks over bonds over both the short and long-term, in part due to their dividend yield and relative cheapness over bonds, while also noting fewer than half of their bear market signals have been triggered.

“For long-term investors, valuations suggest 6% annual returns; add 2% for dividends and this beats most fixed income offerings,” said Subramanian.