U.S. equity futures and Asian stocks rose, along with the yuan, after President Donald Trump said he will delay the next U.S. tariff increase on China by about two weeks. The yen and Treasuries dipped.

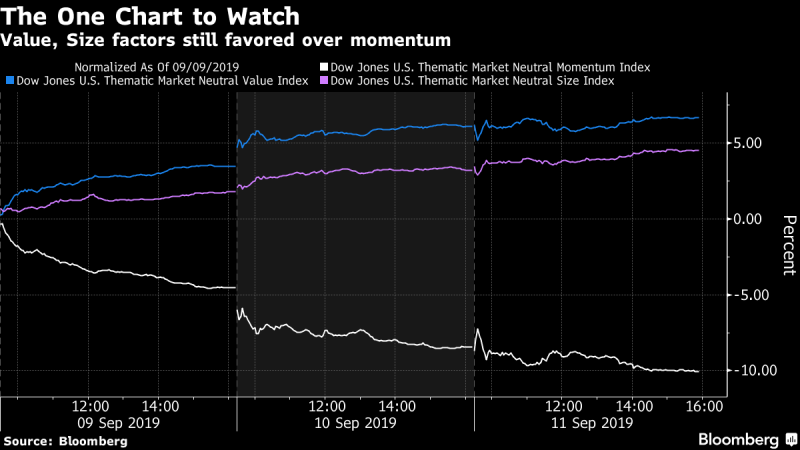

Shares rose in Tokyo, Hong Kong and Sydney on the boost to sentiment as investors awaited a potentially pivotal European Central Bank policy meeting. Earlier, the S&P 500 climbed to the highest since July as tech and healthcare shares gained, with the recent trend of rotation to value from momentum stocks easing. Oil pared overnight losses stemming from signs there could be a thaw in U.S-Iran relations following John Bolton’s departure.

Trump said he was moving back a 5% increase in tariffs on a swathe of Chinese imports by two weeks. China on Wednesday announced a range of U.S. goods to be exempted from 25% extra tariffs put in place last year, as the government seeks to ease the impact from the trade war.

“The quantum and nature of the changes mean they are more symbolic than substantial, but were still well received by investors,” said Michael McCarthy, chief market strategist at CMC Markets Plc in Sydney.

Meantime, focus will turn on Thursday to the ECB’s policy meeting, where it is widely expected to lower interest rates among other potential steps. With the Federal Reserve meeting next week, some have pared their expectations of accommodation and bond traders pulling back from the more bullish sentiment of August. For his part, Trump earlier urged the Fed to cut interest rates to “zero, or less,” in a tweet.

Here are some key events coming up this week:

The ECB policy meeting Thursday is widely expected to see a cut to interest rates and a review of all options, including QE. Policy makers will also publish new forecasts for growth and inflation. ECB President Mario Draghi will hold a press conference.U.S. CPI data is due Thursday.

These are the main moves in markets:

Stocks

Japan’s Topix index rose 0.7% as of 10:25 a.m. in Tokyo.Hong Kong’s Hang Seng advanced 0.5%.The Shanghai Composite added 0.3%.Futures on the S&P 500 Index expiring in December gained 0.5%. The underlying gauge rose 0.7% Wednesday.Australia’s S&P/ASX 200 Index rose 0.7%.

Currencies

The yen fell 0.2% to 108.06 per dollar.The offshore yuan rose 0.2% to 7.0914 per dollar.The Bloomberg Dollar Spot Index was little changed.The euro bought $1.1014.

Bonds

The yield on 10-year Treasuries added two basis points to 1.76%.Australia’s 10-year yield rose two basis points to 1.16%.

Commodities

West Texas Intermediate crude added 1% to $56.29 a barrel.Gold fell 0.3% to $1,493.50 an ounce.