Generally speaking, the higher your credit score, the better off you are when seeking a loan.

But the recovery time from a missed payment or financial setback of any kind differs for everyone.

As many consumers know, your credit score plays a big role in daily life. It can determine the interest rate you’ll pay for credit cards, car loans and mortgages — or whether you’ll get a loan at all.

Those three digits can save you tens of thousands of dollars over time, or cost you just as much.

“Depending on your credit history, a 15- or 20-point shift could mean the difference between being approved or declined or better terms or higher costs,” said Rod Griffin, the director of public education at Experian, a major credit-reporting firm.

The good news is that average credit scores have steadily ticked higher since bottoming out during the housing crisis about a decade ago, when there was a sharp increase in foreclosures. Now scores are at an all-time high, according to FICO, a leading credit-scoring company. FICO scores range from 300 to 850.

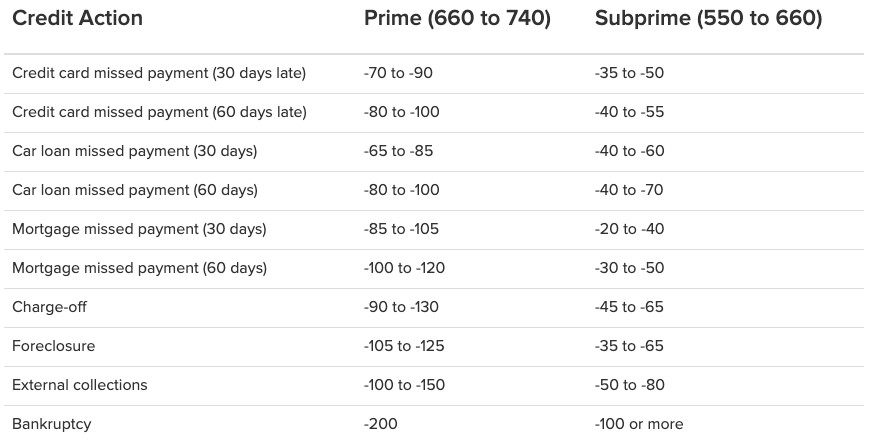

However, a missed payment or default can quickly drag your score down, sometimes significantly. (See financial comparison site SuperMoney’s charts below based on data by VantageScore and FICO.)

The best way to increase your credit score comes down to paying your bills on time or reducing your credit-card balance. (The common advice is to keep revolving debt below 30% of your available credit so that your utilization rate doesn’t hurt your credit score.)

Your payment history and utilization rate typically account for 60% to 70% of a credit score, according to Experian.

Such positive credit behaviors can start to improve your score as soon as a few billing cycles. “As a rule of thumb, you could see an appreciable difference in six months,” said Ted Rossman, industry analyst at CreditCards.com.

However, that also depends on the issues you are trying to overcome.

For example, “if a missed payment has dragged your score down, your score could rebound in a month or two, a series of late payments will take longer to make a full recovery,” Griffin said.

Being late on a mortgage payment is a more serious problem, yet you can recover from that in as little as nine months. File for bankruptcy, on the other hand, and it could take 5 years to 10 years to get back to where you once were, according to Miron Lulic, the founder and CEO of SuperMoney.

In addition, the condition of your credit history also plays a role, Griffin added. “The better your scores are to start with, the more difficult it is to improve them.”

That’s because a lower credit score reflects a pattern of missed payments. Adding one more missed payment is not as significant as it would be on someone who has a clean credit report, according to Lulic.

The goal isn’t to have a perfect score, Griffin said. “The goal is the have a score that qualifies you for the best terms of rates, generally 750 or above.”

Regardless of your starting point, to achieve very good or excellent credit, there are simple things you can do that will have an immediate impact. Here are five tips from SuperMoney to give your score a boost:

- Check your credit report and dispute every error you find.

- Pay your bills on time. Late payments stay on your report for seven years.

- Pay off your credit card balances. This will reduce your credit utilization ratio, which will do wonders for your score.

- Stop applying for credit. Hard inquiries ding your credit for up to 12 months.

- Ask a relative or friend who has good credit habits to add you as an authorized user on their credit card. As long as their payments are made on time, your credit score will improve.