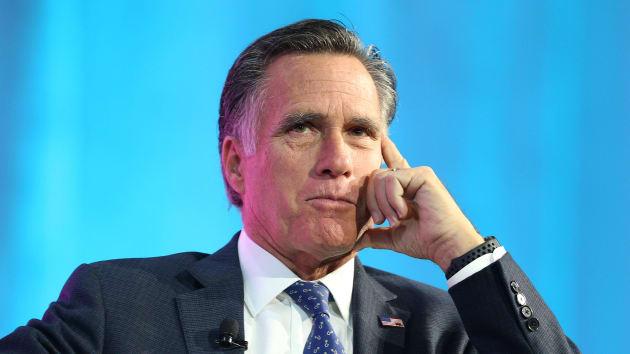

Sen. Mitt Romney, R-Utah, is taking the lead on a new proposal aimed at fixing funding shortfalls for Social Security, Medicare and the nation’s crumbling highways.

What the plan may mean for the future of Social Security has some advocacy groups concerned.

Romney, together with a group of senators from both sides of the aisle, introduced a bill this week to look at government trust funds that are expected to be depleted in the next 13 years.

The affected trusts are the Social Security Old-Age and Survivors Insurance, Social Security Disability Insurance, Medicare Hospital Insurance and Highway Trust Fund.

The proposal comes at a time when House Democrats are pushing their own legislation to extend the solvency of Social Security.

If nothing changes, the program’s trust funds are projected to run out in 2035. At that point, just 80% of promised benefits would be payable.

“We must put in place a responsible process now to prevent dramatic cuts to programs like Social Security and Medicare or be forced to enact massive tax hikes down the road, both of which would be devastating to middle-class Americans,” Romney said in a statement announcing the proposal.

A call to Romney’s office was not immediately returned.

However, Social Security advocacy groups who want to see benefits increased say they are skeptical. That stems in part because Romney called for raising the retirement age, a move that would cut benefits, in his 2012 presidential campaign.

“We agree that it’s important to address solvency,” said Dan Adcock, director of government relations and policy at the National Committee to Preserve Social Security & Medicare. “We also think it’s equally important to address benefit adequacy, because of the struggle that the middle class and working class have these days in saving for retirement.”

How Romney’s bill would work

The Romney-led proposal, called the Time to Rescue United States’ Trusts, or TRUST, Act, would create congressional committees to evaluate how to bolster solvency or make other changes to improve the programs.

It is supported by Sens. Doug Jones, D-Ala.; Joe Manchin, D-W.Va.; Kyrsten Sinema, D-Ariz.; and Todd Young, R-Ind.

Companion legislation has also been introduced in the House by Reps. Ed Case, D-Hawaii; Mike Gallagher, R-Wis.; Ben McAdams, D-Utah; and William Timmons, R-S.C.

Once the TRUST Act is passed, Treasury would have 30 days to deliver a report to Congress on the status of the funds.

Congressional leaders would form a rescue committee for each trust fund. Those committees would be tasked with coming up with legislation to repair those funds’ solvency and identify other improvements the programs may need.

At least two members of each party would be required to work on the legislation.

The proposal also says that any qualifying bills that emerge from the process get expedited consideration in both the House and Senate.

Why some advocates are concerned

The proposal comes at a time when another legislative initiative, the Social Security 2100 Act, could potentially move to a markup by the House Ways and Means Committee and then to the House floor.

That bill, which was proposed by Rep. John Larson, D-Conn., currently has 208 co-sponsors. All of those supporters are Democrats.

The Social Security 2100 Act calls for increasing benefits, including a broad boost equal to 2% of the average benefit and a new minimum benefit that would be 25% above the poverty line.

It would also raise the income thresholds before benefits are taxed to $50,000 for individuals and $100,000 for couples, up from $25,000 and $32,000, respectively.

To pay for those changes, the bill also calls for applying payroll taxes to wages above $400,000. Only wages up to $132,900 are currently taxed.

The bill would also gradually increase payroll taxes for all workers to 7.4% from 6.2% between 2020 and 2043.

In contrast, Romney’s bill aims to create a more bipartisan approach.

However, groups that want to see Social Security benefits increased were quick to criticize the proposal, particularly because it lacks details or transparency.

Nancy Altman, president of Social Security Works, said Romney is “acting true to his income” by putting forward a plan that could potentially pave the way for benefit cuts.

“They want to pretend that they’re saving the program, and they are going to do it behind closed doors in a fast-track process,” Altman said. “They want to do something the American people don’t want, which is why they’re doing it this way.”

Adcock also said the plan potentially gives politicians political cover to cut benefits.

“Solvency is great, but it’s only half the equation,” Adcock said. “The other part is are the benefits adequate enough to make sure seniors don’t live in poverty?”