Few things in life are guaranteed. The old adage says only death and taxes are promised us. Besides that, the future is never guaranteed — even when you solemnly swear “’til death do us part.”

No one plans to get divorced. We can, however, rescue our retirement plan after a divorce. There are many factors to consider on your journey to retirement after divorce, such as taxes, children’s college funding, credit changes, and your own retirement dreams, goals, and desires.

Having personally been through this life event, one of the most important things you can do is take stock of what you have once the dust settles. Having a plan to get you where you want to go needs to start with where you are now.

A New Start

Taking a fresh look at all your assets, whether investible or not, will give you a clear direction for rebuilding or optimizing what you have. If you find your retirement accounts have been reduced by half, then taking an in-depth look at each account’s investment allocation will help you decide if you need to be more aggressive.

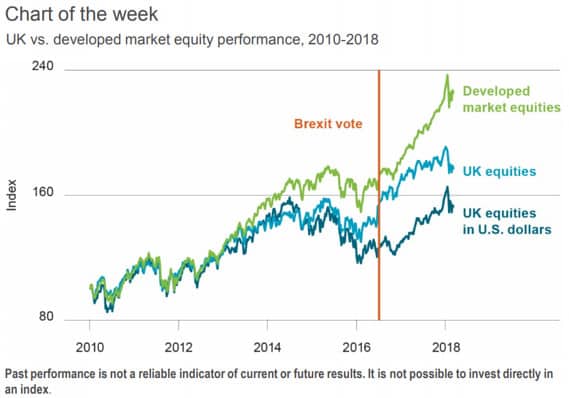

Most employer plans offer a full spectrum of investment options, from low-risk to fixed income bond funds to higher-risk international funds. You should review your positions every 90 days under normal market conditions. With increased volatility in the markets becoming the new normal, it is wise to review your underlying investment rate of return and adjust with market trends accordingly. The key is to actively engage in your retirement accounts moving forward. That way, you can harvest any gains from investments or mitigate any significant drawdowns like we saw in 2008.

You’ll also want to look at the costs associated with these investments. Many times, you can increase your return up to 2% by simply moving away from target date funds and into low-cost indexed funds, which are becoming more prevalent in employer plans.

Reassess Your Goals

Once you have a good picture of your financial foundation, it is time to reassess your goals. Let’s say you are 40 years old, have $100,000 left in your retirement account, make $80,000 a year, and still want to retire at age 65. You would need to save an estimated 10% of your income, or approximately $703 per month, in order to keep the same income in retirement paired with Social Security income.

You may think, “I won’t need the same amount of income when I’m retired because I won’t be going out to lunch with co-workers or buying that coffee and bagel on the way to work.” You may not be driving to work, but you will be driving somewhere! Maybe you’ll be taking grandkids to the mall, or buying them lunch, or investing in hobbies you didn’t have time for before retirement.The point is retirement costs money, and it probably costs more than you think.

Plan Your Way There

Now that you have a known goal, you can dive into a detailed income and expense plan to optimize what you can put away. Looking intently at what truly is a “want” and a “need” and adjusting your lifestyle to that perspective will give you a boost. With a good plan, the retirement you desire is still achievable.

This stage is also a great time to look at what your new tax bracket will be and how to offset the higher limits imposed on single filers. Tax saving vehicles like health savings accounts, flexible spending accounts, and college plans can be key to reducing the amount of taxes you owe to the government.

Up to age 50, there is an annual maximum contribution to a 401(k) plan. After age 50, you can make annual catch-up contributions in addition to the maximum contribution. If you find yourself in an income bracket to max these out, adding the maximum contribution to a health savings account can not only reduce your taxable income but also give you a tax-deferred bucket to pay medical expenses in retirement.

Flexibility Is Key

As you begin to walk your new path toward retirement, keep in mind it needs to be flexible. This is not something you can set and forget. As you continue through life, markets will change, as will your dreams, goals, and desires.

While your goal should be reviewing your retirement accounts quarterly, it isn’t all about the numbers. We recommend reviewing beneficiaries on all accounts at least annually. Also, take a look at beginning your estate plan.

Most of us don’t like to think about what happens when we’re gone, but it becomes even more paramount after a life-changing event like divorce. Having a trust designed to your specific estate plan can help you dictate what happens to your assets should another major life event occur. You can ensure a plan is in place to pass your assets to whomever you want, however you want, whenever you want.

While a traumatic life event like divorce can create a lot of stress and anxiety about your future, sitting down with an advisor who can offer a unique perspective on rebuilding and refocusing your new life goals should be one of your first steps toward your new retirement dream. You have worked hard for your assets, and it’s time we work just as hard for you.