Technology and bank stocks in Asia dominated the top picks for analysts in 2019, as shares in the region made strong gains this year.

Mainland Chinese stocks also rallied this year, with the Shanghai composite soaring nearly 22% higher than the start of the year, while the Shenzhen component skyrocketed by about 43%. The Shenzhen composite also followed the trend, rising some 35%.

Hong Kong’s Hang Seng index, meanwhile, is set to end 2019 higher than the start of the year — about 12% higher, going by last Friday’s close.

MSCI’s broadest index of Asia Pacific shares outside Japan hit a year-high earlier in December. The valuations of Asian stocks, meanwhile, climbed to a new two-year high in November, going by Refinitiv data.

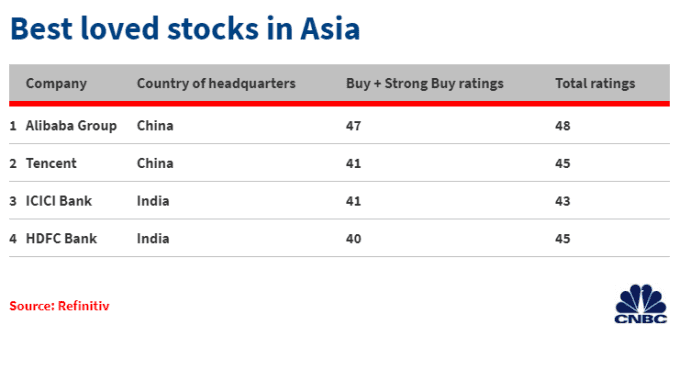

These were the best-loved stocks in Asia this year.

Top picks

Chinese tech giant Alibaba is the most-loved company in Asia, according to Refinitiv data. Of the analysts who covered the New York-listed stock, 47 out of 48 issued “buy” and “strong buy” calls for Alibaba — the highest number among all companies that were covered.

In November, the tech titan debuted in Hong Kong in a much-anticipated initial public offering, and raised $1.12 billion in the secondary listing. It was one of the world’s largest listings this year.

Hong Kong-listed Tencent was a close second, with 41 out of the 45 analysts covering it calling for a “buy” and “strong buy,” Refinitiv said.

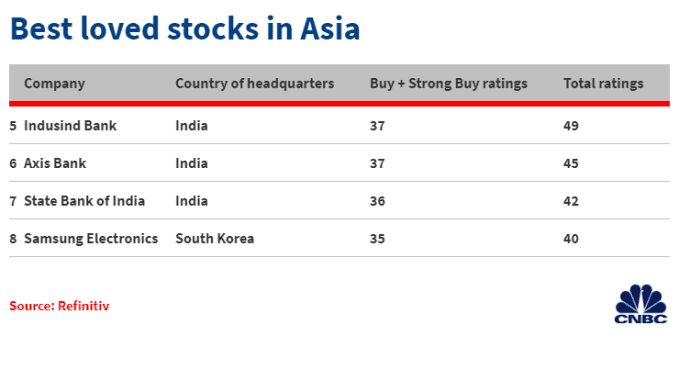

In tech stocks elsewhere, South Korea’s Samsung Electronics was also a favorite. Refinitiv data showed that there were 35 “buy” and “strong buy” calls — out of the 40 analysts covering the stock. As for SK Hynix, 32 out of 38 analysts recommended the stock, data from Refinitiv showed.

Banks in India dominated other top spots in the list, including the State Bank of India and ICICI Bank — which are among the largest lenders in the country.

India’s state banks have been plagued by troubles, laden by debt and are said to have the highest exposure to bad loans. But the government has pumped billions of dollars to help those troubled lenders, in exchange for them implementing reforms. Those reforms are set to strengthen the sector over the next few years, analysts say.

Tech an ‘important bellwether’

Looking ahead, the region is set to benefit from an upturn in the tech cycle in 2020, according to Japanese bank Nomura.

Estimates project a year-on-year rise in semiconductor sales of between 5% to 8%, Nomura said in its 2020 outlook report. Rising demand as a result of investment in 5G is expected to support that, and economies in South Korea, Taiwan, China, Malaysia and Singapore could benefit from it, the Nomura report said.

In particular, Morgan Stanley upgraded South Korea’s information technology sector to an “overweight” rating in a recent report, an indication that it expects it to outperform its peers.

The sector is an “important bellwether” for the overall emerging markets outlook, said Morgan Stanley. Although the semiconductor market has experienced one of its worst downturns, “a turnaround is appearing” in 2020, it said.

On the back of that expected turnaround, the investment bank has upgraded its rating to “overweight” for Samsung Electronics and SK Hynix, two stocks that dominate the South Korean IT sector and the benchmark Kospi index.