Disney reported mixed results for its Q2 2020 earnings after the bell on Tuesday. The stock jumped around on the news of the report but was down more than 2% after hours following the earnings call. The coronavirus pandemic has disrupted Disney’s theme parks and cruise businesses but boosted engagement on its newly-launched streaming service, Disney+.

Here’s what Disney reported:

- Earnings per share (EPS): 60 cents, ex-items

- Revenue: $18.01 billion

Wall Street had been anticipating earnings per share of 89 cents on revenue of $17.80 billion, based on Refinitiv consensus estimates. However, it’s difficult to compare reported earnings to analyst estimates for Disney’s second quarter, as the pandemic continues to hit global economies and makes earnings impact difficult to assess.

This was Bob Chapek first earnings call as CEO of Disney, after former CEO Bob Iger announced in February he would transition to the role of executive chairman. Iger previously told investors would shift his focus to creative projects, but he was the first to speak on the company’s analyst call. Though he was largely absent from the Q&A section. Iger reportedly was called back into the day-to-day operations as stay at home orders accelerated across the U.S.

Disney is suspending its dividend payout for the first half of the fiscal year, CFO Christine McCarthy said on the call. The move would preserve $1.6 billion in cash assuming the dividend held constant at 88 cents per share, McCarthy said. Total operating income was $2.42 billion in the quarter, down from $3.82 billion, a 37% drop.

McCarthy said Disney would revisit and address the dividend again in the next six months once it is better able to assess the impact of the virus.

The pandemic’s impact was especially pronounced in its Parks, Experiences and Products segment. Disney estimated the impact on its operating income for that segment was about $1 billion mostly due to revenue lost because of closures. The company reported a 58% drop in operating income for the segment this quarter compared to the same period last year.

On the company’s analyst call, Chapek discussed the new procedures Disney would put in place at its parks once they reopen, including limiting guest capacity, implementing density control and health precautions like temperature checks and masks.

Chapek said the company is “seeing encouraging signs of a gradual return to some sense of normalcy in China” and would reopen its Shanghai Disneyland park on May 11 with a phased approach. Typically, he said, the park has 80,000 visitors per day, but the government has mandated they operate at 30% capacity, or 24,000 visitors. Chapek said the park would initially open operating well below that capacity and ramp up to reach the 30% cap over several weeks.

The company has furloughed about 100,000 employees as it suffers from shutdowns in its parks business, McCarthy confirmed on the call.

Chapek said Disney is seeing signs that customers still want to go on their cruises, though that won’t be for several more months at least. He credited the sentiment to customer trust in the brand.

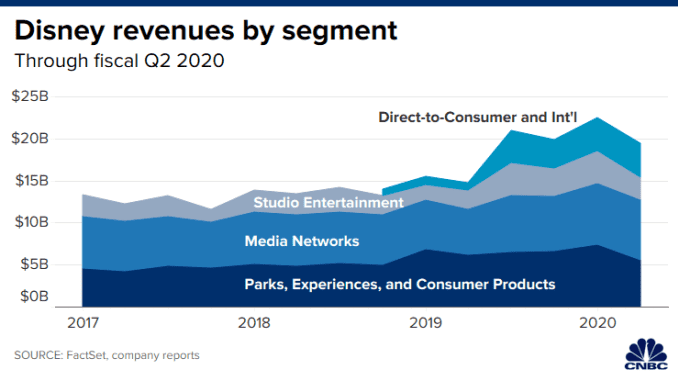

Here’s how Disney’s segments performed in the quarter in terms of revenue compared to the same quarter last year:

- Media Networks: $7.26 billion, up 28%

- Parks, Experiences and Products: $5.54 billion, down 10%

- Studio Entertainment: $2.54 billion, up 18%

- Direct-to-Consumer and International: $4.12 billion, up more than 100%

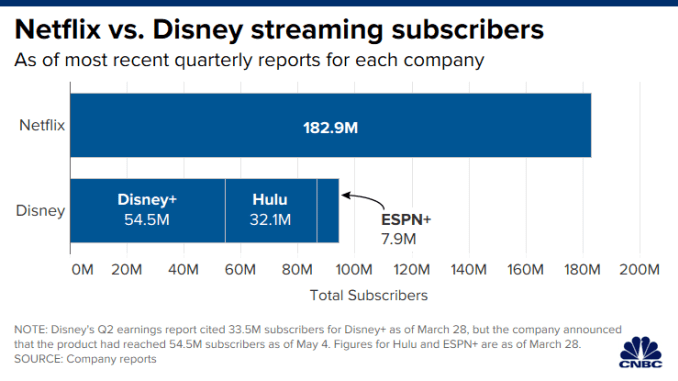

Disney saw a bright spot in its direct-to-consumer business. The company reported that as of March 28, it had 33.5 million paid subscribers to its new streaming service, Disney+. By early April, the company said it had surpassed 50 million paid subscribers as more workers stayed at home to slow the spread of the virus. As of May 4, McCarthy said on the call, that number was 54.5 million.

The company is continuing to roll out the service internationally. Despite the massive growth, executives declined to give new guidance on the service including when they think it will become profitable.

Disney’s Hulu had 32.1 million total subscribers by March 28, up 27% year-over-year.

Disney’s ESPN suffered from the loss of live sports content as major sports leagues postponed their seasons. Advertising revenue was down about 8% in the quarter, which McCarthy credited to the loss of live sports content. But McCarthy said there are positive signs of “meaningful pent up demand” for sports programming. The NFL draft was the most-watched ever, reaching more than 55 million viewers over three days, and the docu-series, “The Last Dance” has seen record viewership as well, she said.

McCarthy would not comment on Disney’s active discussions with sports leagues over cash payments they made for live sports events that postponed indefinitely.

“We are working very very closely with the leagues and the conference partners,” she said.