Since the coronavirus pandemic unfolded, many Americans have cut their spending. But those earning the highest incomes have curbed their purchases the most, according to a new report, even though they were less likely to have lost their jobs or incomes.

But the frugality from the highest earners could jeopardize the speed of the U.S. economy’s recovery, experts warned, because many lower income jobs depend on that spending.

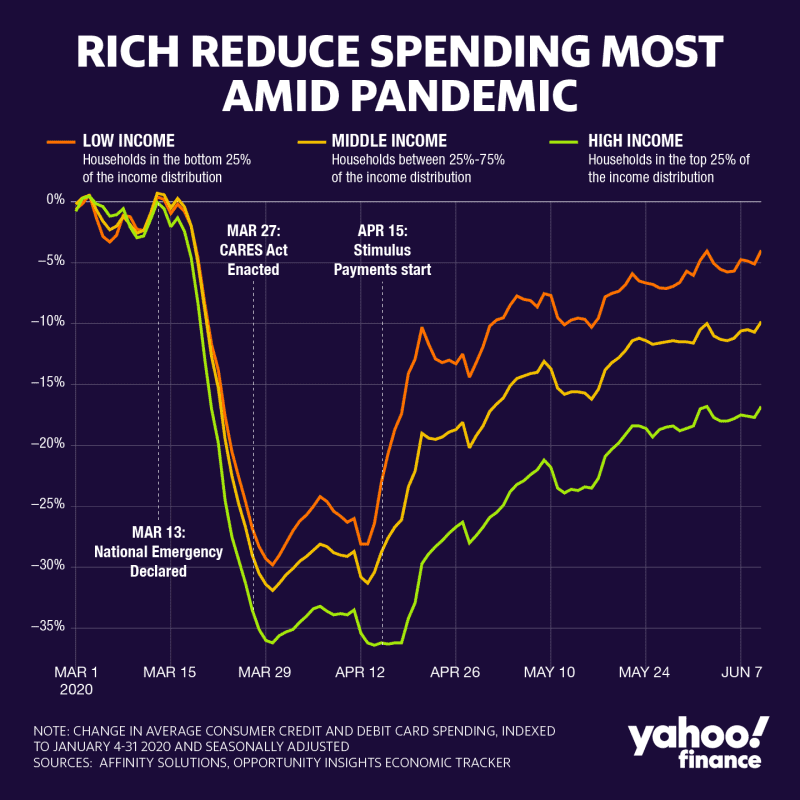

In mid-April when consumer spending reached its bottom, the top quartile of earners reduced their spending by 36%, while low-earners shrunk theirs by just 21%, a new paper by the Harvard-based Opportunity Insights group found.

By mid-June, over half the spending decline in the U.S. since January was due to the pullback from high-income households. Low-income households accounted for only 5% of the decline, the report found.

“They have the resources to spend, but are not currently going out and doing it,” said Michael Stepner, an economist at the University of Toronto and co-author of the paper. “Really the driver with high-income spending is a concern about being exposed to the virus, and not a loss of resources.”

Nearly three-fourths of the spending reduction were on purchases for goods or services that require in-person contact like hotels, transportation, and food services, according to the paper, which analyzed seasonally adjusted consumer debit and credit card spending indexed to January spending data.

‘Most of them have not lost their jobs’

“These are not people who are short of money; this is by definition,” Dean Baker, chief economist at the Center for Economic and Policy Research. “Most of them have not lost their jobs, they’re working from home, or they have substantial job income from stocks or other assets.”

Unemployment due to the pandemic has disproportionately hit low-income Americans, with 2 in 5 workers who lost their jobs in March falling into that category, according to a May Federal Reserve survey.

“The employment of low-income people has declined a lot more than the employment of high-income people,” Stepner said.

Not only are high-earners less likely to have lost their jobs, but they also could better isolate versus workers in lower income brackets. The fact they were more likely to have stayed home also contributed to their drop in spending, Stepner said.

“They have less need to leave the house,” he said. “Because they live in dwellings that are more spacious and easier to spend time in than someone who is living in cramped quarters.”

‘People remain concerned about the health consequences’

While high-income earners largely cut down on purchases that require in-person contact during the lockdowns, they don’t seem ready to return to their old ways as shutdowns are lifted.

“State governors declaring that the economy is reopened has very little impact on spending in that area,” Stepner said. “The reason people are staying home is not just because the state government or the local government has announced there’s a shutdown, but because even if they’re allowed to go back, many people remain concerned about the health consequences.”

Overall, the number of coronavirus cases is a strong predictor of how much spending declines, according to Stepner.

“But it’s an even stronger predictor for high-income Americans than for low-income Americans,” he said.

As long as the health risk remains real, high-income earners won’t resume their pre-pandemic level of spending, no matter if their state reopens, Baker said.

“Every country in Europe [but Sweden] has seen a huge reduction in their infection rates,” Baker said. “I don’t think people realize that we’re just an incredible outlier. We’re down from our peak, but in those countries they’re down like 90-95% from their peaks. We’re down like 30%, so we’ve really just done a horrible job.”

And even when high-earners fully go back to spending as they did before, that won’t make up for the purchases they didn’t make during the pandemic or help businesses recoup earlier losses from reduced spending.

“The fact that you wait an extra month to get your haircut doesn’t mean that now you’re going to get haircuts more often going forward,” Stepner said.

‘People who are earning their paycheck from that discretionary spending are out of work’

One reason high-income households can cut down so much on their spending is because they have more disposable income available to them that goes to discretionary items. But this same discretionary spending supports the jobs of low-wage workers in the service sector.

For instance, in ZIP codes with the more expensive rent — where more affluent Americans live — more than 65% of workers at small businesses were laid off within two weeks after the health crisis began. In more affordable ZIP codes, fewer than 30% of workers lost their jobs.

“Because the rich have so much scope to cut back on their discretionary spending, people who are earning their paycheck from that discretionary spending are out of work,” Stepner said. “[The pandemic] has made clear just how interdependent we are to one another for our income.”