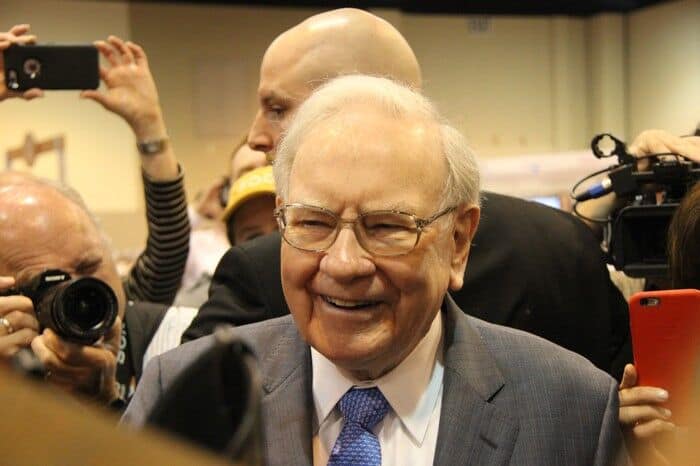

Warren Buffett is generally regarded as one of the greatest investors of all time. Investors who’ve shared his value-oriented philosophy have generally done well for themselves over time, in some cases even earning the title “Superinvestors.”

Still, despite his incredible success as an investor, he follows some money management practices that are downright dangerous for us mere mortals to follow. These three reasons you shouldn’t invest like Buffett cover several of those areas. While what he does with his money may work for him, your circumstances are likely vastly different from his, which makes it important for you to understand which parts of his strategy are dangerous to follow.

No. 1: Nearly all his investing eggs are in one basket

Buffett is worth somewhere in the neighborhood of $82.4 billion, an incredible amount of money. Still, nearly all his money is tied up in the stock of one company, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). Having all your money tied up in one company’s stock is one of the most dangerous financial things you can do, because if that company fails, all your savings will get wiped out.

Consider the case of Arthur Andersen, formerly one of the largest and most respected accounting and auditing companies in the world. It had a nearly 90-year history and around 28,000 employees working for it, and its participation in one single scandal — the Enron debacle — ruined the business and forced it into bankruptcy.

Sometimes, you can see a company’s pending failure coming at you like a slow-motion train wreck. Other times, it will seemingly come out of nowhere and surprise you. Either way, if all your money is tied up in the stock of a company that goes bankrupt, that money will be lost to you forever.

No. 2: That basket is the same company that employs him

Perhaps even scarier than the fact that nearly all of Buffett’s money is tied up in a single stock is that it’s in the shares of the very same company that employs him. For us mere mortals, that’s a double-whammy. After all, if your net worth is completely tied up in your employer’s stock and it goes under, you not only lose your savings, but you your job and source of income as well.

There were more than 22,700 corporate bankruptcy filings in the United States in 2019, and that was pre-COVID. While we won’t know the full 2020 statistics until the year is over, corporate bankruptcy filings are up substantially in the calendar year to date as businesses struggle with the shutdowns from the virus.

In Buffett’s case, he happens to be CEO of the company, and he runs Berkshire Hathaway somewhat like a diversified mutual fund. The company not only operates in insurance, but it also owns a railroad, a battery brand, a furniture and shoe businesses, a candy company, a restaurant chain, a power business, and a whole host of other business lines as well.

Being CEO of Berkshire Hathaway and running it like a mutual fund helps put Buffett more in control of his financial destiny than those of us who are simply trying to scratch out a living and save a few bucks. If you’ve got the opportunity to run your own business and invest its assets across a broad spectrum of companies, feel free to follow Buffett’s lead on this front. If not, then the risk/reward trade-off is simply far too dangerous for you to have all your money tied up in your employer’s stock.

No. 3. He’s 90 years old and invested nearly completely in stocks

Buffett’s declared plan is to work as long as he is mentally and physically capable of doing so. Given that he has a job that requires not much physical exertion at a company where he owns enough of a stake where he’d be difficult to oust, he’s in a great position to do so.

For the rest of us, however, either because we can’t or simply don’t want to be still earning a paycheck at age 90 or beyond, it’s far too dangerous for us to be that age and still be 100% invested in stocks. Don’t just take my word for it — Buffett’s own instructions for managing his wife’s money after he passes includes a 10% bond allocation.

Even in today’s low-interest-rate environment, once you’re dependent on your portfolio to cover your costs of living, that portfolio should not be exclusively tied up in stocks. Although stocks have been a tremendous way to build wealth over time, they’re a terrible vehicle for generating near-term spending cash. They’re simply too volatile to be a reliable source of immediate cash. Recognizing that reality should be a critical foundation of every person’s retirement planning.

After all, your bills need to be paid, and selling stocks while they’re down to cover your costs is a great way to run out of money before you run out of retirement. To cover those spending needs, you need some money in lower-volatility investments such as bonds, CDs, or even cold, hard cash. Like Buffett’s guidance for his wife, it’s perfectly acceptable to keep money in stocks to cover your longer-term future, but money you need to spend in the next few years does not belong in stocks.

Great investor — different life circumstances

Even though you shouldn’t emulate these particular parts of Buffett’s investing strategy, he remains an incredible investor whose overall approach is worth studying. Just recognize that he has different life circumstances from the rest of us, and that enables him to use some money management tactics that are downright dangerous for regular people. Keep that in mind as you look to invest, and feel free to use most of the rest of Buffett’s value-oriented techniques to help you build your nest egg.