The Securities and Exchange Commission has fined General Electric $200 million to settle charges for misleading investors regarding its power and insurance businesses.

The SEC said it found that GE misled investors in 2016 and 2017 about the source of profit in its GE Power business, one of the company’s core operations. The company also failed to fully inform investors about risks associated with GE Capital, its financial services arm, between 2015 and 2017, the SEC said.

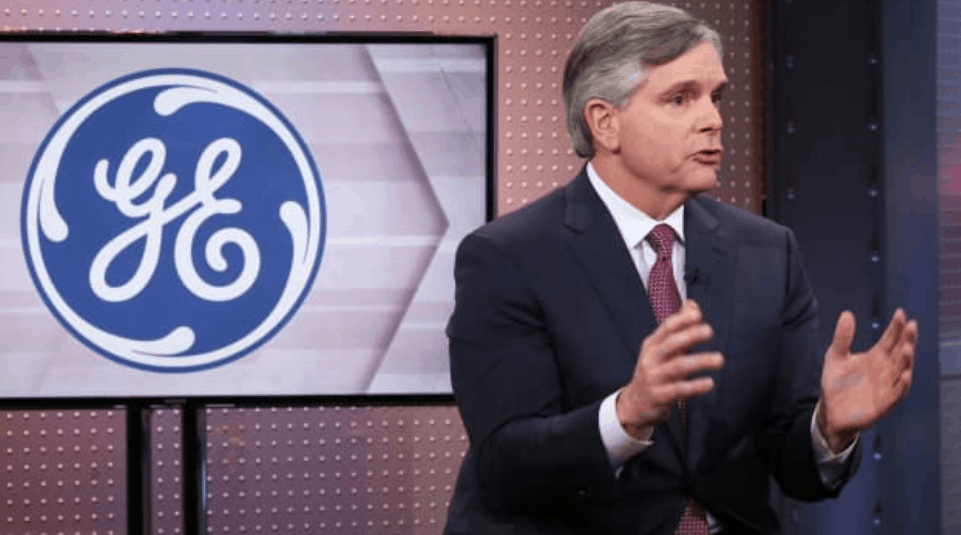

The settlement caps the SEC’s years-long investigation into poor business practices under the conglomerate’s former leadership team. Under CEO Larry Culp, executives are now trying to stage a comeback after years of decline. The company, which made its name selling lightbulbs, now manufactures everything from major appliances to airplane parts and medical devices. It also has power, digital and financial arms.

“Investors are entitled to an accurate picture of a company’s material operating results,” Stephanie Avakian, director of the SEC’s division of enforcement, said in a statement. “GE’s repeated disclosure failures across multiple businesses materially misled investors about how it was generating reported earnings and cash growth as well as latent risks in its insurance business.”

Shares of GE fell almost 75% in 2017 and 2018 as the disclosures became public, SEC said. The company settled the charges and agreed to pay the civil fine without admitting or denying the findings, the SEC said.

Avakian said on a conference call with reporters that GE “failed to disclose material information about how it achieved more than $1 billion of its reported power profits in two separate years.” She added that the company pulled forward $2.5 billion in cash collections that were due five years in the future “by selling receivables to another GE subsidiary.”

“Also at a high level, GE misled investors by failing to disclose worsening trends and the reasonably likely need for additional reserves to cover higher anticipated losses,” she said. “Taken together, these disclosure failures painted a deceptively positive picture of the state of GE’s overall business at the time.”

Avakian said the SEC also found inadequacies in GE’s internal accounting and disclosure controls and procedures. The commission found that GE made misleading statements and omissions to investors in earnings calls, industrial conferences and “in its periodic filings with the SEC,” Avakian said.

The company also agreed to report to the SEC for one year on its accounting and disclosure policies and controls, the commission said.

A GE spokesperson said in a statement to CNBC that “it is in the best interests of GE and its shareholders to settle this matter on the basis announced today,” adding that the company did not admit nor deny the commission’s allegations.

“Today’s announcement brings the entire scope of the SEC investigation of GE to a close, and no corrections or revisions to our financial statements are required,” the spokesperson said.

The settlement brings to end the SEC’s years-long investigation into poor business practices under the conglomerate’s former leadership team. Under CEO Larry Culp, executives are now trying to stage a comeback after years of decline. The company, which made its name selling lightbulbs, now manufactures everything from major appliances to airplane parts and medical devices. It also has power, digital and financial divisions. The company also agreed to report to the SEC for one year on its accounting and disclosure policies and controls.

GE’s shares fell by more than 1% Wednesday in after hours trading on the news after finishing the day up almost 4%.