Farewell, 2020. Hello, 2021.

It is onward and potentially upward, Superman style, for the U.S. stock market next year, based on analysts’ ambitious year-end targets for the S&P 500 index.

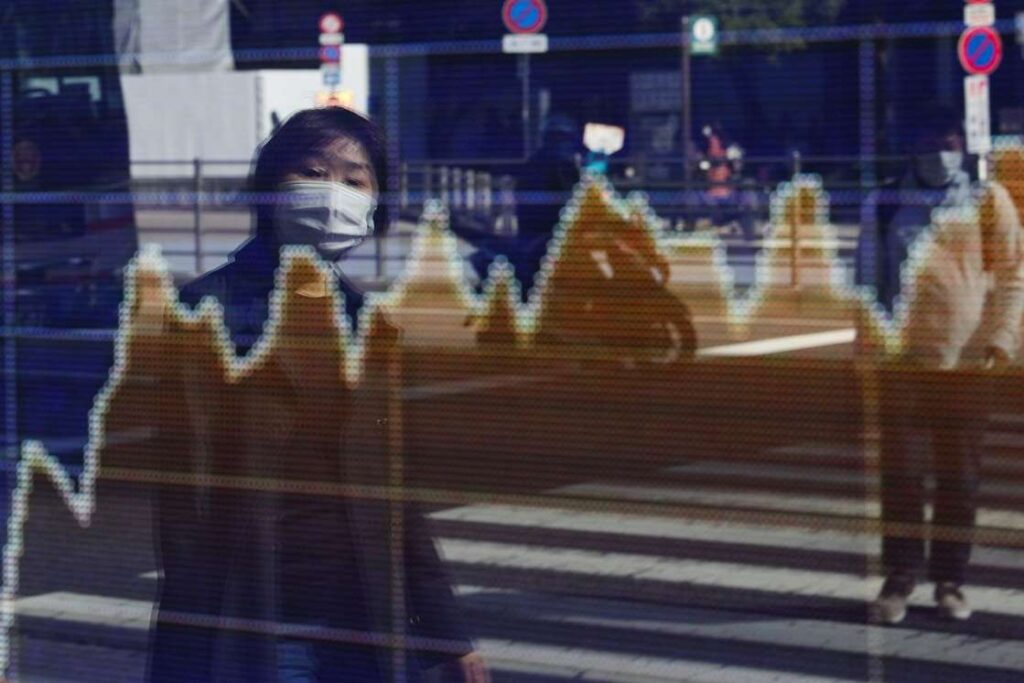

No equity market analysts that MarketWatch surveyed for this report foresee a pullback from current levels, already observed as lofty by more than a few market experts, as investors head into a crucial phase of the recovery from the worst pandemic in over a century and a new presidential regime under President-elect Joe Biden, who takes the oath of office Jan. 20.

Despite nagging fears that valuations and, in particular, values for large-capitalization technology companies, are priced for perfection, with some companies, like Tesla Inc. representing a paradigm of Wall Street’s anxieties about market bubbles, many see equities going only in one direction next year: skyward.

Analysts balk at the notion that the bull market in stocks is getting exhausted, and are instead offering estimates for 2021 year-end gains, and in some cases projecting eye-popping rallies for the market in the coming 12 months.

JPMorgan Chase’s Dubravko Lakos-Bujas delivers, arguably, one of the more gravity-defying forecasts for the S&P 500 at 4,400, which would represent a breathtaking, nearly 19% surge for the benchmark index.

To put that into perspective, the S&P 500 has already posted an almost 15% gain in 2020, the Dow Jones Industrial Average is headed for a 6% rise in the year-to-date, while the technology-heavy Nasdaq Composite Index is on track for a 43% gain in 2020. And don’t even get started on the mind-blowing gains achieved by the major stock benchmarks from the March 23 lows for the year.

And it isn’t just bulls like Dubravko Lakos-Bujas and the handful of other strategists that MarketWatch queried this year, the equity analyst community as a whole is having trouble envisaging a world in which the S&P 500 ends lower next year.

The median year-end price target for the S&P 500 index in 2021 is 4,027.21, according to FactSet data, as of midday Thursday, representing a roughly 9% climb from the closing level of the broad-market index in the holiday-shortened week just past.

It is, perhaps, hard to fault the nearly unbridled enthusiasm for what lies ahead in 2021 after a year marred by immeasurable tragedy from the COVID-19 pandemic.

Overall, the U.S. has reported a total of 18,495,851 cases and 326,871 deaths, as of midday Thursday, data from Johns Hopkins University show. On top of that, more than 22 million people lost their jobs during the worst of the epidemic in the U.S., bringing the economy to its knees.

Kristina Hooper, who maintains one of the more sanguine 2021 market outlooks, said progress rolling out COVID vaccines and remedies has emboldened the bulls, and backstopping all of the past and future buying is the Federal Reserve, which has vowed to hold interest rates steady near 0% until at least 2023 and keep buying bonds and monetizing the U.S. federal debt.

“I expect a lot of the gains to occur in the first half of 2021, discounting a strong economic expansion once vaccines are broadly distributed,” Hooper told MarketWatch Thursday afternoon via email. “I also expect the Fed to remain extremely accommodative, which should be supportive for risk assets, especially stocks,” she said.

CFRA’s Sam Stovall, whose 2021 S&P 500 target, approaching the FactSet median range, offers a relatively sober assessment of the equity outlook at 4,080.

Stovall told MarketWatch that “optimism abounds,” referencing his 2021 research outlook report, and says the target is justified by the expected easy-money policies from the Fed and hope of further government fiscal aid to keep the fragile economic recovery on the rails and the viral outbreak on the ropes.

“As we approach the dawn of 2021, optimism abounds,” he wrote. “A new administration will be installed early in the new year, with the possibility of a unified Congress supporting it, offering the prospect of additional fiscal stimulus, along with the Federal Reserve that has pledged to do ‘whatever it takes,’” he said, referencing former European Central Bank President Mario Draghi’s now-famous pledge in 2012 to preserve the euro at the height of the eurozone debt crisis.

BTIG’s Julian Emanuel and Michael Chu say that next year will represent an epic “redistribution of wealth” where small capitalization stocks could outperform larger-caps and value trounces growth on an annual basis, snapping a years long fallow period for undervalued stocks. That dynamic is likely to bring up the broader market, the pair forecast.

BTIG explains it this way:

It is worth noting, however, that equity analysts were not even close to the mark in their 2020 projections, assuming that the S&P 500 holds its current levels through next week’s holiday-abbreviated trade.

Piper Sandler’s Craig Johnson came the closest to forecasting the S&P 500’s current 3,700 range last year with an initial 2020 year-end target at 3,600, MarketWatch’s Chris Matthews reported. Johnson estimates that the S&P 500 in 2021 will finish at 4,225, based on Piper’s modeling.

“That said, we don’t expect to get there in a straight line,” he told MarketWatch via LinkedIn message.

To be fair, a pandemic is a hard thing to forecast and few, if any, would have been able to properly gauge how the market would react to the public-health crisis before the end of March. There are surely some market participants lurking out there suggesting that a test of the market’s lows are still nigh, as they did here in April and here in May.

However, as MarketWatch columnist Mark Hulbert puts it, stock-market forecasts “aren’t investment roadmaps,” adding that they are mainly marketing documents for fund management companies.

Bespoke Investment Group provides its own take on stock-market prognostications with even more candor:

“We don’t pretend to know where the S&P will be trading twelve months from now. Wall Street strategist targets are just about always wrong in their forecasts,” BIG writes in its 2021 outlook report.

“The whole game of strategists providing year end targets each year reminds us of Charlie Brown trying to kick a Football. Time and time again, he tries to get it right, but every time, Lucy has other plans.”

Looking ahead, there is little on the U.S. economic calendar in the final week of 2020, which will also be abbreviated as much of the world observes New Years on Friday.

Tuesday, investors will watch for S&P Case-Shiller home price index for October at 9 a.m. Eastern Time, Wednesday will see a report on advance trade in goods at 8:30 p.m., a reading of Chicago-area manufacturing activity at 9:45 a.m. and pending home sales at 10 a.m.

The final day of the week and year on Thursday concludes with a report on weekly jobless claims at 8:30 a.m.