Can any of this quarter’s top performers stay on their hot streak?

Two market analysts went digging for so-called stock market treasures that met the following criteria this week on CNBC’s “Trading Nation”:

- Attractive valuation (i.e., low multiple)

- High potential for earnings growth

- Quarterly outperformance

Danielle Shay, director of options at Simpler Trading, had her sights set on big-box retailer Walmart.

“If you’ve seen the earnings growth over the course of the last three quarters, they’ve done very well in spite of the pandemic,” Shay said in a Wednesday interview. “Because of the pandemic, they’ve had to really rush their e-commerce space and it’s doing absolutely amazing.”

Shay added that Walmart+, the company’s answer to Amazon Prime, is also gaining traction, putting Walmart into an even tighter competition with the e-commerce giant. While Walmart shares are beating Amazon’s quarter to date, Amazon’s yearly gains are more than triple that of Walmart’s.

“Additionally, as far as multiples go in comparison to their peers, [Walmart’s] multiple’s going to be lower than Costco, Target and eBay as well,” Shay said. “So, for me, Walmart, especially because it’s oversold, is a great buy right now.”

Three other quarterly winners appealed to Craig Johnson, senior technical research analyst at Piper Sandler.

The first was Tapestry, the parent company of Coach, Kate Spade and Stuart Weitzman and the top-performing stock in the S&P 500 this quarter.

“Here’s a stock that has had a very strong downtrend reversal off of the ’18 highs, you had a nice consolidation and you’re starting to work your way higher,” Johnson said. “It looks like to us this is a stock that could trade up to about 49 and then also toward 53. So, again, nice upside from these current levels.”

Tapestry shares closed up over 1% at $30.85 on Thursday after eking out a fresh 52-week high.

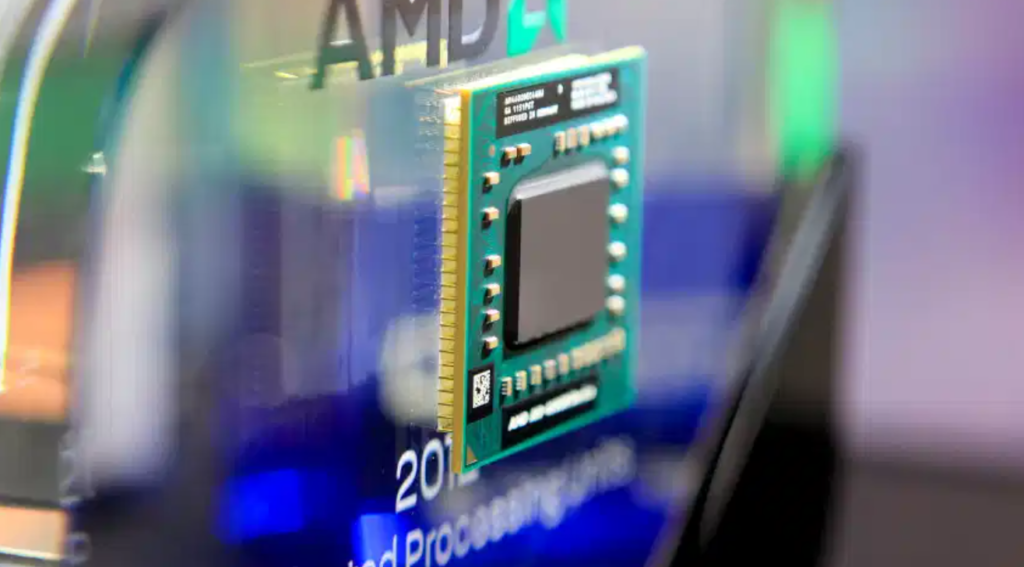

“The second stock [where] X marks the spot for us is AMD,” Johnson said. “The stock is showing good top- and bottom-line growth potential. You’ve also got a nice improvement happening at the margin level, and … while it’s up 100%, we don’t think it’s done running at this point in time.”

AMD’s 100% run this year hasn’t put a damper on its quarterly gains. The stock is up nearly 12% since Oct. 1, outpacing the S&P’s 10% gain.

“We think there’s going to be more upside here left to go,” Johnson said.

His final pick was the stock of Invesco, which he chose based on what he saw as an “attractive valuation.”

“It’s got a 3.5% dividend yield. It’s also toward the lower end of its historical range in terms of price to earnings and also price to book and also, nicely, setting up for a downtrend reversal and ready for another leg higher here,” Johnson said. “So, those would be the treasures that we’re finding right now in the market.”

Shay, a fan of the semiconductor space, doubled down on Johnson’s AMD call.

“Even though AMD has already come so far, I think that they still have a ton of growth potential,” she said. “Semiconductors are going to continue to be strong and this is absolutely one of my favorite picks.”