Stock Markets

The week ended with equities slightly short of their record highs as investors continue to weigh the prospects posed by recent developments. Investor ambiguity was driven by the anticipated $1.9 trillion fiscal-stimulus bill and its possible impact on the long-term sustainability of the government’s deficit spending. Worsening news on the coronavirus situation also caused some concerns, tempering the early optimistic surge on the vaccine rollout. Nevertheless, week-on-week the stock market sustained solid nine-month gains, capping off the strongest surge from post-election to inauguration day since 1932. The coming week will provide further direction with 23% of the S&P 500 releasing reports on company earnings and fundamentals.

U.S. Economy

The housing sector continues to demonstrate strength as starts and permits continue their ascent and demand remains robust due to persistently low rates despite short-term pullback in mortgage and refinancing. Overall, hopes for a full economic recovery and the expectations of a return to normalcy are buoyed by announcements of more, and more effective, vaccines coming to market. There remain looming concerns of a possible increase in tax rate under the Biden administration, although the general sentiment is that these will be postponed until later in the year after recovery has stabilized.

- Much of the expected recovery and continued economic growth hinges on the successful vaccine roll-out, therefore any news that may detract from the vaccine program may cause volatility in the markets. Effective vaccine distribution is crucial to a return to normal consumer spending and demand-led resurgence of service industries, including hospitality and leisure. Opening up of these industries will further alleviate the labor situation caused by the pandemic lockdowns.

- Corporate earnings are poised to grow as a result of the upturn in the business cycle. The GDP is expected to grow 4% to 5% in 2021, while the softening of the U.S. dollar by 7% against foreign currencies may enhance trade competitiveness, enhance revenue growth and enable an increase in profit margins. A growth rate of 20% in 2021 appears feasible for corporate earnings.

- Due to the strong gains already made, a period of consolidation is possible and even expected as the markets price in the improvement in corporate fundamentals. Near-term investor optimism may be moderated somewhat by news of more infectious COVID-19 mutations that are prolonging European shutdowns, and the degree to which legislative processes deliver on the promises of the new administration.

The market’s bullish run is still expected to continue in the long term although occasional volatilities may occur in response to possible policy changes and uncertainty about how they may impact future economic developments.

Metals and Mining

Gold trended upward to reach a two-week high, buoyed by a flight to safe assets as the Biden stimulus was speculated to create inflationary pressures that would pull the greenback further downward. After Biden’s inauguration on the 20th of January, gold rose to $1,874 per ounce before correcting to $1,850 two days later. It does not seem likely that gold will soon test its early-year high of $1,950, as delays in vaccine shipments and the emergence of a faster-spreading coronavirus strain dampened investor hopes of a faster recovery. Silver also chalked up a slight gain for the week to trade at $25.91 per ounce by mid-Thursday. Year-over-year, silver gained considerably, trading at $24 to $25.50, at about 2013 prices. Gold was priced at $1,853.11 while silver traded at $25.39 at about 10:52 am Friday. Platinum and palladium ended the week higher largely due to fears of an interruption in production. Platinum was trading at $1,098 and $2,248 an ounce at 11:10 a.m. on Friday.

Among the base metals, the price of copper rose to $8,000 per tonne which is still below its year-to-date high of $8,146. There continues to be an upside to the metal, though, as worldwide demand for copper will likely be pushed by a recovering global economy in a post-pandemic scenario, sustained industrial growth, and strong demand from China. Zinc rebounded during the week from a two-month low on Tuesday to reach $2,707 on Friday, although future prospects for this metal remains cautious due to continued lockdowns and logistical disruptions. Nickel tested its 18-month high on Thursday at $18,370 per tonne. Lead ended the week at $2,040 from its Monday trading price of $1,974 per tonne.

Energy and Oil

Oil closed down for the week as Brent slid to below $55 per barrel and WTI to $52. Negative news came in the form of increased travel restrictions in Shanghai, Hong Kong and the UK, as well as a temporary rise in the US greenback. Contributing to the pessimism is the first-day executive order by President Biden canceling permits for the Keystone LC pipeline and rejoining the Paris Climate Accord. In light of the policy changes, the Chamber of Commerce and the American Petroleum Institute (API) signaled openness to reimplement methane regulations on oil and gas operations, which were previously held to be applied on a voluntary basis. Biden has also placed a 60-day moratorium on new drill leases on federal lands, a move seen to have little impact on current supplies in the industry as it has stockpiled leases enough to last for years. The new administration is expected to implement policies away from oil and gas and more towards renewables.

Due to the drop in crude oil prices, energy shares likewise fell sharply on Thursday. Oil prices are expected to find support in the anticipated stimulus package in the United States, coupled with the expected inability of Iranian oil to reenter the global market. Suriname is drawing international attention as possibly the next big oil boom with its low-cost exploration and production well into the current year. China’s electricity consumption with rose suddenly within a short period due to the cold spell drove spot gas prices higher in the regional market. Concerning renewables, China increased its wind capacity last year by 72 GW which is more than double over its earlier record. It also added 48 GW of new solar energy capacity. The combination tops 84 GW, the country’s previous record for all renewable energy installations in just one year.

Natural Gas

The U.S. Energy Information Administration (EIA) forecasted an increase of 98-cent per million British thermal units (Btu) in the annual natural gas spot price, to average $3.01 per MMBtu in 2021. The higher natural gas prices are expected to result in increased production of dry natural gas through the second half of 2021, from a monthly low of 87.3 cubic feet per day (Bcf/d) in March 2020. According to EIA expectations, dry natural gas production will descend to an average of 88.2 Bcr/d in 2021 from an average 90.8 Bcf/d in 2020, due to a reduction in natural gas consumption in the electric power sector. Reduced demand for natural gas was driven by the higher prices of natural gas coupled with increased capacity in renewables generation. Natural gas consumption will increase moderately resulting from economic growth in the residential, commercial and industrial sectors. Natural gas imports will exceed exports over the next two years, with natural gas pipeline exports increasing by 0.6 Bcf/d to 8.6 Bcf/d, and liquefied natural gas (LNG) exports increasing by 2.0 Bcf/d to 8.5 Bcf/d in 2021.

World Markets

The STOXX Europe 500 Index moved sideways for the week on the back of continued concerns about coronavirus and doubts about the US economic stimulus. Germany’s Xetra DAX Index increased by 0.63% while Italy’s FTSE MIB declined 1.31% and France’s CAC 40 slid 0.93%. The UK’s FTSE 100 Index dropped 0.60%, constrained by fears of stricter coronavirus lockdown measures and the relative strength of the British pound against the US dollar. The European Central Bank (ECB) signaled that the entire amount available in the pandemic emergency bond-purchasing program may not entirely be used, causing core eurozone government bond yields to rise. Peripheral eurozone bond yields also trended up in tandem with core markets, although the trend eased at the news that Italian Prime Minister Giuseppe Conte won a confidence vote in Parliament. Gilt yields rose due to good news released by the Bank of England (BOE) about the UK’s economic recovery and the UK’s vaccine rollout.

In Japan, the stock market also remained relatively unchanged for the week, as the Nikkei 225 Stock Average inched upward 112 points (0.4%) to close at 28,631.45, a new weekly closing high, up 4.3% year-to-date. The yen ended almost unchanged at JPY 104 against the US dollar. Japan’s central bank announced that it intended to continue its current quantitative and qualitative monetary easing policy in keeping with its price stability target of 2% core inflation. The growth domestic product (GDP) growth forecast was further adjusted by the monetary policy committee to -5.5% from -5.4%, while its growth target for fiscal year 2021 was increased from 3,6% to 3.9%. Finally, the customs data indicated that for the first time in two years, Japan’s exports increased due to a growth in plastics, nonferrous metals, and semiconductor production equipment, offsetting a decrease in auto-related production equipment.

Chinese stocks surged on strong economic data and the prospects of improved US-China economic relations under the new administration. The Shanghai Composite Index increased by 1.1% to 3,606.8 while the CSI 300 large-cap index advanced 2% to 5,569.8. The three Chinese companies ordered delisted from the New York Stock Exchange (NYSE) have appealed the decision and expect a response in the next 25 days. The yield on the country’s sovereign 10-year bond remained flat despite strong December economic data. In currencies, the renminbi-to-dollar exchange rate remained stable.

The Week Ahead

Expected during the coming week are important economic data that includes personal income, consumption growth, and inflation breakdowns.

Key Topics to Watch

- FHFA house price index (year-over-year change)

- S&P Case-Shiller home price index (year-over-year change)

- Consumer confidence index

- Durable goods orders

- Core capital goods orders

- FOMC meeting announcement

- Jerome Powell press conference

- Initial jobless claims (regular state program, SA)

- Continuing jobless claims (regular state program, SA)

- Gross domestic product

- Advance report on trade in goods

- New home sales

- Leading economic indicators.

- Personal income

- Consumer spending

- Core inflation

- Employment cost index

- Chicago PMI

- Consumer sentiment index (final)

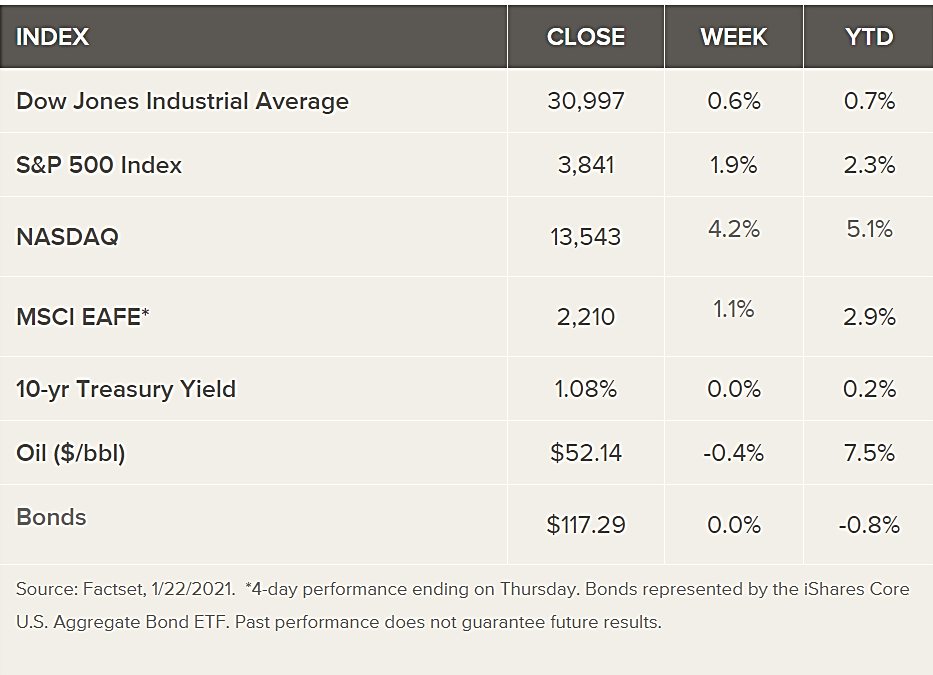

Markets Index Wrap Up