Stock Markets

Amid strong earnings reports and the likelihood of additional fiscal stimulus, stock indices ended up slightly positive for the second week of February. Plans have been announced for the purchase of an additional 200 million vaccine doses as the rollout continues to accelerate. In pace with equities, bonds likewise edged further up but slowed tentatively midweek as fresh inflation data was weighed and discounted by investors. The 30-year Treasury bond yield rose to 2% for the first time in a year as expectations of an increasing inflation rate appeared to gain validation for the first time since 2014. Inflation and jobs data releases show a slowdown in recovery and the entertainment and restaurant industries remain lethargic, providing little incentive for stock indices to rise. Expectations about the improved vaccine distribution continue to provide hope for a further push in the job market and resumption of the bullish stock market trend.

U.S. Economy

Fears of rising inflation appear to gain ground in a high-liquidity, low-productivity scenario with lockdowns still in place and the stimulus package about to be released. The following suggest that inflation may indeed inch upward from the current low-inflation regime.

- Prices in April, May and June of 2020 dropped steeply at the height of the pandemic lockdown, setting the stage for annual inflation to jump for the same months this year on a year-on-year basis. The reduction in prices was partly impacted by gasoline prices falling 34% and airfare by 28% during the second quarter of the past year. These depressed the consumer price index (CPI) for the same months in 2020, causing the base for computation of this year’s inflation to drop and this year’s rates to seemingly spike. The markets are not likely to react adversely since Fed officials are aware of the likelihood of this mathematical aberration. Since Fed Chair Powell announced that U.S. employment is significantly behind where it needs to be, it is unlikely that the Fed will start to lift its accommodating monetary policy anytime soon.

- Demand patterns have shifted due to the pandemic, redirecting consumption spending towards goods rather than services. This tendency has created bottlenecks and disrupted global supply chains. An example is the recent drop in automotive production that was caused by a shortage in semiconductor chips has caused car manufacturers significant revenue losses. Simultaneously, rising shipping and raw-materials costs are pushing commodity prices to their highest levels than they have been for more than a year. A survey of purchasing managers in the manufacturing industry confirms increasing production costs that will likely translate to higher-end prices for the consumers.

Notwithstanding the inflationary pressures, a persistent rise in prices is not expected due to structural forces that work to hold inflation down. Prices have remained lower and more stable since the mid-nineties; furthermore, the link between stimulus, labor-market conditions, and inflation appear to have been realigned since after the 2008 global financial crisis. Over the last ten years, the inflation rate has averaged a consistent 1.7% and moved slightly upward to 2.3%in 2019 as unemployment fell to 3.5%, the lowest it has been for half a century. Another contributor to deflationary forces is the “Amazon” effect, wherein disruptive technologies and a fully transparent market work to keep prices at their lowest levels. Gains in productivity in the post-pandemic period and the increased adoption of technology are likely to exert downward pressures on prices that will continue to keep inflation in check.

Metals and Mining

Gold prices rallied to a four-week high during trading in the past week before downward pressure exerted by the rising US dollar. An increase in the dollar’s valuation arrested the spike in the precious metals sector which saw breakthrough prices in most counters. Gold continued to test the $2,000 per ounce resistance level, opening the session at $1,829 and hitting its five-day peak at $1,851 before holding at $1,825.03 on Friday afternoon. The inverse correlation between gold and the dollar appears to prevail and will persist in the near future. Silver also tested its ceiling, trading at a four-week high of $27.66 per ounce on Tuesday and trading Friday afternoon at $27.31. Silver is expected to remain strong throughout the year, according to forecasts by the Silver Institute. Platinum traded as high as $1,262 for the week and slid to $ 1,242 per ounce on Friday. Palladium also rallied to settle at $2,305 per ounce on Friday.

Base metals also traded higher for the week with copper starting at $8,007 per tonne and closing Friday at $8,292. Zinc likewise rallied 7.3 percent from its year-to-date low of $2,539 per tonne to close $2,726 by week’s end. Nickel prices increased by 2.9 percent to trade at $18,599 per tonne by Friday. Lead likewise realized slight gains for the week, beginning trading at $2,052 and increasing to $2,082.50 per tonne where it held until the end of trading.

Energy and Oil

In Friday’s early trading, Brent held at $61 per barrel despite a slightly stronger dollar. Analysts are divided concerning prospects for the rally’s continuation or a possible slowdown in upward price momentum. The OPEC cartel announced on Thursday that they expected oil demand to increase by 5.8 million barrels per day (bpd) which is a 100,000 bpd downward adjustment from projects made last month. The adjustment is attributed to the continuing lockdowns in the major developed economies.

In the meantime, U.S. shale is expected to grow later this year with WTI over $50, according to the EIA. Supply forecasts for 2022 by the agency were increased to 11.53 mb/d, an increase from last month’s 11.49 mb/d. With regards to oil, a broad commodity supercycle is taking place that could create an upside risk to $65, as per Goldman Sachs. A macro-repricing is foreseen by analysts which will likely lead to repricing for everything. Libya’s oil port has reopened after a month-long strike during which time output was reduced by more than half from 320,000 to 120,000 bpd. Finally, some good news as the Advanced Research Projects Agency-Energy (ARPA-E) of the U.S. Department of Energy announced the availability of $100 million in funding for high-risk high-reward early-stage low-carbon technologies.

Natural Gas

Responding to an extended cold-weather trend that continues to sweep most of the lower 48 states, natural gas spot prices increased for most of the week from February 3 to 10, and below-freezing temperatures being forecasted until the Gulf coast. The Henry Hub spot prices rose to $3.68 per million British thermal units (MMBtu) by week’s end after beginning the week at $2.91 per MMBtu. Price likewise increased at the Chicago Citygate by $1.14 from $2.85 per MMBtu to hit a weekly high of $3.99 per MMBtu on Wednesday as temperatures in the city dropped more than 18˚F lower than normal since Friday. Throughout the West, natural gas prices also reached new daily highs. The PG&E Citygate price at Northern California reached $4.11 per MMBtu on Wednesday from $3.55 the week prior, and at the SoCal Citygate in Southern California, it increased from $3.18 per MMBtu to $4.97.

The average total supply of natural gas, as per data from HIS Markit, dropped by 0.6% week-on-week. During the same period, dry natural gas production fell by 0.2 percent, while average net imports from Canada likewise decreased by 4.8 percent. Flows on the pipe were reduced due to an outage on Compressor Station 2 of the Enbridge West Coast Transmission in British Columbia, thus affecting the supply of natural gas into Washington State. The total U.S. consumption of natural gas increased by 3.6 percent from the previous week, although natural gas consumed for power generation fell by 2.5 percent. Consumption in the residential and commercial sectors increased by 7.9 percent, and in the industrial sector consumption increased by 3.5 percent. Exports of natural gas to Mexico increased by 3.5 percent.

World Markets

Volatility continued to dominate in the European markets although prices ended higher overall. The equity markets were generally propped up by improved vaccination rollouts, improving coronavirus infection rates, and optimism of a forthcoming U.S. stimulus package, although worries about extended valuations resulted in some profit taking by skittish investors. The pan-European STOXX Europe 600 Index rose 1.09 percent as major indexes were mixed. Italy’s FTSE MIB climbed 1.42 percent while France’s CAC 40 gained 0.78 percent and Germany’s Xetra DAX Index moved sideways. Showing the largest gains was the UK’s FTSE 100 Index which increased a modest 1.55 percent. Yields generally came under downward pressure on a lower-than-expected U.S. inflation report and a gloomy European Commission (EC) economic outlook. The EC forecasted a 3.8 percent growth in the eurozone economy for 2021-22. The projection is lower for 2021 than previously expected, although slightly more optimistic for 2022.

The Japanese bourses showed a continuation of the robust gains it exhibited the week before, with the Nikkei 225 Stock Average rising 2.6 percent to close at 29.520.07, ahead by 7.56 percent year-to-date. Weekly gains were also recorded by the broader equity market benchmarks, the large-cap TOPIX Index and the TOPIX Small Index. The yen closed stronger against the dollar to close Friday at JPY 105 per USD. Despite the strong showing, sentiment remained week due to concerns about the continued effects of coronavirus on the economy. The latest data showed a decrease in household spending, and much of Japan remained under a state of emergency due to the pandemic. In China, stocks rallied in advance of the Lunar New Year holiday. In the shortened trading week that ended Wednesday, the Shanghai Composite Index gained 4.5 percent while the large-cap CSI 300 Index shot up by 5.9 percent. Holidays throughout Asia are expected to last the week beginning February 12, prompting Hong Kong’s stock index to increase by 18% to date in 2021 as a result of record inflows from mainland investors. Stock, bond, and currency markets across China will resume trading on February 18.

The Week Ahead

Reports detailing important data expected in the coming week include the February preliminary Markit Purchasing Managers’ Index, producer inflation, and retail sales growth

Key Topics to Watch

- Empire State manufacturing index

- Retail sales

- Retail sales ex-autos

- Producer price index final demand

- Industrial production

- Capacity utilization

- Business inventories

- National Association of Home Builders index

- FOMC minutes

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Housing starts (SAAR)

- Building permits (SAAR)

- Import price index

- Philadelphia Fed manufacturing index

- Market manufacturing PMI (flash)

- Markit services PMI (flash)

- Existing home sales (SAAR)

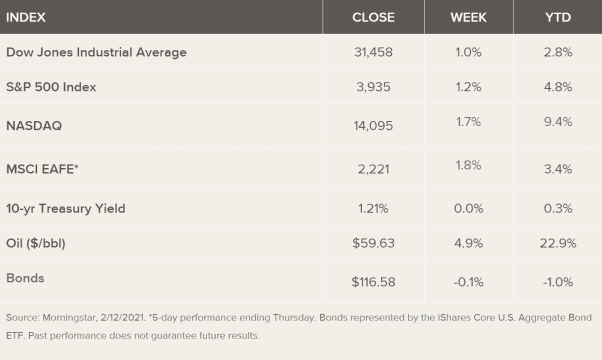

Markets Index Wrap Up