While younger people just entering the workforce may think that they do not need to worry about retirement savings until later in life, the sooner you start saving for retirement, the better.

If your company offers a 401(k) plan, it can be an easy way to start saving for the future, even if you start small. Not only are contributions your 401(k) excluded from your taxable income, but if your company offers a match, then you are essentially getting free money as well.

For many Americans, 2020 was a tough year financially. Between March 2020 and January 2021, around 1.6 million individuals took out savings from their 401(k) plans under the CARES Act, which allowed those affected by the pandemic to withdraw up to $100,000 without incurring the usual early withdrawal penalty, according to retirement-plan provider Fidelity. That represents 6.3% of eligible individuals using Fidelity’s workplace savings platform.

But despite the volume of withdrawals from 401(k) accounts under the CARES Act, a third of 401(k) savers increased their savings rate in 2020. Fidelity also saw record contributions from women in the fourth quarter of 2020.

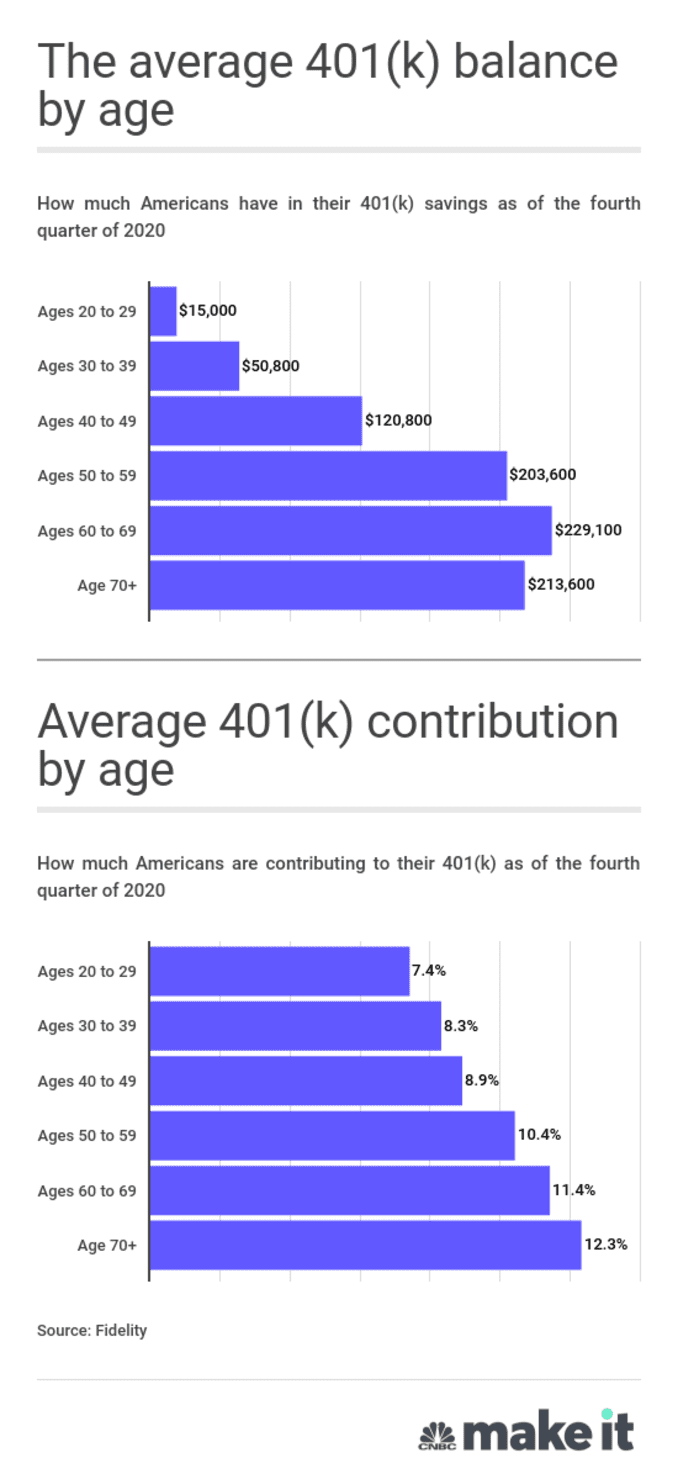

The overall average 401(k) balance came to $121,500 as of the fourth quarter of 2020, according to Fidelity.

How much money Americans have saved in every age group

Fidelity also provided CNBC Make It with a look at how much money Americans have in their 401(k)s at every age.

Below, check out the average amount of money Americans have saved in their Fidelity accounts as of the fourth quarter of 2020, as well as how much their contributions are in relation to their salaries.

How much you should you save for retirement

You should think of planning for retirement as something you do throughout your career, not just when you have a large salary.

“The most important thing is to start saving as early as possible and consistently over time because that is really what ends up building up your balance at retirement,” says Eliza Badeau, vice president of thought leadership at Fidelity.

Although retirement may seem far away, it’s better to start saving early because it allows you to ride out the highs and lows of the market, says Badeau.

Fidelity recommends having 10 times your salary socked away by the time you retire. To get there, the company recommends aiming to consistently save 15% of your income, including both your employee contribution and the employer match.

“Start saving what you can from your paycheck and at least, if you do get a matching contribution, contribute enough to get that match so you are not leaving any money on the table,” says Badeau.

Even if you start small, try to increase your contribution by small increments as you can to work your way up to 15% of your salary, Badeau says.

How much emergency cash to have on hand

In addition to saving for retirement, it’s also important to get your finances stable from a short-term perspective so you do not have to dip back into money that you have put away for the long-term, Badeau says.

Aim to save three to six months worth of living expenses in a liquid cash account. You should think of that as an emergency fund to keep you afloat if you were to lose your job, Badeau says.

It may seem overwhelming to try and save so much at one time, but it’s OK to start small. Set achievable goals by saving one month at a time, and eventually work your way up to your desired balance.