One of the biggest hurdles when trying to save money is just that — actually doing it.

Sure, most of us are familiar with the personal finance advice to pay yourself first. And who wouldn’t want a high-yield savings account holding a three-to-six month emergency fund? We all know how important these money milestones are when you’re working toward financial security.

But the reality is saving can be a real challenge for anyone regardless of how much money they make. Unexpected needs always seem to arise, like a car repair or a doctor’s bill, not to mention everyday expenses that can add up quick month over month. And once our needs are met, then come all the wants, making it hard to prioritize saving even when you want to.

That’s where Wealfront’s Self-Driving Money™ feature comes in. It’s a budgeting tool that fully automates your savings plan according to your financial goals and directs your money to the right account(s).

Instead of using spreadsheets and cash envelopes, users select their preferences and let Wealthfront automation pay bills and allocate savings for an emergency fund, short-term savings and bigger, long-term goals.

Wealthfront Investment Account users may already have experience relying on Wealthfront’s robo-advisor services. Self-Driving Money aims to add a similar level of service to the Wealthfront Cash Account (a basic no-fee checking option).

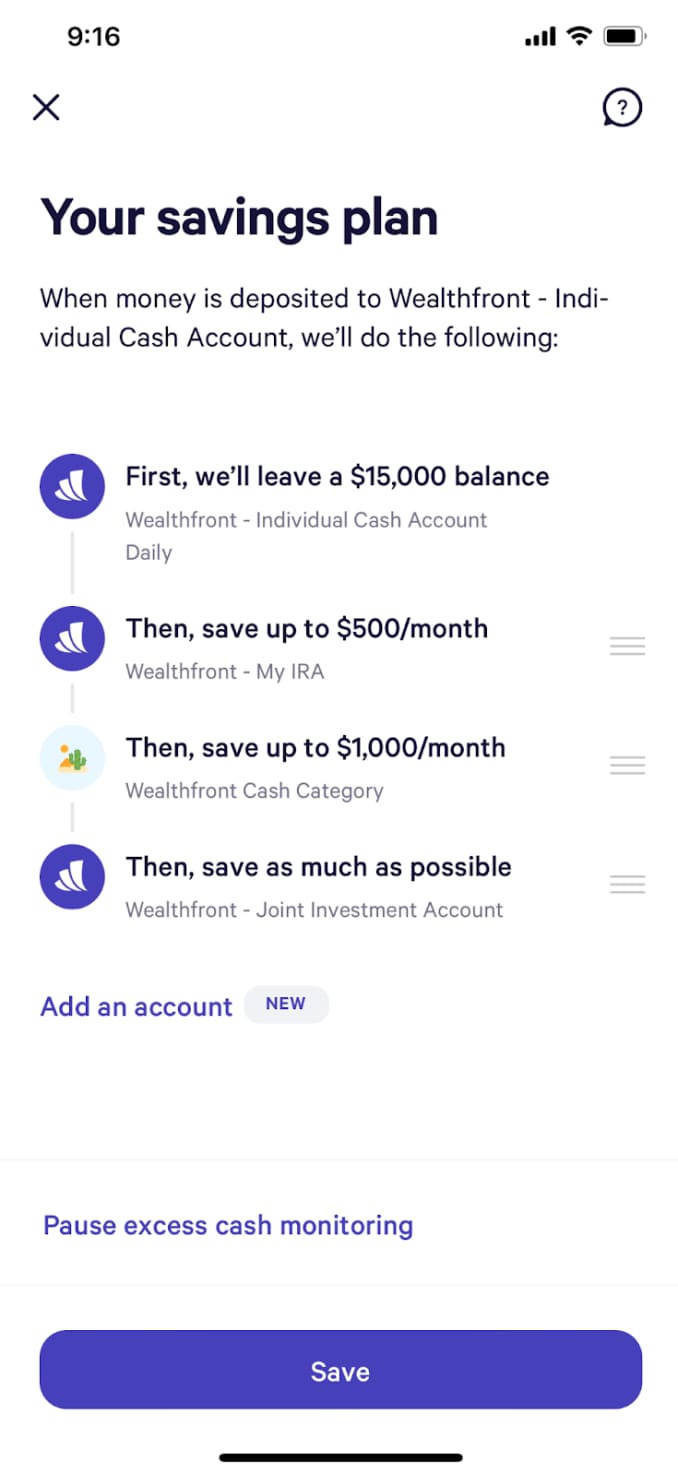

Here’s a snapshot what that could look like in action:

Clients no longer need to manually move money between multiple institutions (which can often feel clunky and overwhelming). With the new program, customers can share their goals and preferences, then let automation take care of the rest.

With a few clicks, customers can set target balances for each of their accounts, as well as the timeline and monthly budget for each. You determine how to route your paycheck, which accounts the money gets deposited into and what to do with anything leftover after your goals are met. Then you’re all set.

When deciding on how to prioritize your goals, it can be helpful to speak with a financial planner or trusted advisor first. That way, you can have a clear idea how much cash you want to allocate to each account depending on when exactly you’ll need the money and for what.

“The way the financial system is designed makes it nearly impossible to properly manage your money,” said Dan Carroll, co-founder and chief strategy officer at Wealthfront, in a press release. “Now that automation can carry out our clients’ financial decisions, they will see enormously better outcomes.”

Carroll believes Self-Driving Money will propel the financial success of Gen Z and Millennial investors by removing the stress and inertia from financial decisions, making it easy to optimize every dollar in their accounts.

Current Wealthfront clients who already have direct deposit into a Wealthfront Cash Account will immediately have access to Self-Driving Money. Anyone can open a Wealthfront Cash Account with just $1. The Wealthfront Cash Account offers a debit card with access to free ATMs and FDIC insurance up to $1 million through Wealthfront’s partner banks.