Stock Markets

Throughout the past week, the stock markets surprisingly declined due to the Federal Reserve’s June 15-16 policy meeting and subsequent comments from a Fed official later in the week concerning a potential hike in interest rates earlier than expected. The Fed meeting drew close attention, coming soon after the latest inflation announcement showing that core consumer prices are increasing at a rate faster than at any time in the last two decades. The Dow Jones Industrial Average ended lower as a result of the pronouncement. Several cyclical companies that are most reliant on economic growth are listed in the DJIA, which explains the greater downturn. On the other hand, the Nasdaq Composite Index, which tracks the technological industry, exhibited only a moderate loss. As expected, the S&P 500 that measures the broad market likewise declined. Large capitalized equities were more resilient than the small caps. Growth stocks in general did better than the value stocks because investors unloaded stocks in the energy and financial sectors. The fear is that the Fed may remove the policies that accommodated businesses, and rates may be raised sooner than market participants were initially led to expect.

U.S. Economy

The Fed stimulus was the driver for the recent bull market, but concerns about rising inflation have caused investors to be wary of their market positioning. If it is any indication, however, the lack of substantial volatility in the uncertain market is a sign that investors still have a sense that the economy is likely to recover further, justifying higher prices still in equities. Despite the news that the Federal Reserve meeting may taper future bond purchases, the Fed signaled that it anticipates that the first interest rate hike may still take place in 2023. Inflation is therefore seen to be merely transitory for now, and even factoring in the announced acceleration in the timeline the rate hike is still seen to be two years away. There is still therefore room for further economic growth without signs of overheating that would justify the Fed adopting measures to reign in excess liquidity.

Metals and Mining

Gold took a deep dive in the past trading week. Spot gold prices lost 5.93%, ending this week at $1,764.16 per ounce, down $100 from last week’s close of $1,875.31. This precipitated a similar decline across the precious metals market and creating deeper price declines for silver, palladium, and platinum. The Federal Reserve released a cautionary announcement on Wednesday that forecasted at least two quarter-point rate increases by 2023, although for the short-term the Fed promised to retain a supportive stance to enhance jobs recovery. The announcement caused the dollar to surge above a two-month high that eroded the bullion’s value as investors transferred to U.S. Treasury yields and increasing the opportunity cost of holding gold. A further pullback may be possible as speculative play in gold is dampened until lower levels are attained.

Following the gold sell-off, silver lost 7.76% ending at $25.79 per ounce from last week’s $27.96. Palladium closed at $2.475.46 per ounce, down 11.05% from the previous week’s $2,783.10. Platinum slid 9.03% from the previous week’s $1.147.08 to end at $1,043.48 per ounce. The significant drop in palladium may be followed by a correction if a rally materializes in the coming week, as the sell-off appears to have been overdone for this metal. The weakening physical demand in gold and the other precious metals may see these prices further recede after some buying correction. But the coming bearish sell-downs may entice some value investors to buy the dips, as a further move to $1,700 may attract buyers.

Energy and Oil

The oil price rally of the past months appears to have entered into consolidation this past week as the markets weigh in on the change in outlook by the Federal Reserve. The potential interest rate hikes announced to take place in 2023 will likely raise the price of oil in non-dollar-denominated economies, thereby causing a reduction in demand. While many oil traders expect the price to remain above $70 per barrel for the near future, $100 appears more and more to be an achievable target. This outlook must be balanced, however, by the move towards electric vehicles (EV) by more automotive manufacturers. General Motors, for instance, expects to raise EV spending to $35 billion within the four years to 2025, and also invest in two new U.S. battery plans. The move appears to be a competitive play to match Ford’s announcement several weeks ago that it will spend $30 billion on EV’s by 2030. Another factor to consider is that the level of drilling and, subsequently, capital investment appears inadequate, as it has been for several years, to maintain current levels of oil production. Coupled with this is a projected increase in oilfield services due to increasing demand on oilfield service providers. There is already a discernible increase in activity and an increase in the pricing of services, that may materialize in a stronger uptrend in the coming months.

Natural Gas

The price of natural gas increased at most locations for the reporting week June 9 to June 16. This is in response to the continued hot weather throughout the western United States that has spurred demand for air conditioning and its attendant clamor for electric power. The Henry Hub spot price increased to $3.17 per million British thermal units (MMBtu) at the end of the week from $3.10/MMBtu at the start of the week. The price of the July 2021 New York Mercantile Exchange (NYMEX) advanced by $0,12 from $3.129/MMBtu on June 9 to $3.251/MMBtu on June 16. The 12-month strip averaging July 2021 to July 2022 contracts were priced higher by $0.10/MMBtu at $3.204/MMBtu.

World Markets

In Europe, equities shed significant margins in reaction to the announcement by the U.S. Federal Reserve that it will increase rates earlier than anticipated. The pan-European STOXX Europe 600 lost 1.19%. Italy’s FTSE MIB Index dropped by 1.94%, Germany’s Xetra DAX descended by 1.56%, and France’s CAC 40 Index slid 0.48%. The UK’s FTSE 100 Index decreased by 1.63%. The core eurozone government bond yields, on the other hand, climbed in tandem with the U.S. Treasury yields in line with the announcement by the Fed of the projected interest rate increase for 2023. A cautious word from the European Central Bank (ECB) has tempered this move. The peripheral government bond yields closely mirrored the core markets. UK gilt yields are bound for higher levels as the Bank of England (BOE) announced that it would tighten monetary policy after inflation surpassed the bank’s target, and also in response to the Fed’s more cautious forecast.

Japan’s stock market ended mixed with the Nikkei 225 Index advancing 0.05% and the broader TOPIX Index receding 0.38%. The Japanese 10-year government bond yield rose to 0.06% as the yen came down to JPY110.23 versus the dollar. Coronavirus restrictions were eased by the government just slightly more than a month before the start of the Olympics. Also to be lifted will be the state of emergency in nine prefectures; nevertheless, seven areas will remain under a quasi-emergency state, including Tokyo and Osaka. The loosening of restrictions comes in response to the nationwide reduction in infections and the speedier deployment of vaccines. The government remains cautious as cases may again spike due to possible furtherance of the contagion.

In China, stocks registered a loss for the third consecutive week. The large-cap CSI 300 Index slumped by 2.3% while the Shanghai Composite Index dropped 1.8%. There was a discernible A-share liquidity in June even as domestic mutual funds appeared to bow to increased pressure for redemptions. On Friday, an official of the 2021 China Association of Automobile manufacturers projected an increase in New Energy Vehicle (NEV) share of new vehicles will grow from 20% to 30% within five to eight years, causing a rally in NEV stocks. Regarding fixed-income securities, the yield on China’s 10-year government bond ascended five basis points to 3.20%. In currency trading, the renminbi (RMB) lost some value to the U.S, dollar, closing at 6.44 per dollar. In the meantime, economists perceive that China’s growth momentum may have peaked in light of the weaker-than-expected May economic data announced by the National Bureau of Statistics.

The Week Ahead

Consumer income and consumption, market manufacturing PMI, and the GDP are among the important data expected to be released in the coming week.

Key Topics to Watch

- Existing home sales (SAAR)

- Current account deficit

- Market manufacturing PMI (flash)

- Markit services PMI (flash)

- New home sales (SAAR)

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Durable goods orders

- Nondefense capital goods orders, excluding aircraft

- Trade in goods, advance report

- GDP (revision)

- Personal income

- Consumer spending

- Core PCE price index

- UMich consumer sentiment index (preliminary)

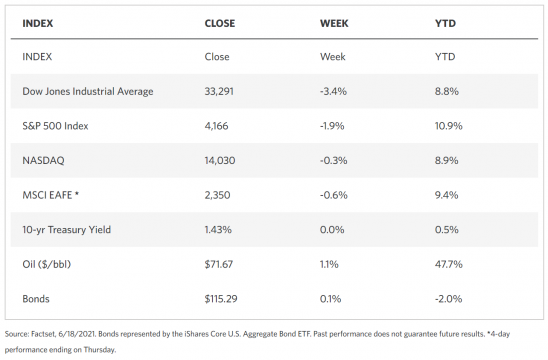

Markets Index Wrap Up