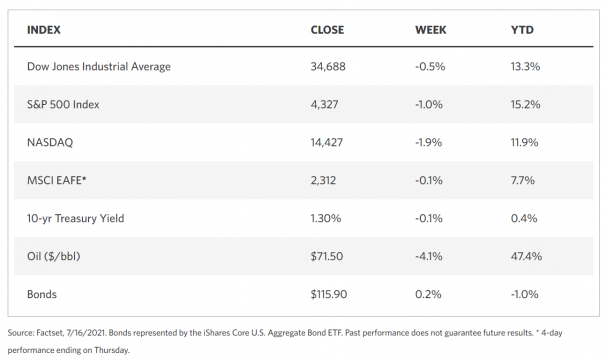

Stock Markets

The major indexes closed at lower levels, although the S&P 500 and Nasdaq Composite touched new intraday highs within the week before ending with a correction. Equities suffered some losses this week but the uptrend established from the beginning of 2021 remains intact. That being said, there appear to be signs that a reversal may be taking place in the second quarter from the first quarter, suggesting that investors should take a more cautious approach. For one, the 10-year yields have returned to pre-pandemic levels, suggesting that asset class performance and market-based inflation expectations have reversed in this second quarter. Furthermore, the rally for value investments, cyclical sectors and small-cap stocks have lost momentum. Central banks have also resumed deliberating about possible shifts in policy. While the second-quarter earnings reporting season has begun, market activity is noticeably subdued.

U.S. Economy

Data released during the weak indicated that headline and core consumer prices (excluding food and energy) had increased by 0.9% in June, which is twice the approximate consensus estimates, causing a retreat in stock prices on Tuesday. The core rate grew 4.5% in the last 12 months, the fastest increase in this indicator since 1991. Responsible for nearly one-third of the increase is the surge in used-car prices; even so, inflationary pressures were perceived by consumers, with food prices increasing by 0.8% for the month, and gasoline prices rising by 2.5%. The New York Federal Reserve announced on Monday that year-ahead inflation expectations are now at the highest on record since 2013, at 4.8%. Concerns were somewhat allayed when Fed Chair Jerome Powell informed Congress that inflation pressures are temporary and there is still substantial progress expected on the Fed’s employment and inflation goals. The Fed is generally expected to taper asset purchases before raising short-term interest rates, a move that is intended to maintain downward pressure on long-term rates. Chicago Fed President Charles Evans cautioned on Thursday that tapering too early could undercut the Fed’s objectives.

- Economic data released this week were mixed relative to expectations. A slight contraction in manufacturing output for June was attributed to difficulty among carmakers in finding chips for their production efforts. In contrast, in the New York region, an index of manufacturing activity touched a record high, indicating that there is strength in both new orders and shipments. Weekly jobless claims have reached a low for the pandemic period at 360,000, which is just in line with analysts’ expectations.

- The was a 0.6% increase in retails sales in June, outperforming consensus expectations of a decline by 0.4%. Without counting the auto sector which had been volatile due to the global chip shortage, sales increased by 1.3%. The effects of the reopening of the economy were evident in the Commerce Department data, with consumer purchases shifting from home goods towards leisure, restaurants, and apparel. Inflation worries continued to affect consumer sentiments as mirrored by the University of Michigan’s preliminary gauge of consumer perceptions. Consumer complaints concerning the surging prices of homes, vehicles and household durables have reached an all-time high, based on the survey conducted by the university.

Metals and Mining

The spot price of gold was up by 0.3% for most of the week, although it corrected slightly at the close of Friday’s trading. Price appreciated by 0.21% week-on-week, closing at $1,812.05 per ounce from last week’s $1,808.32 per ounce. The contraction on Friday is attributed to a stronger dollar, weighing the metal further from its one-month high in the previous session. Despite Friday’s sell-off, gold still ended up for the week. Further declines in the price of this precious metal appears to be limited, however, because of the improving physical demand for bullion particularly from China, a top global consumer, as well as central bank purchases. Gold saw a one-month high last Thursday after Federal Reserve Chair Jerome Powell reiterated the central bank policy to remain accommodative. This stance by the Fed may continue for some time while Delta variant cases continue to intermittently spike for an indefinite time.

In the market of other precious metals, palladium dropped 6.45% for the week, ending at $2,630.83 per ounce from last week’s $2,812.18 per ounce. Platinum, on the other hand, traded sideways, registering a marginal 0.2% gain to close at $1,104.91 per ounce from $1,104.67 per ounce. This was Palladium’s first weekly decline in the last four weeks. Tepid trading in both was due to the reported decline in U.S. motor vehicle sales due to supply chain problems caused by a global semiconductor shortage. Both metals are used in the automotive manufacturing industry to limit emissions in engine exhaust systems. Meanwhile, silver slid by 1.69%, closing at $25.66 per ounce from last week’s $26.10 per ounce.

Base metals also ended mixed for the week. Copper lost 0.35% from last week’s close of $9,519.50 per tonne, ending Friday at $9,486.50 per tonne. Zinc also lost by 0.29%, closing the week at $2,968.50 from $2,977.00 per tonne. On the other hand, Aluminum gained 0.66%, from $2,501.50 to $2.518.00 per tonne. Tin outperformed the other metals for the week. The price of tin rose by 4.58%, closing at $33.130.00 per tonne on Friday from the previous week’s $31,680.00

Energy and Oil

A familiar path forward for the global oil markets became evident as a result of the baseline amendment agreement struck between Saudi Arabia and the UAE. The lack of particulars on exactly how OPEC+ members would bring back production levels still suggests much uncertainty. Amidst a peak driving season, lackluster demand from the US continues to cast doubts on the robustness of global gasoline demand. A return to pre-pandemic demand is foreseen by OPEC by 2022. Assuming effective containment of COVID-19, the annual average demand is expected to reach 99.86 million barrels per day, amounting to a 3.4% year-on-year growth.

The demand for fossil fuels will continue to grow as global electricity demand growth overtakes aggregate renewals capacity growth. The production of more fossil fuels will be necessary to match the accelerating needs, according to the International Energy Agency or IEA. The IEA forecasts that 2021 power consumption will rise by 5% year-on-year, and an increment of 4% in 2022. In the global arena, India seeks to entice investors in the upstream oil industry by reducing the number of regulatory approvals needed to launch an exploration project. The streamlined procedures will involve only 18 from what were formerly 37 approvals, in an attempt to resuscitate its upstream sector. India produces about 770,000 barrels per day of crude and is facing structural decline, with 80% reliance on oil imports.

Natural Gas

For this report week (July 7, Wednesday, to July 14, Wednesday), natural gas spot prices rose at most locations. The Henry Hub spot price increased to $3.75 per million British thermal units (MMBtu) from $3.60/MMBtu the previous week. The price of the August 2021 New York Mercantile Exchange (NYMEX) contract climbed by $0.06 to $3.660/MMBtu from $3.596/MMBtu. The price of the 12-month strip averaging August 2021 through July 2022 futures contracts increased by $0.06/MMBtu to $3.478/MMBtu.

World Markets

European shares slid on worries that coronavirus cases may once more spike and cause a derailment in the efforts to secure economic recovery. Furthermore, investors are concerned that central banks may shift to tighter monetary policies sooner than they originally intended to in response to a surge in inflation. The pan-European STOXX Europe 600 Index closed the week lower by 0.64%. The major European stock indexes mirrored the pan-European index. France’s CAC 40 Index dropped by 1.06%, Italy’s FTSE MIB Index dipped 1.03%, and Germany’s Xetra DAX Index slid by 0.94%. The UK’s FTSE 100 Index underperformed the other indexes, losing 1.60% of its value during the week’s trading. The core eurozone government bond yields declined in tandem with the move in US treasury yields, in reaction to the reaffirmation by the US Federal Reserve and the European Central Bank that the inflationary increase is merely temporary. Investors’ concerns about the delta variant and other rapidly spreading strains of the coronavirus appeared to weigh on yields. While the peripheral eurozone bonds tracked core markets in general, the UK gilt yields appeared to have bucked the trend and remained flat. The weredownward pressure on yields caused by the movement in the U.S. Treasuries was somewhat offset by the higher-than-expected inflation results in the UK and hawkish commentaries from some policymakers from the Bank of England.

In Japan, stock markets realized modest gains during this trading week. The Nikkei 225 Index appreciated 0.22% while the broader TOPIX Index gained 1.04%. The fourth coronavirus state of emergency was imposed on Tokyo this week, to continue until August 22 and covering the entirety of the Olympic Games. The announcement was in line with government efforts to mitigate the resurgence of COVID-19 infections. The highest daily count in new cases since January was recorded in the capital during the past week. In light of this development, the yield on the 10-year Japanese government bond dipped marginally to 0.02%, even as the yen remained unchanged at JPY 110.04 versus the U.S. dollar. Meanwhile, in China, the Shanghai Composite Index and large-cap CSI 300 Index gained 0.4% and 0.5% respectively in volatile trading. The announcement of China’s second-quarter gross domestic product (GDP) on Thursday was consistent with expectations, providing much-needed relief to the choppy markets. Equity inflows into China through the Stock Connect channel entered into positive territory as a result of the announcement of the most recent GDP data, exhibiting the highest data inflow in the last ten months. Foreign investors picked up financial, technology and consumer stocks with strong fundamentals. They generally avoided expensive counters such as electric vehicles. Regarding the pandemic situation, only a small number of new coronavirus cases were reported in some provinces in southern China.

The Week Ahead

In the coming week, watch out for important economic data to be released, including Housing starts, the PMI composite, the Leading Economic Indicators.

Key Topics to Watch

- NAHB home builders’ index

- Building permits (SAAR)

- Housing starts (SAAR)

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Existing home sales (SAAR)

- Index of leading economic indicators

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

Markets Index Wrap Up