Stock Markets

Although the stock market suffered a deep sell-off registering as a 700-point drop in the Dow on Monday, it rebounded on Tuesday and the rest of the week to end higher than last week’s close. The rally was concentrated mostly in the technology and internet-related companies known as the FANG+ stocks, referring to 10 of today’s highly-traded tech giants. Growth stocks comparatively outperformed value stocks for five weeks in a row, cumulatively establishing a significant year-to-date lead. Trading volumes were narrow; the number of shares transacted on Thursday was at a level second to the lowest on record for the year. The plunge at the start of the week was attributed by many to renewed fears of the coronavirus Delta variant. There was a surge in cases and hospitalizations in various parts of the United States as well as other parts of the world. Shares of companies in industries linked to the economic recovery, such as airlines and cruise operators, performed poorly as a result. Energy stocks likewise suffered as oil prices suffered their heftiest losses since April 2020 following a deal struck by OPEC and other large oil exporters to increase output. For the rest of the week, the major benchmarks recovered nearly all their losses due to positive news on the housing sector.

U.S. Economy

The principal mover of the economy still appears to be the uncertainties related to the spread of the COVID-19 and its variants. Also weighing on the anticipated recovery is the market’s expectation for the possible shift in Fed stimulus and the high bar that has been set for the expectation of economic growth. These factors appear to increase the probability that a more dramatic stock market pullback may materialize towards the end of the current year.

- While the delta variant remains the apparent cause, much of the volatility in the markets may be attributed to the growing likelihood of inflationary pressures and the gnawing suspicion that the markets may have reached their peaks. The GDP growth rate for 2021, determined to approach almost 7%, may be the strongest reading in the economic expansion into the future, as the maturing economy is likely to usher in a more moderate growth rate.

- While the foregoing may be a possibility, it is however more plausible that the market will continue its long-term growth with its underlying health intact. Despite inflationary concerns, the Fed continues to keep its accommodative policies. It is expected that despite the winding down of its bond-buying stimulus, monetary policies implemented by the Fed will remain historically positive for a longer time. The economy is expected to grow at a faster-than-average rate, and GDP will continue to expand through 2022. Corporate profits continue to grow, which will drive long-term market viability. Double-digit earnings growth is expected for this year and the next due to the deep base created as a result of the COVID-19 lockdowns. Therefore, despite a possible pull-back in the markets, the economy still appears to be on a stable footing.

Metals and Mining

The gold spot price has suffered a slight correction week-on-week as investors returned to risky instruments with the strengthening of the dollar and increase in yields. This week, gold ended 0.55% lower than the previous week, closing at $1,802.15 per ounce compared to the prior weekly close of $1,812.05. The price of bullion suffered a devaluation after it moved tentatively to the last month’s peak, With the concerns of the threat posed by the Delta variant subsiding, investors have regained their confidence in risky assets and moved out of safe-haven vehicles like gold. The increase in the benchmark Treasury yields tends to draw investor interest away from gold since investments in commodities, such as precious metals, pays no interest. Instead, it converts to an increased opportunity cost as a result of holding the commodity.

Other major precious metals followed suit with the trend of gold prices. The spot price for silver lost 1.87% of its value week-on-week, closing this past week at $25.18 per ounce over last week’s close of $25.66. Platinum also gave up 3.74% of its value, from last week’s close of $1,104.91 per ounce to this week’s close of $1,063,54 per ounce. Palladium appeared to buck the trend for precious metals, however. The metal gained 1.74% for the week, beginning at $2,630.83 per ounce and closing last Friday at $2,676.62. Base metals were mixed for the week. Copper rose marginally by 0.31%, ending at $9,516.00 per tonne from the previous close of $9,486.50. It outperformed zinc which shed 15.70% of its value, closing for the week at $2.502.50 per tonne from the earlier close last week of $2,968.50. The other base metals performed better, with tin closing up higher by 4.14%, from $33,130.00 per tonne to $34,500.00. Aluminum posted a significant gain of 17.67% for the week, from its previous closing price of $2,518.00 per tonne, to $2,963.00 in last Friday’s close.

Energy and Oil

A major plunge in oil prices in the just-concluded week resulted from the news of OPEC+ returning to its previously withheld production in August 2021. The oil price cartel followed through with 400,000 barrels per day (bpd) increments until the end of 2021. The latter half of the week nevertheless saw a strong rebound in the price of oil when market players came to realize that the additional OPEC+ supply will be sufficiently absorbed by the recovering worldwide demand for oil. The strong recovery also indicated that the market may have discounted the risk of the spread of the COVID-19 Delta variant through the U.S. and Southeast Asia.

Natural Gas

The price of U.S. natural gas futures hit its highest level in nearly three years, since December 2018, in light of the warmer-than-expected weather and the higher demand for air conditioning power. This caused the Henry Hub spot price to rise from $3.75 per million British thermal units (MMBtu) on July 14, to $3.91/MMBtu on July 21, the duration of this report week. The price of the August 2021 New York Mercantile Exchange (NYMEX) contract gained $0.30, rising from $3.660/MMBtu to $3.959/MMBtu. The price of the 12-month strip, averaging August 2021 through July 2022 futures contracts, also rose $0.22/MMBtu to $3.693/MMBtu.

World Markets

European shares climbed on positive investor sentiment concerning the anticipated corporate earnings season and the reaffirmation by the European Central Bank (ECB) that it would continue to adopt accommodative monetary policies. The favorable factors worked to reverse early softness in the market growing out of concerns for the spread of the Delta variant and its impact in slowing down the global economic recovery. The pan-European STOXX Europe 600 Index closed 1.49% higher than its ending price of the previous week. Also increasing in value are the main European stock indexes. France’s CAC 40 Index climbed 1.68%, Italy’s FTSE MIB Index rose 1.34%, and Germany’s Xetra DAX Index gained 0.83%. The UK’s FTSE 100 Index also grew by 0.28%. As expected, core eurozone bond yields fell in reaction to the strong equities market. Fears surrounding the spread of the coronavirus pandemic and reiteration by the ECB of its view that the inflationary push is only transient caused a shift to high-quality government bonds. The peripheral eurozone bond yields followed the trend set by core markets. The UK gild yields were volatile as they reacted to reports of surging coronavirus cases by midweek.

The equities markets in Japan lost ground on Wednesday in advance of an extended weekend before the commencement of the Tokyo Olympics. The Nikkei 225 Index plunged 1.63% while the broader TOPIX Index corrected 1.44%. The weakness in the markets is partly due to concerns that the Olympic games may further worsen the COVID-19 spread in the country and negatively impact the progress of the ongoing economic recovery. Since Prime Minister Yoshihide Suga took office in September 2020, support for its cabinet was reported to have slid to its lowest level this past week. The yield on the 10-year Japanese government bond declined to 0.016% and the yen’s value slightly lost ground to JPY 110.45 versus the U.S. dollar.

Chinese stocks ended the week mixed, with the Shanghai Composite Index rising 0.3%, outperforming the large-cap CSI 300 Index that declined by 0.1%. The People’s Bank of China pegged loan rates to their current levels for one- and five-year maturities. While monitoring pressures on leveraged borrowers such as property developers, the central bank is expected to continue to ensure stable credit flows to state-owned enterprises, companies, and consumers. The yield on the 10-year sovereign bond lost 4 basis points to close the week at 2.93%, causing bond yields to also move lower. The renminbi climbed 0.2% to end at 6.47 versus the U.S. dollar. It is likely that China’s net long-term capital inflows and stable current account surplus will provide the needed support for the currency in the near future.

The Week Ahead

Included among the important economic data to be released in the coming week are Personal Consumption, Personal Income, and Pending Home Sales.

Key Topics to Watch

- New home sales (SAAR)

- Durable goods orders

- Nondefense capital goods orders, excluding aircraft

- S&P Case-Schiller home price index

- Consumer confidence index

- Housing vacancies

- Advance trade in goods

- Federal Open Market Committee announcement

- Fed Chair Jerome Powell press conference

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Gross domestic product, first estimate (SAAR)

- Pending home sales index

- Employment cost index

- Personal income

- Consumer spending

- Core inflation

- Chicago PMI

- UMich consumer sentiment index (final)

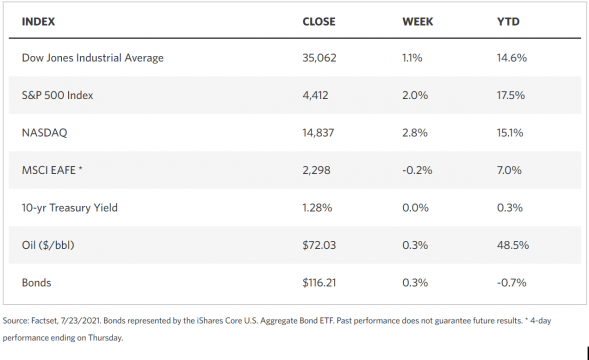

Markets Index Wrap Up