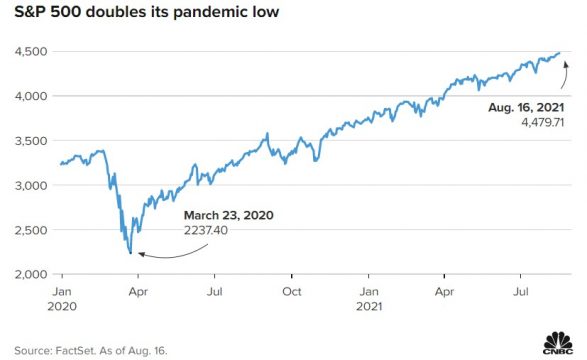

Here’s a market milestone to encapsulate how stunning the recovery rally has been: The S&P 500 just doubled its level from its pandemic closing low.

The broad equity benchmark has rallied 100% on a closing basis from its Covid trough of 2,237.40 on March 23, 2020. It took the market 354 trading days to get there, marking the fastest bull market doubling off a bottom since World War II, according to a CNBC analysis of data from S&P Dow Jones Indices.

The S&P 500 closed at a record 4,479.71 Monday, up 0.3% on the day and 100.2% higher than its low Covid close.

During the financial crisis, the S&P 500 hit its bottom at 676.53 on March 9, 2009, and the benchmark did not double that number on a closing basis until April 27, 2011. On average, it takes bull markets more than 1,000 trading days to reach that milestone, the analysis showed.

“Usually it takes many years to double, so this is another way of showing just how incredible this bull market has been,” said Ryan Detrick, chief market strategist at LPL Financial.

Many credited unprecedented monetary and fiscal stimulus for the market’s leap out of its massive pandemic slump. At the height of the crisis last year, the Federal Reserve slashed interest rates to near zero, while flushing financial markets with $120 billion in emergency monthly bond purchases. The rescue action came as the S&P 500 suffered its fastest 30% drop in history.

Meanwhile, the government injected trillions of dollars into the economy in Covid relief spending, sending direct payments and unemployment insurance to many struggling Americans.

The market gains have come so fast and furious that they have pushed the S&P 500 about 4% above the average year-end target of 4,328 from the top Wall Street strategists, according to the CNBC Market Strategist Survey.

While the numbers may seem too good to be true, this powerful rally does have a fundamental support — a massive earnings comeback. Corporate profits have jumped off the pandemic bottom, with S&P 500 companies reporting 53% year-over-year earnings growth for the first quarter and set to post a 93.8% surge for the second quarter, according to Refinitiv.

“This quarter can be characterized by not only a large number of beats, but also the impressive magnitude of surprises,” David Kostin, head of U.S. equity strategy at Goldman Sachs, said in a note. “Companies are confident that rising input costs can be offset or managed. Firms are taking advantage of excess cash and prioritizing investments for growth while simultaneously maintaining high levels of buybacks.”

The latest tick up in stocks came after data showed consumer prices rose at a more moderate pace in July than last month. Meanwhile, investors cheered Senate passage of the $1 trillion infrastructure bill, which includes $550 billion in new spending for areas such as transportation and the electric grid.

The technology sector led the early stage of the historic market rebound with a 120% return from its pandemic bottom. Investors flocked to tech shares that benefited from a stay-at-home trend in 2020, while embracing the safety of megacap names like the so-called FAANG stocks. The rally in the sector slowed down in 2021, and beaten-down value names and shares tied to economic growth took the baton and sprinted.

These cyclical areas of the market — materials, energy, financials and industrials — have all doubled from their 2020 bottom thanks to a strong comeback this year as optimism toward the reopening grew.

Still, after the eye-popping milestone, many expect more bumpy trading and muted returns down the road. The list of worries is piling up — the spread of delta variant of the coronavirus, slowing economic growth and a Fed that has started mulling dialing back easy policies. Plus, the market hasn’t had a sizeable pullback in about 10 months.

“Although we remain bullish, we haven’t seen so much as a 5% pullback since last October, so one might want to continue to avoid walking under a ladder, but also be aware some type of well-deserved market pullback could be in the cards at any time,” Detrick said.

There has been growing support within the Fed to announce a tapering of its bond purchases in September and begin the reduction in buying a month or so after.