Stock Markets

The S&P 500 reached a new record high of 4,480 on Monday, which is more than double its March 23rd intraday low of 2,192. However, stocks pulled back for the rest of the week, with small-cap stocks lagging and the Russell 2000 Index briefly correcting, down by more than 10% from its recorded peak in March 2021. Among the S&P 500 listings, energy shares underperformed the other sectors while a wide range of health care counters lifted the index. Volumes were at their highest monthly level, signaling a retail trading rebound. Sentiments that weighed the market down during the week included signs of an emerging economic slowdown in China, prompting advice from the Securities and Exchange Commission for investors to exercise caution when taking positions in Chinese stocks due to disclosure issues and regulatory uncertainties. Also causing headwinds are signs that the Federal Reserve may soon adopt a policy of tapering in the central bank’s monthly asset purchases. Midweek, the Fed released the minutes of its latest policy meeting wherein several members signified that they expected tapering may begin by the year’s end. By the end of the week, however, such worries were dispelled by Dallas Federal Reserve President Robert Kaplan when he expressed favor in delaying the tapering should the effects of the delta variant further proliferate in the economy.

U.S. Economy

There were also concerns that indicators released during the week were showing signs of a slowing down of the anticipated economic recovery. On Tuesday, stocks fell after an announcement by the Commerce Department of a 1.1% retail sales slump in July, despite an upward revision in the June base figure. The decline was concentrated on auto sales, which dipped 3.9% due to negative reaction to high prices and automakers dealt with supply shortages of semiconductor chips and other components. However, due to an increase in industrial production by 0.9% in July, automakers moderated or canceled plans to shut down production lines. Home Depot fell short of its sales expectations, causing stock prices to correct sharply even as sales fell on furniture and online purchases. Restaurants and bars experienced a resurgence in sales, however, as this sector opened up further with the lifting of pandemic mandates. Signals were mixed in the housing sector with building permits rising higher than forecasted but July housing starts falling 7%, more than consensus expectations. Labor and building supply worries hampered builder sentiment, a measure of which fell to its lowest level over the past year.

- The results of the last Federal Reserve meeting show that reducing bond purchases has increasingly gained favor among the Fed members. Thus, it is only to be expected that the Fed may begin to gradually firm up its plans for the tapering, the timeline of which may be expected to be announced during the September meeting. It is expected, however, that the Fed has learned from its prior experience in 2013 and would take care to be more communicative and transparent.

- The taper is not expected to become an event risk because it is likely to be better managed. It may, however, reduce the buffer against the disappointments over uncertainties concerning economic growth and policy over uncertainties concerning economic growth and policy adjustments. The relative tranquility in the markets in 2021 was partly due to the high level of monetary stimulus. With a gradual reduction in the amount of monetary accommodation, equities will likely experience a greater degree of short-term volatility and occasional pullbacks.

- The inevitability of the necessity to wind down Federal support becomes more evident as the economy moves farther away from crisis conditions. The recovery is well underway with unemployment at 5.4% and trending downward while GDP growth is on pace to exceed the growth of the past four decades Credit conditions are robust and inflation, though heating up, remains moderate. The prospects of moves towards further normalization are therefore reassuring, even if it may entail tapering policies.

Metals and Mining

A return of investors to gold is possible in light of the recent volatility in cryptocurrencies. Although bitcoin is seen as digital gold and a possible hedge against inflation, it does not have the longevity and security that gold has proven to have. Furthermore, a massive amount of speculative money is required to maintain a viable position in cryptocurrencies. Therefore, it is reasonable to expect that those who fled to bitcoin will eventually return to gold as inflation rises. Any decline in the price of gold should therefore be seen as a buying opportunity. Over the past week, gold moved sideways, marginally increasing by 0.08% from $1,779.75 to $1,781.11 per ounce. This exhibited the resiliency of the yellow metal at this price, since other precious metals succumbed to significant corrections. Silver lost 3.03%, closing at $23.03 from $23.75 per ounce. Platinum closed at $997.10 per ounce, 3.39% lower than the previous week’s $1,032.08. Palladium suffered the greatest weekly loss of 14.09%, closing at $2.276.57 per ounce from the previous week’s close at $2,649.96.

Base metal prices also underwent major corrections over the past trading week. Copper spot prices lost 5.57% of their value, ending the week at $9.037.00 per tonne from the previous week’s closing price of $9.570.00. Zinc fell 3.46% from $3.033.50 one week ago to $2,928.50 per tonne in this week’s close. Aluminum corrected by 2.06% to close at $2,546,50 per tonne at the close of the week from $2.600.00 last week. Finally, tin ended the week at $32.237.00 per tonne, a drop of 8.74% from the previous week’s close of $35,324.00.

Energy and Oil

The downward trend in oil prices continued over the past trading week, declining by 7% week-on-week. Concerns about the proliferation of covid variants and the continued strengthening of the U.S. dollar coincided with the Federal Reserve cutting its stimulus measures for the year. The ICE Brent fell below $66 per barrel on Friday while WTI prices fell to $63 per barrel. With respect to production, OPEC compliance in July stood at 109%. The OPEC’s Joint Technical Committee reported that July’s production quotas were down 3% from June, and OPEC members’ compliance likewise dropped to 116% due to Saudi Aramco’s rollback of its unilateral supply cut. In another part of the world, the Nord Stream-2 Gas Pipe, which is to bring Russian gas to Germany from along the Baltic Sea, is reported to be 99% complete, and is set to meet its construction deadline set for the end of August. The NS2 is likely to be brought onstream before the end of the year.

Natural Gas

For this report week (August 11 to August 18), natural gas prices lost ground in most locations. The Henry Hub spot prices declined from $4.07 per million British thermal units (MMBtu) at the start of the week to $3.86/MMBtu at the week’s end. The price of the September 2021 New York Mercantile Exchange (NYMEX) contract fell by $0.21, from the week-earlier price of $4.059/MMBtu to $3.852/MMBtu a week later. The price of the 12-month strip-averaging September 2021 through August 2022 futures contracts also fell by $0.15/MMBtu to $3.668/MMBtu.

World Markets

The stock market benchmarks indexes in Europe lost steam and succumbed to global worries regarding the spread of the coronavirus’ delta variant, the political upheaval in Afghanistan, and the economic slowdown in China. In the first two weeks of August, the STOXX Europe 600 Index reached a series of record highs, but finally declined 1.48% at the end of the past trading week. The country stock markets followed the trend, with France’s CAC 40 Index dropping 3.95%, Italy’s FTSE MIB dipping 2.78%, and Germany’s Xetra DAX Index sliding 1.14%. The core eurozone bond yields also declined in the past trading week due to investors fleeing to lower-risk assets. Compared with highs of -0.456% on Monday, Germany’s 10-year bund yield closed the week at around -0.495% on Friday. In the currencies market, the euro and the British pound both weakened against the greenback. The risk-off environment apparently benefitted the U.S. dollar,

In Japan, stocks plunged during the week as the Nikkei 225 Index dropped sharply by 3.45%, closing at its lowest level for the year. The broader TOPIX ended 3.03% lower, partly on news that Japanese automotive company Toyota Motor will cut production for September by 40% from its earlier plan. The announcement heightened concerns that the country’s economic recovery was not proceeding as anticipated. A sell-off followed in the shares of car manufacturers’ stocks and companies along its supply chain, including steel and rubber manufacturers. Also contributing to the negative sentiment was the government’s decision to extend the coronavirus state of emergency to September 12 over Tokyo and five other areas, also while expanding coverage of the state of emergency to seven other prefectures. Even with positive economic data releases that signaled Japan’s return to economic growth in the second quarter, market losses continued. The yield on the 10-year Japanese government bond descended to 0.01% while the yen remained unchanged at JPY 109.7 versus the U.S. dollar. Japan’s gross domestic product (GDP) grew in the second quarter of 2021 by 1.3% annualized, still ahead of consensus estimates – a positive sign since it follows a 3.7% contraction in the first quarter.

China’s stocks, like the rest of the world’s bourses, also suffered weakness in part due to Beijing’s regulatory pressures on companies in the technology sector. Investors feared that other sectors may soon follow, thus losing buying interest in the counters. After state media reported that the State Administration for Market Regulation was contemplating new regulations for liquor companies, the liquor stocks suffered a sell-off. Health care companies also dipped on fears that the profits gained by the industry are likely to be tempered by new regulations. During the past trading week, the Shanghai Composite Index pulled back by 2.5% and the CSI 300 Index of large-cap stocks gave up 3.6% of its value, ending at its lowest close since the end of July. Hong Kong’s Hang Seng Index fell into bear market territory, diving by 20% from its peak earlier in 2021. At the close of the past week, China and Hong Kong lost more than $560 billion in market value combined. The renminbi touched 6.5059 against the dollar, a three-week low for the currency. The yield on the 10-year government bond fell three basis points to close at 2.87%.

The Week Ahead

Among the important economic data to be released in the coming week are initial and continuing jobless claims as well as personal income and consumption.

Key Topics to Watch

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

- Existing home sales (SAAR)

- New home sales (SAAR)

- Durable goods orders

- Nondefense capital goods orders, excluding aircraft

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- GDP revision (SAAR)

- Personal income

- Consumer spending

- Core PCE price index

- Trade in goods, advance

- UMich consumer sentiment index (final)

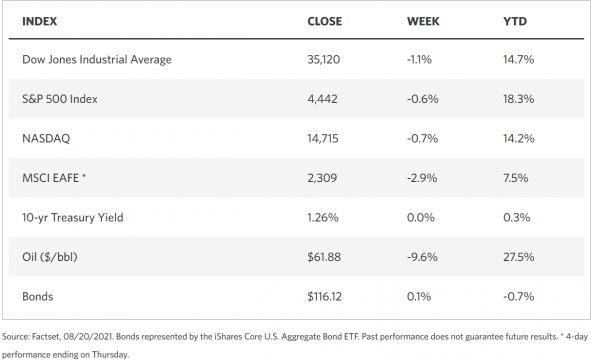

Markets Index Wrap Up