Stock Markets

Impressive stock market gains were garnered in the just-concluded trading week as investor sentiments rose on the news that full Food and Drug Administration (FDA) approval was granted to the Pfizer-BioNTech COVID-19 vaccine. This signaled the strong possibility that the economic recovery will continue unabated and that the worst of the pandemic is over. The broad-market S&P 500 Index and the large-cap Dow Jones Industrial Average were outperformed by the tech-heavy Nasdaq Composite index, and the Russell 2000 Index of small-cap stocks surged on strong gains. As crude oil prices rose 10% for the week, stocks in the energy sector jumped commensurately. Despite the strong price performance, volumes were generally very light, consistent with the seasonal variations. The week was not without its worries; an attack at the Kabul airport in Afghanistan that resulted in casualties in the midst of the U.S. military’s withdrawal from the country. Sentiments were also weighed down by speeches delivered by three regional Federal Reserve (Fed) presidents in support of a more expedient commencement of the tapering of the central bank’s bond purchases. The stock market will continue its alternate optimism-caution rotation in line with local and foreign developments.

U.S. Economy

The economic data released during the week was generally positive, with July’s existing home sales beating consensus expectations by rising 2% from June. This is a signal that more inventory became available on the housing market. New home sales are still down 27% from July 2020, but rose 1% from June. The weekly initial jobless claims remained near their lowest levels during the pandemic although this indicator did rise slightly. The steady labor market performance is indicative that despite the continued spread of the delta variant, the labor sector continues to strengthen. The revised estimate of second-quarter gross domestic product (GDP) growth by the U.S. Commerce Department saw the economy expand at a seasonally-adjusted annual rate of 6.6%, slightly higher compared to the initial estimate of 6.5%.

- Despite increasing anticipation for the Fed to start its winding down or tapering of bond purchases, interest rates continue to remain at historic lows. Even though unemployment has fallen and yields have not made significant progress through the summer, GDP has returned to and even exceeded pre-pandemic levels. Also coinciding with these developments are the rise in inflation together with rising wages and supply shortages. What is likely to take place is a combination of continued economic growth, the start of the Fed taper, and stickier inflation that may drive longer-term rates higher.

- Restrictions attributed to containing the spread of the delta variant have muted consumer spending at restaurants and retail establishments. Economic indicators over the past week suggest the emergence of spending fatigue. A modest 0.3% increase in spending was indicated by the July personal-spending report, a level significantly weaker than the corresponding June indicator as well as a deceleration over the 1.6% average for the last six months. The observation is consistent with last month’s weaker retail sales report and triggers worries concerning the sustainability of the economic recovery.

Metals and Mining

Investor worries are focused on the impending Fed tapering of bond purchases that will signal a tighter monetary policy. While this has not yet taken place, however, the continued inflationary pressures have gold spot prices gaining 2.05% over the past week, from a previous close of $1,781.11 to $1,817.57 per ounce. This development could lead gold prices to the $1,900 per ounce level by the end of 2021, according to the forecast published by the Bank of America last Thursday, August 26. While it may test this resistance level, it is more likely that gold prices may settle around $1,800 per ounce during the final quarter of this year. This may be the highwater mark for the yellow metal as prices hold steady at around $1,800 through the first semester of 2022. One bright note for gold is the growing inflation rate as gold provides a low-risk safe haven for investments, however, the increasingly tighter monetary stance of the Fed may cause gold to look unattractive for the moment.

Other precious metals saw price increases consistent with the gold surge. Silver outperformed the yellow metal, rising 4.34% from $23.03 to $24.03 per ounce over the past week. Platinum gained 1.55%, from $997.10 per ounce to $1,012.53. Palladium outperformed the other precious metals week-on-week, climbing 6.43% to $2,423.00 from its previous close at $2.276.57. Base metals also rose over the week. Copper ended at $9,410,00 per metric tonne, 4.13% higher than its previous week’s close at $9.037.00. Zinc rose 2.53% to $3.002.00 per metric tonne from $2.928.50. Aluminum prices surged by 4.04% from $2,546.50 to $2.649.50 per metric tonne, and tin ended at $33.600.00 from $32.237.00 per metric tonne for a gain of 4.23%.

Energy and Oil

The fundamentals this week remained largely as they were last week. Nevertheless, oil prices continue to ascend, posting significant gains. West Texas Intermediate (WTI) spot price increased to a shade below $69 per barrel while the global benchmark Brent rose above $72 per barrel. What triggered the increase was the blaze at the Ku-Maloob-Zaap offshore Mexico platform, for the moment reducing supply by some 400,000 barrels per day of crude in the market. Further, the forced evacuation of personnel from the production platforms in the Gulf of Mexico prior to the arrival of Tropical Storm Ida contributed to the supply disruption. These issues overshadowed COVID worries and physical market weakness. In the meantime, the supply side may be buttressed by offers from the Venezuelan state oil company PDVSA of 20 million barrels (MMBbls) of heavy crude for September lifetime. Prices range from $35 to $41 per barrel. Venezuela seeks to increase oil exports in light of July outflows totaling 520 thousand barrels per day (kbpd).

Natural Gas

India is making a bid to boost its liquid natural gas (LNG) potential with the commissioning of a 5 million tonnes per annum (mtpa) liquid natural gas (LNG) import terminal scheduled for next year. The terminal will be located in the western state of Gujarat, with private investor Swan Energy targeting completion by March. State companies IOC, Bharat Petroleum, and ONGC each have leased 1mtpa of Swan’s capacities per year.

For this report week (August 18 to August 25), natural gas spot prices rose at most locations. The Henry Hub spot price climbed from $3.86 per million British thermal units (MMBtu) at the beginning of the week to $4.01/MMBtu by the end of the week. The price of the September 2021 New York Mercantile Exchange (NYMEX) contract increased by $0.04 to $3.897/MMBtu pm August 25 from $3.852/MMBtu on August 18. The price of the 12-month strip averaging September 2021 to August 2022 futures contracts rose $0.04/MMBtu to $3.709/MMBtu

World Markets

In Europe, central banks’ accommodative policies continued to provide buying incentive. Shares rose as investor sentiments are buoyed by strong signs of continued economic growth, with higher vaccination rates dispelling pandemic worries of rising case counts. The STOXX Europe 600 Index gained 0.75%. The country-specific indexes followed the same trend; France’s CAC 40 Index gained 0.84%, Italy’s FTSE MIB Index rose 0.34%, and Germany’s Xetra Dax Index inched up 0.28%. The UK’s FTSE 100 Index increased by 0.85%. Meanwhile, the core and peripheral eurozone bond yields also gained ground this week, mirroring the developments in U.S Treasuries. The UK gilt yields also followed suit.

The Japanese bourse also gained ground over the week. The Nikkei 225 Index rose 2.31% and the broader TOPIX Index increased 2.01%, notwithstanding more negative news regarding the coronavirus situation. The yields on the Japanese government bond rose to 0.02% from 0.01% the week previous. The yen, on the other hand, fell to JPY 109.9 against the U.S. dollar, from its previous exchange rate of JPY 109.7. The COVID-19 state of emergency was extended to eight more prefectures, imposing restrictions until September 18. In most regions, infections are said to be spreading on an unprecedented scale, according to Prime Minister Yoshihide Suga. The country continues to speed up its vaccination roll-out, with 60% of the population expected to be fully vaccinated by the end of September.

In China, stocks continued their recovery from the lows encountered in late July. The Shanghai Composite Index climbed 2.8% and the large-cap CSI 300 Index rose 1.2%. The China Securities Regulatory Commission committed to cooperate with the U.S. SEC concerning the auditing of Chinese companies that trade in the U.S. bourses. This resolves a years-long dispute with the U.S. wherein China refused to provide full access to the financial data of Chinese Companies trading in the U.S. on the grounds of national security. In the bond market, the yield edged up two basis points on the 10-year central government bond, to 2.89%. In currencies, the renminbi gained slightly against the U.S. dollar, closing at 6.480.

The Week Ahead

Important economic reports scheduled for release in the coming week include Unit Labor Costs, Hourly Earnings, and Consumer Confidence.

Key Topics to Watch

- Pending home sales

- Case-Shiller home price index (year-over-year)

- Chicago PMI

- Consumer confidence index

- ADP employment report

- Markit manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Motor vehicle sales (SAAR)

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Trade balance

- Productivity (revision)

- Unit labor costs (revision)

- Factory orders

- Core capital goods orders (revision)

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Markit services PMI (final)

- ISM services index

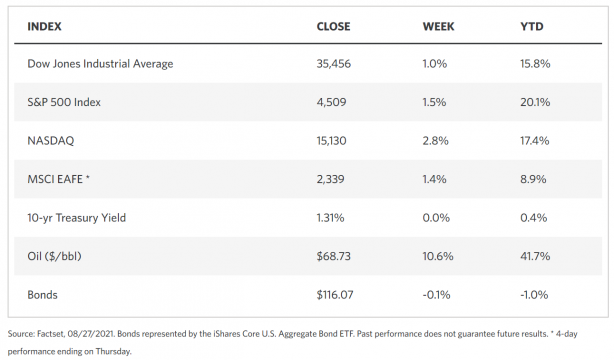

Markets Index Wrap Up