Stock Markets

Stock exchanges retreated over the shortened trading week since markets were closed on Monday due to the Labor Day holiday. Equities signaled caution as the S&P 500 experienced its first five-day losing streak since the middle of February. In this index, the small real estate sector led the declines in response to the increase in long-term interest rates, while consumer staples and utilities sector proved to have greater resilience among all the sectors. The small-cap Russell 2000 Index underperformed among all the indexes after two consecutive weeks of chalking up gains over the large-cap benchmark indexes, while value stocks lagged behind growth stocks. Although there was an increase in volatility, trading volumes continued to remain low, partly due to the shortened week. Historically, however, September is a low period for stocks, even as the missed payroll report figures in August appeared to carry over to the investor sentiment in this succeeding month. The past week’s developments gave little comfort as delta variant coronavirus worries once more arose. On Thursday, President Biden announced a new vaccine mandate, that all large employers must require their workers to either be fully vaccinated or subject themselves to weekly testing. The announcement also covered mandatory testing for all federal workers and contractors.

U.S. Economy

There is increasing global concern in the face of rising uncertainty as central banks are beginning to loosen their restrictive monetary policies and markets continue to remain relatively calm. In the past two weeks, there have been several downgrades economists have made to forecasts for third-quarter returns and 2021 GDP growth. The consensus is that economic growth is now expected at 6% for the year, which is below the 7% projected as of the end of July. Even at the adjusted forecast, this would still be the fastest pace of GDP growth since 1984, not surprisingly due to the recovery from the pandemic recession. Reasons for the downgrade include the slowing consumer demand due to continued COVID-19 delta variant restrictions and supply-chain disruptions that continue to hinder production.

- The positive outlook relative to this downgrade is that growth and economic output will not be entirely foregone but are likely to shift from the third to the fourth quarter and next year in a best-case scenario. The GDP growth forecasts for next year have increased as the estimates for the remainder of 2021 have declined. Caution is advised, however, as markets are more prone to reward growth at present rather than in the future because of its greater uncertainty.

- Vaccinations and COVID-19 cases are likely to peak soon, thus the reopening of the economy is more likely to be merely delayed rather than derailed. As face-to-face classes are imminent and the enhanced unemployment benefits are soon to expire, the labor supply situation will improve with labor shortages easing. The supply-chain disruptions that have hampered productivity will soon be alleviated, building up the currently lean inventories as a result of the supply chain problems. These processes are expected to contribute to further economic growth. Consumers will continue to drive higher than average consumption growth, the engine that fuels the U.S. economy. These developments will be complemented by rising wages, a robust labor market, rising personal savings, and higher net worth as a result of fast-rising house valuations.

Metals and Mining

After the remarkable performance of gold prices in mid-July when the metal tested the $1,830-per-ounce resistance level, it failed to hold to its gains, and the disappointing employment numbers of the previous week drove gold to its one-month high. Immediately after, however, gold corrected, opening lower on Tuesday and continuing its downtrend for the week. As a result, the precious metal is concluding the trading week at below the $1,800 support. There is growing concern that the inability of gold to maintain an upward momentum may attract the attention of short-sellers which could push prices further down to their lows in August, treading $1,700 an ounce. In the shortened trade week, gold lost 2.2% off its earlier close of $1,827.74, ending the week at $1,787.58.

Other precious metals also followed the lead of gold. The spot price of silver lost 3.96%, closing at $23.74 from the previous week’s $24.72 per ounce. Platinum price plunged by 6.43% to end the week at $960.75 per ounce from its former close at $1.026.76. Palladium underperformed the three above precious metals, losing 11.65% of its value as it closed the week at $2,138.37 per ounce compared to the earlier week’s close at $2,420.45.

Base metals fared better than their precious counterparts. Copper spot prices gained 2.79% from the previous week’s close of $9,431.00 per metric tonne, to close this week at $9,694.50. Zinc rose 4.09% to close at $3,119.00 per metric tonne from the earlier week’s $2,996.50. Aluminum climbed 7.22% from $2,727.00 in the week previous to close this week at $2,924.00 per metric tonne. Finally, tin inched up 1.6% over the week to close at $33,583.00 per metric tonne compared to the earlier week’s close at $33.055.00.

Energy and Oil

Last week, category 4 Hurricane Ida ploughed into Louisiana from the Gulf of Mexico, affecting the price movements of oil and other commodities. It comes at a time when three-quarters of oil crude production in the Gulf of Mexico is still shut. Aside from a tight supply situation in the U.S., the Energy Information Administration (EIA) reported a 1.5 million barrels per day (bpd) drop in total production week-on-week. Also for the first time in history, the Strategic Reserves Administration of China is set to hold an auction on Strategic Petroleum Reserve (SPR) volumes that will be supplied to integrated refiners and state-owned chemical plants. As of Friday, Brent traded at $73 per barrel as the West Texas Intermediate (WTI) remained just short of $70 per barrel.

Natural Gas

U.S. natural gas futures surged this week on expectations that demand for air conditioning will rise in the short term. The anticipated weather conditions are expected to be warmer which coincides with production outages resulting from the disruptions induced by Hurricane Ida. October delivery prices surpassed the $5 per metric million British thermal units (MMBtu). This is the first time that prices have increased to this level since February 2014. Natural gas spot prices increased in most locations for this report week, September 1 to September 8. The Henry Hub spot price climbed to $4.78/MMBtu at the end of the week from $4.46/MMBtu. The October 2021 New York Mercantile Exchange (NYMEX) contract price rose by $0.30 to $4.914/MMBtu at the week’s end from $4.615/MMBtu at the start of the week. This was the highest close since late February 2014 for a NYMEX futures front-month contract. The price of the 12-month strip averaging October 2021 through September 2022 futures contracts rose by $0.25/MMBtu to $4.315/MMBtu. The average includes futures contracts for December 2021 and January 2022 delivery. Both of these closed above $5.00/MMBtu.

World Markets

European equities pulled back amid economic uncertainties, concerns of the COVID-19 pandemic, and worries about the direction of central bank policy. The pan-European STOXX Europe 600 Index closed the week 1.19% lower, in line with the major stock indexes. Italy’s FTSE MIB Index underperformed with a loss of 1.45%, Germany’s Xetra DAX Index followed with a drop of 1.09%, and France’s CAC 40 Index dipped by 0.39%. The FTSE 100 Index of the UK eroded by 1.53%. The core eurozone bond yields inched higher, shaving earlier gains caused by the European Central Bank’s decision to reduce its emergency bond purchases; ECB President Christine Lagarde stated, however, that such reduction was not considered tapering. The ECB decided to move to a “moderately lower pace” of bond purchases for the rest of the year in line with its Pandemic Emergency Purchases Programme after a rebound of European growth and inflation. UK gilt yields increased on expectations that the Bank of England (BOE) may commence raising short-term interest rates.

Japan’s stock market saw an extension of their earlier gains throughout the week, encouraged by prospects of a fresh political start and expectations of a new fiscal stimulus under their new prime minister. Current Prime Minister Yoshihide Suga has decided to step down to give way to a new mandate. The Nikkei 225 Index gained 4.3% while the broader TOPIX Index increased by 3.78%. Despite the government extending its coronavirus state of emergency measures, investor sentiment was elevated by the announcement that restrictions are expected to be eased around November when it is estimated that the majority of the population would have been vaccinated. The heightened optimism did not impact the 10-year Japanese government bond which remained unchanged week-on-week at 0.04%. The yen weakened slightly to JPY109,97 against the U.S. dollar, compared to JPY109.92 in the previous week.

For the past three consecutive weeks, Chinese stocks rose on strong trade data and rising investor sentiments following the reported candid telephone call between the U.S. and Chinese presidents. The Shanghai Composite Index climbed 3.4% and the large-cap dominated CSI 300 Index rallied 3.5%. The yield on the Chinese 10-year government bond rose to end the week at 2.89%; meanwhile the renminbi currency increased by 0.2% against the U.S. dollar to settle at 6.4423 per dollar, its strongest level since the middle of June. The favorable trade data involved the 25.6% increase in China’s merchandise exports in August. Imports ascended 33.1% as reported by China’s statistics office. The report exceeded forecasts, despite renewed lockdowns in response to a renewed coronavirus outbreak. The country’s monthly trade surplus grew to $58.34 billion in August, an improvement over the July figure of $56.58 billion.

The Week Ahead

Reports on important economic data scheduled for release in the coming week include Inflation, Retail Sales growth, and the Michigan Sentiment index.

Key Topics to Watch

- Federal budget

- NFIB small business index

- Consumer price index

- Core CPI

- Import price index

- Empire State index

- Industrial production

- Capacity utilization

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Retail sales

- Retail sales ex-autos

- Philadelphia Fed manufacturing survey

- Business inventories

- UMich consumer sentiment index (preliminary)

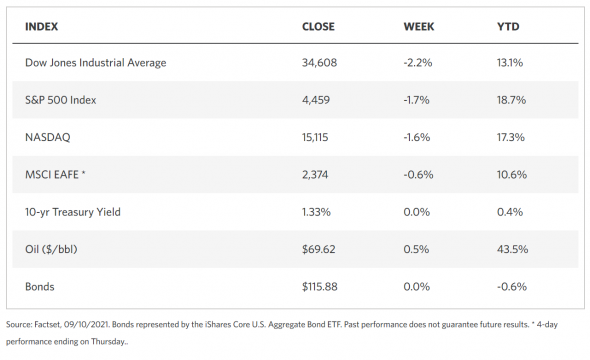

Markets Index Wrap Up