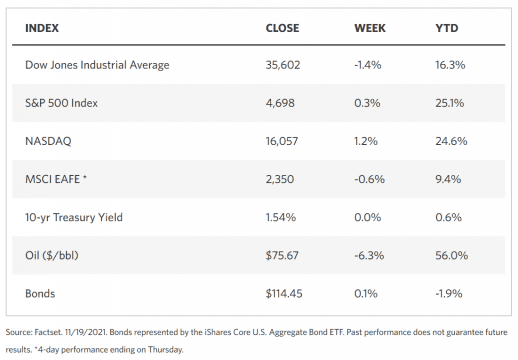

Stock Markets

The past week saw the major indexes ending mixed even as the Nasdaq tested a new record high. Investors swayed between fear and greed as they weighed the prospects of strong economic data and corporate profits reports against concerns about rising inflation, prevailing supply constraints, and the upsurge in coronavirus cases in certain regions. Value stocks were outperformed by growth stocks, accounting for the new intraday high attained by the Nasdaq Composite index during Friday’s trading. Within the S&P 500 Index, sector returns varied widely. Consumer discretionary stocks were boosted by strong gains in Amazon.com shares and a partial resurgence in Tesla. Information technology shares rallied on the back of a strong performance by Apple. As oil prices dropped for the week, so did energy stocks in line with discussions between China and the U.S. about the release of strategic reserves, and as U.S. inventories climbed for the first time in the past five weeks.

Taking a longer-term view, the bourses are up approximately 25% since the beginning of the year. It treaded a relatively easy path, with only one 5% correction so far. Some investors are exhibiting signs of fearing that they had missed out on the bottom as they continue to buy with good volume among the high-flying stocks whose significant gains continue to attract attention among those eager to catch up. Simultaneously, however, there is a sense among those who came in early that the overheated market may signal some profit-taking. The sustained rally poses some prospects of a major correction, possibly to digest some of the gains before heading back towards positive territory.

U.S. Economy

There are signs that the economic expansion is again gaining momentum. For instance, the Commerce Department reported on Tuesday a jump in October retail sales amounting to 1.7%. This represents the largest gain recorded since March, even as September’s retail sales figure was revised upward. Inflation may have accounted for some of the increase, as sales in gas stations ascended 3.9%, but the impact of early holiday shopping could not be discounted. There was also a higher-than-expected increase in October’s industrial production, at 1.6% compared to 0.7%. The current measure of manufacturing activity in the New York region also showed higher than expected results.

There is also speculation about the future direction of Fed policy, although it is generally accepted that more stringent measures are coming to address the rising inflation rate. What is uncertain is how soon and how severe the more restrictive monetary policies may be. Due to the role played by the extraordinary monetary stimulus and liquidity in the stock market rally, it is likely that equities may dramatically respond to the coming bond taper and eventual rate hikes. Some analysts even suggest that the forthcoming tighter Fed policy may usher in a possible future recession or bear market. But this is all speculative, as currently, the situation is far from foreboding that an overly restrictive monetary setting is likely. The more likely scenario is that the Fed restrictions will be introduced more gradually and with sufficient forethought, and though it may cause some volatility into the markets, monetary policy by the Federal Reserve may well be more than a tailwind than a headwind for the longer term.

Metals and Mining

The week was mostly one of quiet sideways trading, with gold likely to end the week strong. However, movements in the U.S. dollar caused precious metals to move south very quickly. At the close of the week, gold ended below $1,850, its critical initial support, thus possibly signaling further downward movement barring any fundamental changes over the weekend. The U.S. currency simultaneously shot up to end the week at a new 16-month high, ascending 96 points. The rising currency value is creating headwinds for precious metals concerning their valuation in dollar terms. The growing gap in monetary policies is the cause of the strengthening of the dollar, as the Federal Reserve proceeds with its plan to taper monthly bond purchases, potentially leading to interest rate hikes in 2022.

There is still some upside to precious metals as inflation continues to pose a threat to other, riskier, investment vehicles. The recent dips in metal prices may be an opportunity to accumulate. Gold spot price began last week at $1,864.90 and ended at $1,845.74 per troy ounce, for a weekly loss of 1.03%. Silver ended one week ago at $25.32 and the just-concluded week at $24.62 per troy ounce, losing 2.76%. Platinum began at $1,085.80 and closed the week at $1,034.16 per troy ounce, plunging 4.76%. Palladium came from $2,111.41 to end at $2,061.25 per troy ounce, sliding 2.38%. Base metals did not fare much better. Copper began at $9,633.50 per metric tonne but closed Friday at $9,441.50 for a weekly loss of 1.99%. Zinc, which was at $3,279.00 the week before, ended last week at $3,159.00, losing 3.66%. Aluminum was previously $2,660.00 but ended at $2,616.00 per metric tonne, thus descending 1.65%. Tin, however, bucked the trend to close 1.98% higher, climbing from $37,708.00 to close at $38,453.00 per metric tonne.

Energy and Oil

For most of the week, crude prices were stagnant in the light of conflicting market signals – inventories have dropped to their lowest point in years, off by about 300 million barrels from their summer highs. There were unprecedented stock draws in both the Americas and Asia that confirm the sentiment of tightness in the market. At the same time, the unexpected increase of coronavirus cases across the Atlantic Basin heightened demand concerns as nations mull over a return to lockdowns, further slowing the economic recovery. Austria is poised to be the first Western European country to reimpose a full coronavirus lockdown this autumn, due to the resurgence of COVID infections. The situation between OPEC+ and the U.S. also failed to improve this past week. On Friday, the U.S. West Texas Intermediate crude oil futures traded lower after they descended steeply from their intraday highs during the trading session. The sudden strengthening of the U.S. dollar also weighed in on the demand forecasts. The possibility was also raised that the potential release of crude reserved in leading economies may flood the market with too much supply.

Natural Gas

For the report week starting November 10 and ending November 17, 2021, natural spot prices rose at most locations. Henry Hub spot price increased from $4.58 per million British thermal units (MMBtu) at the week’s open to end at $4.79/MMBtu on Wednesday’s close. International natural gas prices also went up for the same duration. For the balance of November, swap prices for liquefied natural gas (LNG) cargos in East Asia increased for the second consecutive week. The weekly average increased to $32.69/MMBtu for this report week, $0.55 higher than the previous week’s average of $32.13/MMBtu. In the Netherlands at the Title Transfer Facility (TTF), Europe’s most liquid natural gas spot market, the day-ahead price gained for the second week in a row to average a weekly $27.68/MMBtu, ahead by $2.95/MMBtu from $24.73/MMBtu, the previous week’s average. Compared to the same week last year – i.e., for the week ending November 18, 2020 – prices in East Asia and at TTF were $6.80/MMBtu and $4.74/MMBtu, respectively.

World Markets

In Europe, shares were mostly unchanged for the week as the coronavirus surge through the region posed a challenge to the economic recovery. The pan=European STOXX Europe 600 Index closed 0.14% lower week-on-week. The major European indexes were mixed. Italy’s FTSE MIB Index lost 1.42%, Germany’s Xetra DAX Index rose 0.41%, while France’s CAC 40 Index gained 0.29%. The UK’s FTSE 100 Index slid by 1.69%.

The core Eurozone bond yields fell on comments by the European Central Bank (ECB) President Christine Lagarde signaling the continuation of accommodative policies. Lagarde dispelled worries of interest rate increases, pointing to the prospect of a dissipating inflation increase. She also broached that asset purchases may proceed even after the expiry of the Pandemic Emergency Purchase Programme. After Austria’s announcement of the reinstatement of a nationwide coronavirus lockdown, fears spread in Europe that further COVID restrictions may once again become prevalent, pushing core yields down further. Peripheral eurozone bonds followed the trend set by core markets, while UK gilt yields remained broadly unchanged, taking their cue from the ECG’s announcement.

In Asia, Japan’s stock market returns were cautiously up after the government announced a larger-than-expected stimulus package. The Nikkei 225 Index gained 0.46% and the broader TOPIX Index increased by 0.19%. The Bank of Japan announced that monetary policy would continue to be accommodative, leading the yen to slightly weaken against the U.S. dollar from JPY 113.9 last week to JPY114.5 at the end of this week. The yield on the Japanese 10-year government bond inched up to 0.08% from 0.07% the week earlier.

The Chinese bourses were not much different, ending the week mixed as the CSI 300 Index moved sideways and the Shanghai Composite Index ticked up 0.5%. Lackluster third-quarter earnings and revenue performance announced by Alibaba Group Holdings, the e-commerce Chinese conglomerate, topped a week of mostly negative news on the economy and on efforts by real estate firms to raise funds. The People’s Bank of China (PBOC) remained supportive of the economy with the unveiling of its targeted lending program worth RMB 200 billion in financing aimed at the domestic coal sector. Yields on the country’s 10-year government bonds remained steady at 2.946% for the week, in reaction to Beijing’s willingness to use the PBOC’s balance sheet to direct credit at the margin toward favored sectors. The yuan slipped to 6.4009 per U.S. dollar, constituting a two-week low.

The Week Ahead

Personal income and credit, the PCE index, and the PMI composite are among the important economic data scheduled to be released in the coming week

Key Topics to Watch

- Chicago Fed national activity index

- Existing home sales (SAAR)

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- GDP revision (SAAR)

- Gross domestic income (SAAR)

- Durable goods orders

- Core capital goods orders

- Trade in goods (advance)

- Personal income (nominal)

- Real disposable income

- Consumer spending (nominal)

- Real consumer spending

- Core inflation

- Core inflation (year-over-year)

- New home sales (SAAR)

- UMich consumer sentiment index (final)

- 5-year inflation expectations

- FOMC minutes

Markets Index Wrap Up