Volatility in U.S. natural gas prices is set to continue in the coming weeks and during the winter, as a number of both bullish and bearish factors will alternate to impact market sentiment and prices.

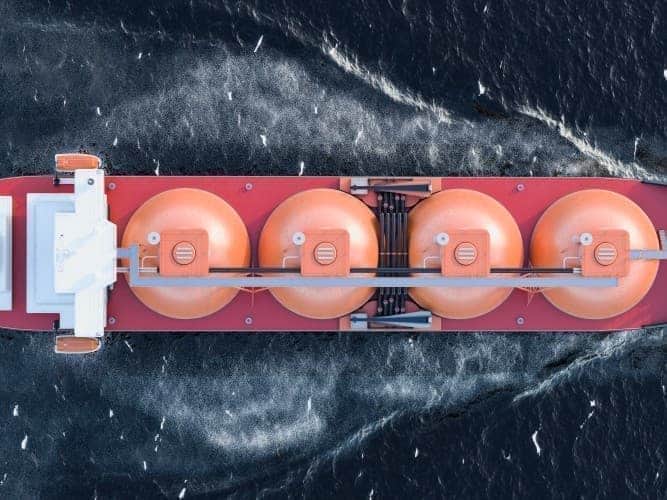

Record American liquefied natural gas (LNG) exports are set to support the benchmark U.S. natural gas price at Henry Hub, while a resurgence in COVID cases in many parts of the United States and Europe could slow down gas demand if economies also slow amid newly imposed restrictions and lockdowns.

Winter weather in the northern hemisphere is the biggest wild card for natural gas prices in the next few months. A colder than normal winter could propel prices higher as the tight European gas market will become even tighter, impacting prices elsewhere, especially in Asia. If Asia’s winter is also colder than usual, high prices are on the cards, driving up additional U.S. LNG exports because of the lower Henry Hub prices compared to the benchmarks in Europe and Asia. Sustained high American LNG exports are, in turn, tightening the U.S. market and driving the U.S. natural gas benchmark higher.

U.S. exports of LNG have reached near-record levels in recent weeks amid record shipments to China in recent months.

After a year without U.S. LNG shipments to China between March 2019 and February 2020, due to the trade war, American exports to China started rising toward the end of last year to reach a record high in August 2021, the latest available EIA data shows.

So far in November, the volume of gas feeding to U.S. LNG export facilities has been higher than in October and near the monthly record from April 2021, per Refinitiv data cited by Reuters. So far in November, the volumes of gas flowing to U.S. export plants have averaged 11.1 Bcf/d, up from 10.5 Bcf/d last month and slightly down from the April monthly record of 11.5 Bcf/d.

On Friday, November 19, the volume of gas flowing to U.S. LNG export facilities was estimated by Refinitiv to have hit an all-time high of 12.03 Bcf/d, up from the previous record of 11.99 Bcf/d from late March 2021.

Due to near-record exports, U.S. natural gas futures rose by 6 percent in the week to November 19, following a 13-percent slump in the previous week, per Reuters estimates.

On Monday, November 21, prices opened lower and traded below $5 per million British thermal units (MMBtu), after they had settled above $5 on Friday.

According to investing.com’s Satendra Singh, this week’s decisive point for the immediate direction of Henry Hub prices would be the level of $5.562/MMBtu, with a sustainable move above that level this week signaling a bullish trend and a sustainable move below suggesting possible sell-offs.

Colder weather this week would support prices, as U.S. domestic natural gas demand is estimated by NatGasWeather.com to swing between moderate and high as a chilly weather system with rain and snow tracks across the Great Lakes and East early this week.

U.S. natural gas prices averaged $5.51/MMBtu in October and are set to average $5.53/MMBtu from November through February, the EIA said in its latest Short-Term Energy Outlook (STEO). Prices were high in recent months because of inventories below the five-year average.

“Despite high prices, demand for natural gas for electric power generation has remained relatively high, which along with strong global demand for U.S. liquefied natural gas (LNG) has limited downward natural gas price pressures,” the EIA said.

“We forecast that U.S. inventory draws will be similar to the five-year average this winter, and we expect that factor, along with rising U.S. natural gas exports and relatively flat production through March, will keep U.S. natural gas prices near recent levels before downward price pressures emerge,” according to the U.S. administration.

Price pressures downwards will emerge next year as high prices now incentivize more production, but throughout this winter—especially if it’s a colder-than-usual one from America to Europe and Asia – natural gas prices have room to rally further.