Stock Markets

Trading was shortened for the week due to the Thanksgiving holiday, but not before a sharp sell-off on news that a possibly more contagious and deadly coronavirus variant was spreading in South Africa. This new strain, dubbed the Omicron variant, has not yet been fully assessed as to whether it could effectively evade the protection provided by the current vaccines, but the market of risky assets, particularly equities, proved averse to the possibility of renewed lockdowns and pandemic restrictions on businesses and consumers. Before the suspension of trading, the information technology sector slumped as the rising Treasury yields eroded the value of future expected corporate profits in present terms. The yields fell on Friday in the midst of a flight to safe haven assets. Value stocks proved more resilient than growth stocks despite the selling pressure on leisure and travel stocks during the last trading day.

U.S. Economy

Thanksgiving marks a shift in the consumer shopping season with the Black Friday opening salvo. Consumer spending habits have evolved, however, with a larger volume of transactions being conducted online as well as holiday sales exceeding the traditional Thanksgiving-to-Christmas shopping window. Overall spending may experience a healthy jump despite possible supply-chain disruptions forcing consumers to limit their selections to in-stock brick-and-mortar store items. The National Retail Federation (NRF) foresees a hike in holiday sales for this year to the tune of 8.5% to 10.5% year-on-year.

There is much to fuel a healthier consumption appetite in the coming year, with the personal savings at 7.5% of disposable income. This is the highest personal savings rate approaching Thanksgiving in the past 25 years. Although this is a significant discount from the spike during the pandemic lockdowns when consumer spending was at a halt, the savings rate is still well above the 6.5% long-term average (or 6.1% excluding 2020). On the other hand, the wage growth rate, currently at 4.2%, is the highest it has been since this corresponding period in 2007, furthering impetus for consumer spending. Over the past quarter-century, as wage growth rises above 4% and accelerates, the growth in the gross domestic product (GDP) averages 3.2% compared with a 2.5% average for the entire period. A further improvement in the labor market is likewise expected to support a possible bull run for the next year. Labor shortages remain a problem that may be exacerbated by the likelihood of a new covid strain. The new post-pandemic low in the initial jobless claims that were reported last week, however, appears likely to support the strengthening of the labor market in 2022 with a decline in the prospective unemployment rate from the present 4.6%.

Metals and Mining

Monday and Tuesday of the past week saw a massive sell-off in precious metals after President Joe Biden’s announcement that he would nominate Jerome Powell to continue as chair of the Federal Reserve. While the connection is not clear, investors may expect that Powell may not adopt as dovish a policy as Lael Brainard, the other person considered for the position. Powell, however, is not expected to be openly hawkish in his stance. The rise in inflation has investors overly cautious of the imposition of restrictions in the monetary policy before the end of the year. \

After the initial sell-off in precious metals, however, there was a noticeably strong rebound when the news of the latest COVID-19 variant was released. The discovery of the Omicron mutation in South Africa and its likelihood of triggering another round of surges and lockdowns around the world has shifted attention back to gold as a safe haven asset during times of heightened risk. The price of gold bounced off an almost three-week low, and recovered, although to a level short of the previous week’s close.

At the close of trading for the week, the spot price of gold, which began at $1,845.74 per troy ounce, ended at $1,802.59, lower by 2.34%. Silver also lost 5.93% in value, descending from $24.62, its close of the previous week, to Friday’s close at $ 23.16 per troy ounce. Platinum also slid for the week, from $1,034.16 to $958.28, or a loss of 7.34%. Palladium ended the week 14.36% lower, starting at $2,061.25 and ending at $1,765.28 per troy ounce. Base metals (3Mo) took the opposite direction of their precious counterparts. Copper rose 3.81% for the week, from its $9,441.50 of the previous week to Friday’s close at $9,801.50 per metric tonne. Zinc gained 4.48% to close at $3,300.50 on Friday from the earlier week’s close at $3.159.00 per metric tonne. Aluminum climbed 3.88% to its recent close at $2,717.50 per metric tonne from the prior week’s close at $2.616.00. Tin also gained 3.27% week-on-week to close at $39,709.00 per metric tonne from $38,453.00.

Energy and Oil

On Friday, oil prices plunged by more than 10% across the board on jitters that a new COVID strain is starting to spread from South Africa. The so-called Omicron variant has once more resurrected fears of future economic lockdowns and the likelihood of a curtailed demand on oil and gas. Earlier, the release of Strategic Petroleum Reserves announced by Joe Biden failed to bring down prices of oil and, instead, spurred them higher. What the U.S. President intended to achieve, therefore, was attained by the prospect of a new virus and fears of a reversal of the fledgling economic recovery. With the scheduled meeting of the OPEC+ on December 2 meeting, it is still possible for the consortium to influence the outcome of the SPR release and the recent price fluctuation by possibly reducing production targets for 2022. Thus far, the OPEC’s Economic Commission Board estimates that global crude surplus for the first quarter of 2022 will only be inflated by the SPR releases set in motion by the United States and its partners. It may eventually lead to a slower-than-assumed OPEC+ production rollout.

Natural Gas

The recent news release concerning the Omicron covid variant has arrested the climb of LNG spot prices in Asia. Instead, fears of a reduction in demand for liquefied natural gas due to a slowdown in the economic recovery have gas prices dipping to $36 per million British thermal units (MMBtu), although demand is still ramping up in Japan and South Korea. The price currently remains above the seasonal high. In the west, US natural gas prices continue their ascent despite the past week’s trading being shortened by the Thanksgiving holiday. The U.S. natural gas Henry Hub futures rose 5% for the week to end at $5.16/MMBtu. This is likely due to the expected increase in the demand for heating as the cold winter months approach. Week over week, U.S. natural gas consumption has increased mainly by the residential and commercial sector, rising 3.0% or 2.3 billion cubic feet per day (Bcf/d). U.S. LNG exports have also increased during the same period, amounting to 22 LNG vessels with a combined carrying capacity of 79 Bcf/d departing the U.S. between November 11 and November 17, 2021.

World Markets

Equities in Europe declined precipitously on concerns that the economic recovery of the region may be interrupted by the spread of the Omicron variant of the coronavirus. The new mutation was discovered in South Africa, and it is perceived to spark a new round of pandemic restrictions throughout Europe and possibly the world. The pan-European STOXX Europe 600 Index closed the week lower by more than 4%. The principal indexes in Italy, France, Germany, Spain, and the Netherlands also took a nosedive. The UK’s FTSE 100 Index was not as severe since the pound’s exchange rate against the dollar depreciated. Since many of the listed companies in the FTSE 100 Index are multinationals earning in US dollars, the weaker pound tends to bolster the index. The core eurozone bond yields were relatively unchanged as the news of the Omicron variant softened their ascent from the week’s highs. The peripheral eurozone bond yields have remained high due to the prevailing fears of continued inflation and the possibility that central banks may adopt more restrictive policies, following the UK gilts.

In Japan, the stock exchanges appeared to sustain their high levels halfway through the week, but to later give way on fears that the economic recovery may be derailed. The Nikkei 225 lost 3.3% when it descended below 29,000 points to close at 28,752. The Topix performed only slightly better, falling 2.91% to finish below the 2,000-point support and ending at 1,985. Selling pressure was evident in the airlines and automotive sectors as sentiments were negatively affected by the slower than expected pace of economic recovery. Later in the week, the reappointment of Federal Reserve Chair Jerome Powell exacerbated concerns that interest rates in the U.S. may be raised sooner than expected, creating a wider divergence from Japan’s policies. At this point, growth-oriented stocks and highly valued technology companies absorbed the selling pressure of the speculated monetary tightening. The yen also slid to new multi-year lows, while the benchmark 10-year Japanese government bond yields rose to 0.085%, its highest level for the month of November before it corrected to 0.07%.

The Chinese bourses also weakened although not as sharply as the Western and Japanese markets. The CSI index dipped 0.6% while the Shanghai Composite Index remained unchanged, even as U.S.-Chinese tensions (i.e. regarding Taiwan’s status and trade issues) prevailed and economic pressures continued to rise, further fueling expectations for supportive government measures. The yields on China’s 10-year government bonds descended from the previous week’s 2.946% to 2.881% as a result of investors’ flight to safe haven assets. The yuan strengthened slightly to 6.3917 against the U.S. dollar, compared to last week’s exchange rate of 6.4009 per USD.

The Week Ahead

The employment rate, the consumer confidence index, and the PMI index are among the important economic data due for release in the coming week.

Key Topics to Watch

- Pending home sales

- S&P Case-Shiller home price index (year-over-year-change)

- Chicago PMI

- Consumer confidence index

- ADP employment report

- Markit manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Beige Book

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Markit services PMI (final)

- ISM services index

- Factory orders

- Core capital goods orders (revision)

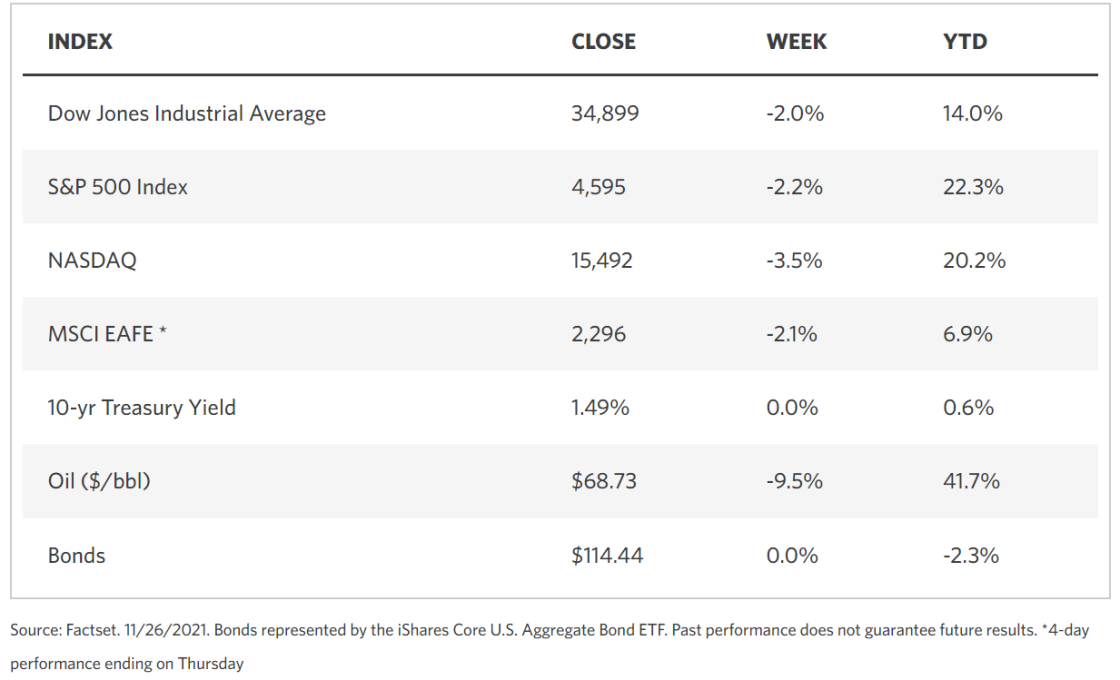

Markets Index Wrap Up