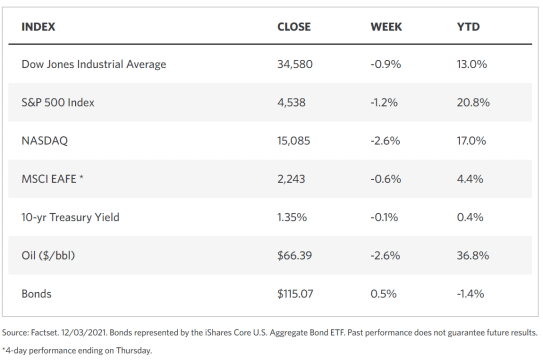

Stock Markets

Volatility characterized the past week’s trading with the major equity indexes pulling back on the announcement by Fed Chair Jerome Powell that the Federal Reserve may begin tapering on its monthly asset purchases and do so at a faster rate than expected. Also factoring in on investor sentiment are concerns that the emerging omicron variant of the coronavirus, which the World Health Organization (WHO) labeled as a variant of concern, may slow down the economic recovery and growth by further prolonging supply chain disruptions. The smaller and mid-cap benchmarks were outperformed by large-capitalized stocks. The communications services sector lost the most ground while the utilities sector was the only sector that realized any gains within the S&P 500. Among bonds and other fixed-income markets, worries that the omicron variant may wreak havoc once more in the global economy, together with uncertainties surrounding the upcoming move by the Feds. The Treasury yield curve flattened during the trading week as long-term rates decreased and short-maturity yields rose. Generating positive returns through most of the week were tax-free municipal bonds, which also performed consistently with the broad-sector U.S. Treasuries.

U.S. Economy

The principal concern about the sustainability of the ongoing economic recovery is the discovery of the omicron variant and how transmissible and severe it could be amid fears of the drop in the effectiveness of the current vaccines. Travel restrictions were tightened by many countries to stave off the possible spread of the variant, and hopes linger that the vaccines can continue to provide some protection against severe illness and hospitalization due to the unknown mutation.

The larger economic picture, however, looks stable, with strong household finances resulting from extensive fiscal support and government-income transfers emerging as the key factors behind the robust economic rebound post-pandemic. There is a reported $2.3 trillion estimated additional savings relative to the comparative average levels before the pandemic. This provides a safety buffer for uncertain times on the horizon for strong consumer spending should uncertainties materialize. There is also strong positive economic momentum with the most recent data indicating strength in the U.S. economy. Real GDP is growing at nearly 10% in the fourth quarter based on the forecast by the Atlanta Fed.

- Consumer spending is showing no signs of slowing, which is reassuring since it is the main driver of the U.S. economy. Last month, spending was reported as rising strongly even in real terms (i.e., without the effect of inflation).

- The leading indicator of factory activity, the ISM manufacturing PMI, moved higher in November and remains at close to its highest readings since 2004, although it is still off its peak. The comparative indicator for the services sector also rose to its record high, based on Friday’s report.

- The labor market remains robust. Although job growth in November registered its smallest gain for the year at 235,000 payroll jobs, the unemployment rate nevertheless fell by 4.2%, a larger than expected number. Labor force participation also rose steadily. The four-week claims have now descended to new pandemic lows, having fallen below the lowest point recorded in five of the last six expansions.

Metals and Mining

The gold market continues to struggle to find its strategic place among the financial markets as investors’ concerns increase over the more hawkish pronouncements of Federal Reserve Chair Jerome Powell. This is a reversal from three weeks ago when gold was on a bullish uptrend as investors flew to risk havens from inflationary pressures. At that time, the Fed regarded inflation as transitory and soon to descend to normal levels. More recently, however, the policy setters appear to dismiss the notion that the trending inflation was merely temporary and take the threat of inflation more seriously. The Fed announcement showed that it is prepared to adopt more aggressive in adopting monetary tightening measures, which the market took to mean that the tapering off of monthly bond purchases will be conducted at a faster pace in December. For 2022, the market is starting to price in four rate hikes. Gold remains stuck in this neutral territory for the meantime as investors try to discount the recent Fed proclamations.

There still remains long-term potential in precious metals as some investors shift to an accumulation strategy. It was announced in the just-concluded week that both the central banks of Singapore and Ireland began to purchase gold for the first time in decades. Singapore bought 27.35 metric tons of gold between May and June. For its part, the Irish central bank bought two tonnes of gold, marking its first gold purchase since 2009. For the week, gold lost 1.07% to end at $1,783.29 per troy ounce from $1,802.59 the previous week. Silver went from $23.16 to $22.52 week-on-week for a loss of 2.76%. Platinum also slid 2.31% from $958.28 to $936.19 per troy ounce for the week. Palladium buck the trend and closed at $1,817.43 per troy ounce from the earlier week’s close at $1,768.28, for a 2.95% gain.

For base metals, prices generally succumbed to the downward spiral. 3Mo copper descended 3.91% from $9,801.50 to $9.418.00 per metric tonne. Zinc fell 4.21% to $3.161.50 per metric tonne from $3,300.50 the week earlier. Aluminum began at $2,717.50 to slide down by 3.48% to $2,623.00 per metric tonne week-on-week. Tin, meanwhile, inched down 0.94% from $39,709.00 to $39,335.00 per metric tonne for the week.

Energy and Oil

The much-anticipated decision from OPEC+ about reducing or ceasing its monthly 400,000 barrels per day (b/d) oil increase did not materialize, and the week’s expected stellar event fizzled out when the country-members decided to remain committed to the original plan. The oil consortium nevertheless committed to maintain its option to reverse that decision if the situation calls for it. Oil prices corrected on the news, the market subsequently calmed when players saw that the OPEC+ did not disregard the threat of the new Omicron virus strain. The member states committed to reconvene quickly if a sudden shift in market conditions came about. Also, the countries that have overproduced their quotas so far will see a cap on their upcoming production targets in order to balance their annual production volumes. These announcements helped to support oil prices and push them slightly upwards towards the end of the week.

Natural Gas

For the report week November 24 to December 1, natural gas spot prices fell at most locations. The Henry Hub spot price cam down from $4.90 per million British thermal units (MMBtu) to $4.23/MMBtu during the week. International natural gas prices remained close to all-time-highs, while prices in the U.S. fell due to seasonally warm temperatures across most of the country. The Henry Hub spot price descended 14% or $0.67/MMBtu. Forecasts by the National Oceanic and Atmospheric Administration (NOAA) projects possible above-normal temperatures throughout most of the lower 48 states and an equal chance of normal temperatures across the rest of the country. U.S. natural gas consumption increased week-over-week in all sectors except the power sector. Exports of natural gas increased from the previous week, while U.S. LNG exports remained unchanged on a weekly basis.

World Markets

Trading in Europe’s stock markets was mixed as volatility returned due to Omicron variant concerns and continued signs of inflationary pressures. The pan-European STOXX Europe 600 Index ended 0.28% lower based on local currency terms. Among the major bourses, Germany’s Xetra DAX Index dipped 0.57%, France’s CAC 40 Index gained 0.38%, and Italy’s FTSE MIB Index also rose 0.33%. The UK’s FTSE 100 Index climbed 1.11%. The core eurozone bond yields fell to lower levels, affected by negative news on the further spread of the omicron variant. Comments by Federal Reserve officials indicating the adoption of tighter monetary policies created less of an impact on bond yields than the coronavirus news. Counterbalancing the Fed announcement are comments made by Bank of England Monetary Policy Committee member Michael Saunders that he may vote against a rate hike this month, in light of the uncertainties created by the omicron variant. This declaration further weighed down on yields.

The Japanese stock markets traded downward for the week also due to concerns that the omicron variant may spread throughout the country. These worries compelled Japan to close its borders to foreign nationals (except for those with special permission to enter), a move that caused investor sentiment to turn negative. The Nikkei 225 Index lost 2.51% of its value while the broader TOPIX Index also fell 1.37%. The yield on the ten-year Japanese government bond slid to 0.05% from 0.07% at the previous week’s close, mainly on safe-haven demand. The yen remained broadly unchanged from the previous week, at JPY 113.3 against the US dollar. The release of positive economic data, particularly the increase in industrial production and decrease in the unemployment rate, provided further support to investor sentiment.

Chinese stocks realized gains for the trading week despite the return of tensions between this country and the U.S. Tensions flared after the Chinese ride-hailing app Didi announced that it would delist its shares from the New York Stock Exchange. The CSI Index climbed 0.84% while the Shanghai Composite Index gained 1.2%. The announced delisting of Didi was a reaction to the directive by the U.S. Securities and Exchange Commission that Chinese companies listed on the U.S. stock exchanges must disclose whether they are owned or controlled by a government agency or instrumentality and for those companies to provide evidence of their auditing inspections. The yields on the country’s ten-year government bonds surged to 2.926% from 2.881% the week prior, in pace with the increase in U.S. Treasury yields in response to Federal Reserve news of an impending speedier tapering of the U.S. central bank’s monthly bond purchases. The yuan rose against the U.S, dollar to 6.3718 from 6.3917 the week before following the stronger midpoint rate set by the People’s Bank of China. China’s central bank allows the exchange rate to fluctuate 2% above or below the midpoint rate that it sets every morning.

The Week Ahead

Inflation, productivity, and consumer credit are included among the important economic data expected to be released in the week to come.

Key Topics to Watch

- Trade deficit

- Productivity revision (SAAR)

- Unit labor costs revision (SAAR)

- Consumer credit (change)

- Job openings

- Job quits

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Wholesale inventories (revision)

- Real household wealth

- Real domestic nonfinancial debt

- Consumer price index

- Core inflation

- CPI (year-over-year change)

- UMich consumer sentiment index (preliminary)

- Expected inflation, five-years (preliminary)

- Federal budget

Markets Index Wrap Up