Bitcoin is so volatile that if you want to “buy the dip,” the dip will likely be there.

Case in point: After peaking at over $68,000 in early November, the price of the world’s largest cryptocurrency wasn’t able to maintain its upward momentum. In fact, over the past weekend, it dipped below $50,000.

Trading at $51,444 as of this writing, Bitcoin has dropped 18.7% in the past month. Could this be an opportunity for investors who were previously standing on the sidelines?

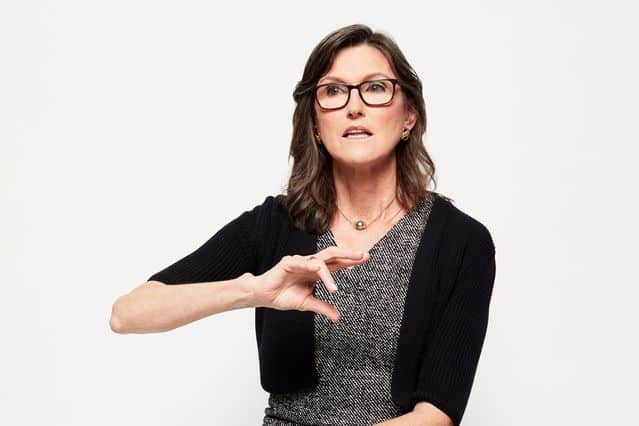

It all depends on how high you believe Bitcoin could go. Ark Invest’s Cathie Wood, for instance, told Barron’s last month that if “institutional investors move into Bitcoin and allocate 5% of their portfolios,” the price of the cryptocurrency would soar to $560,000 by 2026.

Based on where Bitcoin is at today, her latest projection implies an upside of 988%. That might seem far-fetched, but remember Wood was right on the money when she predicted a 1,200% upside in Tesla.

So here’s a couple of ways to play the crypto boom — including options with small price tags and zero commissions.

Bitcoin ETFs

Wood herself is offering a new way to invest in cryptocurrency. In September, Ark Next Generation Internet ETF tweaked its prospectus to include exposure to Bitcoin via Canadian ETFs.

The first bitcoin ETF on the New York Stock Exchange started trading in October, but Canada has been ahead of the U.S. for a while. Several Bitcoin ETFs launched in Canada this year, including Purpose Bitcoin ETF, 3iQ CoinShares Bitcoin ETF, CI Galaxy Bitcoin ETF and Evolve Bitcoin ETF.

In the U.S., the debut of the ProShare Bitcoin Strategy ETF was arguably a major catalyst behind Bitcoin’s rally in October. The fund holds bitcoin futures contracts that trade on the Chicago Mercantile Exchange.

Investors who want exposure to the crypto market can invest in these ETFs, but you can also buy Bitcoin directly. Some investing apps allow you to buy both cryptocurrencies and ETFs commission-free.

Cryptocurrency stocks

Companies that have tied themselves to the crypto market provide another way for investors to benefit from a crypto rally.

For instance, enterprise software company MicroStrategy purchased 7,002 bitcoins between Oct. 1 and Nov. 29. That brings its total bitcoin count to 121,044, a stockpile worth nearly $6.2 billion.

Because of MicroStrategy’s huge Bitcoin stake, some investors have used it as a proxy for investing in the cryptocurrency. In the past, rallies in Bitcoin usually led to similar moves in MicroStrategy’s share price.

Then there’s Riot Blockchain, which mines Bitcoin and hosts Bitcoin mining equipment for institutional clients. Thanks to the rise of the cryptocurrency, Riot shares have returned a staggering 182% over the past 12 months.

Investors can also check out Coinbase, which runs the largest cryptocurrency exchange in the U.S. The company’s share price fell below its IPO price of $250 during the summer, but the pop in cryptocurrencies in October and early November brought it to well over $300. Today, Coinbase trades at $283 apiece.

And while crypto stocks can be pricey, you can get a piece of these companies using a popular app that allows you to buy fractions of shares with as much money as you’re willing to spend.

Look beyond Bitcoin

At the end of the day, cryptocurrencies are volatile. Not everyone feels comfortable holding an asset that seems to make wild swings every week.

If you want to invest in something that has little correlation with the ups and downs of the stock market and crypto market, take a look at some alternative assets.

Traditionally, investing in fine art or commercial real estate or even marine finance have only been options for the ultra rich, like Wood.

But with the help of new platforms, these kinds of opportunities are now available to retail investors, too.