Stocks rebounded for a second straight day Tuesday following the waves of recent sell-offs that have swept over Wall Street.

In the thick of it last week, the selling came fast and furious. But, with the S&P 500 at its lows last week just 4% from all-time highs set in November, the damage looked to be superficial.

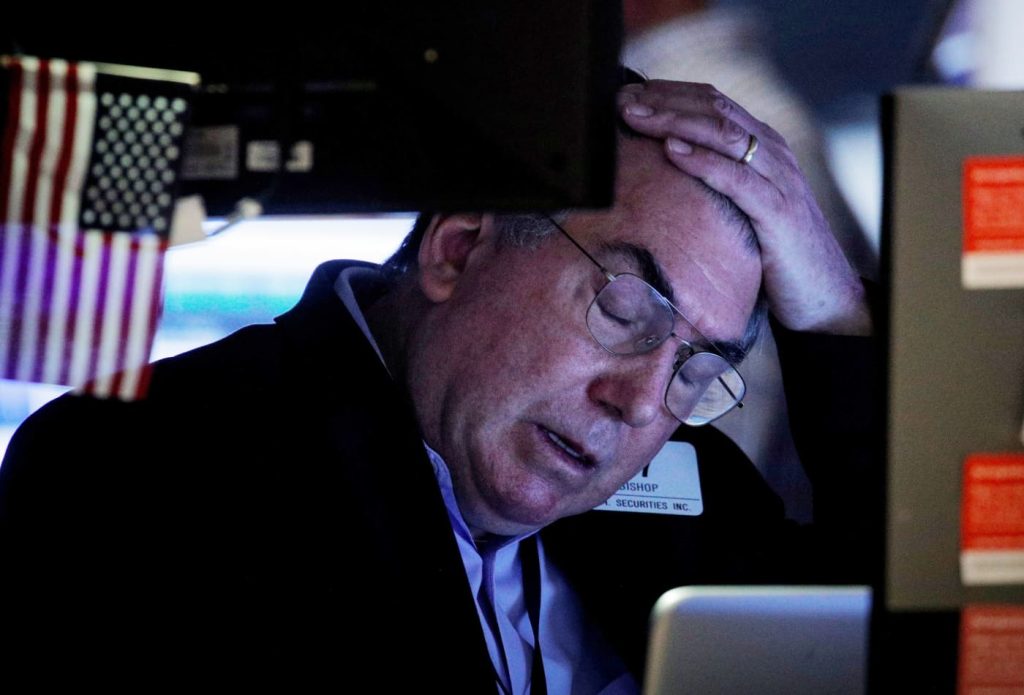

Look underneath the surface and the fallout appeared far worse, according to Art Hogan, chief market strategist at National Securities.

“When you pull back the trunk lid a bit and look at what’s been going on underneath the surface, you see that there’s been a massive sell-off in everything related to momentum and growth, all the pandemic darlings, a lot of the travel and leisure names,” Hogan told CNBC’s “Trading Nation” on Monday.

Nearly half of the S&P 500 on Monday was in a correction or worse, having fallen at least 10% from 52-week highs. Some of the hardest-hit stocks this year including Penn National Gaming, Biogen and Gap have plummeted more than 50% from their highs.

Growth stocks, especially, have come under intense selling pressure. The IVW growth ETF, which holds Microsoft and Amazon, slipped more than 2% in the past week as of Monday, nearly double the losses for the broader S&P 500.

“So we’ve seen a real correction in those,” Hogan said. “Certainly the number of names that are at 52-week highs versus 52-week lows sits at a level where we can say we’ve done a lot of the damage in the near term and it’s likely pointing to the fact that if not today, certainly this week, we will likely see a point at which most of this negativity that’s worked its way into the month of December has worked its way into prices of stocks.”

A worse sell-off than what a surface-level glance at markets suggests would actually be good for investors, added Hogan. After the steep runup this year, it would mean concerns over the new dual headwinds of the omicron variant and a more hawkish Federal Reserve have been priced in.

It would also offer investors a better entry point, he said.

“It’s good for investors because you’re coming at it at a much more reasonable valuation. So when we sort of look at the overall valuation, certainly things got very stretched in the fast momentum, revenue-growing names, and we’re seeing sort of price to sales [that were] at 30 and 40 times that are now sort of, call it, 20 to 25 times so the overall valuation metric is better,” he said.

The forward price-earnings ratio for the IVW ETF, for example, closed in on 30 times in November. It has since receded to 28.6 times forward earnings.

“We’ve had an outsized reaction in markets to the two latest headwinds at a time where valuations were looking pretty stretched in November. So it’s not just about what’s going on this week and last. I think it’s about what’s been going on since we made a peak in November and I think we’re at much more sustainable levels with the washout we’ve seen,” said Hogan.