What happened

The cryptocurrency market let out a proverbial sigh of relief on Thursday, easing into the extended holiday weekend with solid gains across the board.

Here’s what some of the leading names looked like as of 2:30 p.m. ET:

| Stock or Token | Brief Description | 24-hour Price Change |

|---|---|---|

| Bitcoin (CRYPTO:BTC) | The oldest and largest cryptocurrency, specialized in storing and transferring monetary value. | 3.5% |

| Ethereum (CRYPTO:ETH) | The second-largest digital token, powering decentralized applications (dApps) via smart contracts. | 2.6% |

| Silvergate Capital (NYSE:SI) | Leading provider of banking services and trading platforms in the cryptocurrency market. | 5.3% |

| Marathon Digital Holdings (NASDAQ:MARA) | America-based Bitcoin miner. | 11.2% |

| Bitfarms (NASDAQ:BITF) | Bitcoin miner with mining sites in Québec and Washington state. | 13.1% |

So what

The news behind these robust price gains is not systematically positive. The Securities and Exchange Commission (SEC) rejected two applications to start Bitcoin-holding exchange-traded funds (ETFs) on Wednesday night. More to the point, the SEC refused to change its listing rules to allow the creation of Bitcoin-oriented ETFs in general. The Commission argues that these funds cannot exist unless they are managed under surveillance by a regulatory body that can impose penalties if any fraud is detected. That framework is not in place yet, so the SEC doesn’t want any Bitcoin ETFs on the market.

On that note, the cryptocurrency surge in the afternoon appears linked to an upcoming Bitcoin bill in the U.S. Senate. Sharing the news on social media, Senator Cynthia Lummis said she is crafting a detailed Bitcoin and cryptocurrency bill to be introduced on the Senate floor in 2022. The Republican senator has reached out to find bipartisan support for this vision, which aims to set up clear guidelines on how regulators should treat different types of cryptocurrencies. In addition, Lummis wants to set up a whole new organization to oversee digital assets, under the joint jurisdiction of the SEC and the Commodity Futures Trading Commission.

If successful, this bill looks like a positive piece of the regulatory puzzle. Some of the provisions may turn out to be stricter than Bitcoin and Ethereum enthusiasts would prefer, but any increase in regulatory clarity must be seen as a step in the right direction.

Marathon and Bitfarms make their living directly from their Bitcoin mining activities, so their stocks tend to move in the same direction as Bitcoin prices on any given day. Silvergate Capital doesn’t invest in digital currencies itself, but the company is known as the leading provider of banking services and third-party trading networks for other companies in the cryptocurrency sector. Hence, this stock typically rises when volatility is rising in the digital asset market, driving more demand for Silvergate’s services.

Now what

Senator Lummis’s bill is just one baby step toward a properly regulated cryptocurrency market. This framework will probably go through months of amendments and approvals before senators get to vote on it, and a positive result there kicks the ball into the House of Representatives for the second round of examinations. When properly signed, sealed, and delivered, this bill would still need support from a broader framework of U.S. legislation, plugged into the global patchwork of different rules for every country.

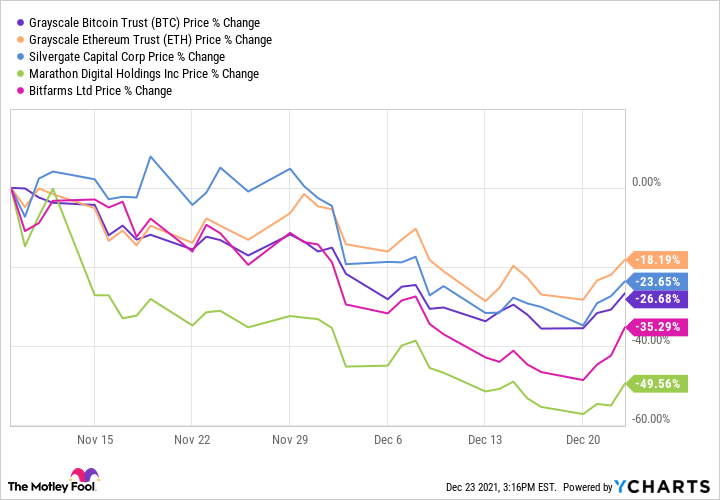

So today’s surge is far from a full recovery from the cryptocurrency sector’s recent weakness. All of the tickers mentioned above still trade more than 17% below their prices in early November, led by price cuts of 35% for Bitfarms and 50% for Marathon:

November’s crash showed that cryptocurrencies (and stocks related to the sector) can be sensitive to the same economic trends as stocks or bonds. The digital assets market had been climbing to fresh, all-time highs back then, only to be hamstrung by disappointing inflation reports.

The cryptocurrency market remains volatile and unpredictable. The news was more good than bad today, inspiring a sharp upturn. In the long run, we cryptocurrency investors really need that regulatory framework to come together, whatever shape it might take. Again, more clarity is always good news.