Stock Markets

As the official start of the earnings season begins, the large-cap indexes posted their second consecutive weekly loss to start the year, and the Nasdaq Composite its third. At the close of the week, financial shares showed weakness on Friday as a result of major banking companies reporting lower fourth-quarter profits. JPMorgan Chase and Citigroup released their financial results on Friday as they are typically among the first companies to do so in the earnings reporting season. Also coming under pressure were utilities, health care shares within the S&P 500, while the energy sector outperformed the rest due real estate, and to the renewed rise in oil prices back to their peaks in October.

While the initial earnings reports from banks appear to put financial shares under pressure, the outcomes remain solid. The pessimism seems to be due to the bar for this and other sectors being set high. Over the past three consecutive years, above-average returns were reported by the listed companies, setting their recent valuations relatively high compared to their own history. Some retracement is not only possible but likely, particularly after the post-pandemic catch-up. The S&P 500 earnings forecast is at 21% growth over the fourth quarter, which marks the fourth quarter that growth exceeded 20%. The consensus expectation for 2022 is for a deceleration in earnings growth while still retaining a robust 9%. Valuations may decline slightly which is in line with the historical performance after Fed-tightening cycles. Overall, the current earnings estimates are within reasonable expectation and may even surprise investors with upside potential if the economy continues in its above-trend growth.

U.S. Economy

The bull market is still expected to continue despite slowing economic growth, high inflation, and anticipated Fed rate hikes. These developments may slow returns and increase volatility, but economic growth will remain robust. The principal economic concern is still the rising inflation and concerns surrounding rising interest rates, with more Wall Street analysts opining that the Federal Reserve may increase interest rates four times within the year. Fed Chair Jerome Powell, during his Congressional renomination hearing last Tuesday, conveyed his intention that the central bank will commit to contain inflation without hesitation.

Other data that were released during the week were largely in line with expectations. The Labor Department reported on Wednesday that overall consumer prices rose 7% year-on-year, which is the most significant gain since June 1982 based on a 12-month cycle. The core inflation, excluding food and energy, climbed 5.5% which is the highest increase since February 1991. On Thursday, the core producer prices were reported to rise 8.3%, also a record figure since 2011. Analysts and policymakers are mostly convinced that the current inflationary trend is still temporary, but there has been speculation of a possible wage-price spiral (i.e., when higher prices trigger workers’ demand for higher wages that in turn prompts companies to raise prices). This remains mainly guesswork, however, as retail sales have dropped by 1.9% in December, which some analysts attributed to the Omicron variant. The coronavirus does not seem to be the reason, however, since online sales have also receded sharply and retail inventories rose 1.3% in November, a possible indication of easing supply problems.

Metals and Mining

The gold market continues to be impacted by the inflationary trend, much like a double-edged sword. While inflation is expected to keep real interest rates low, increasing consumer prices are triggering increased speculation that the Federal Reserve will soon adopt aggressive measures to slow the economy. As the Fed aims to conclude its monthly bond purchases in March, this is also the month when markets anticipate seeing its first rate hike. While this may present some challenges for the precious metals market, there is currently still much bullish sentiment in gold and silver this early in 2022.

Over the past week, gold spot prices rose by 1.19%, from the previous week’s close at $1,796.55 to Friday’s $1,817.94 per troy ounce. Silver climbed 2.64% from $22.37 to $22.96 per troy ounce, and platinum also realized a 1.28% gain when it closed at $974.53 from $962.20 per troy ounce. Palladium bucked the trend of precious metals, ending lower by 2.77% when it began the week at $1.935.20 and ended it at $1,881.50 per troy ounce. Base metals were also mixed as copper ended the week 0.75% higher at $9.719.50 from $9,647.00 per metric tonne. Aluminum rose 2.13% from $2,914.50 to $2,976.50 per metric tonne. Tin gained 1.32%, closing the week at $40,351.00 from its start at $39.826.00 per metric tonne. Unlike the other base metals, Zinc closed lower by 0.34% to end the week at $3,521.00 from the earlier week’s $3.533.00 per metric tonne.

Energy and Oil

China announced that it would release crude from its Strategic Petroleum Reserve at about the Lunar New Year as part of the US-led initiative to bring runaway oil prices under control. Despite this news, there was little reaction in the oil market over the past week which largely ignored its implications. There is still a significant bullish sentiment in line with a weakening dollar, supply issues from Libya, and lower than expected output from OPEC+. Aside from these reasons, the oil price rally appears to have gained impetus in reaction to reports of multi-year lows among product inventories. At present, refineries are still cautious about bringing their production to full capacity. Stocks are unlikely to be met with quick replenishment, making the global situation quite bullish for oil prices. On Friday, the global benchmark price for Brent hovered at about $85 per barrel and WTI approached $83 per barrel.

Natural Gas

This report week ending January 12, natural gas spot price movements ended mixed. The Henry Hub spot price increased to $4.59 per million British thermal units (MMBtu) on the week’s end from $3.79/MMBtu the previous week. The U.S. total natural gas supply rose week-over-week due to higher net imports from Canada, while the U.S. consumption of natural gas also substantially increased across all sectors for the second straight report week. U.S. liquefied natural gas (LNG) exports increased slightly by one vessel during this report week over the week earlier. Elsewhere in the world, spot LNG prices in Asia proceeded to plummet this past week due to sufficient inventories and the above-average warm weather, slowing down buying activity. Delivery prices for March 2022 have already reached $25/MMBtu.

World Markets

European stocks retreated on speculation that the U.S. Federal Reserve is close to tightening monetary policy sooner than the market previously factored in. the pan-European STOXX Europe 600 Index closed the week lower by 1% in local currency terms. France’s CAC 40 Index lost 1.06%, Germany’s Xetra DAX Index slid 0.40%, and Italy’s FTSE MIB Index gave up 0.27%. Going in the other direction was the UK’s FTSE 100 Index which advanced 0.77%. The core eurozone bond yields pulled back, mimicking the U.S. Treasury yields. Peripheral eurozone bonds and UK gilts generally tracked the core markets. The decline in gild yields appeared to have been moderated by data showing better than anticipated economic growth in November in the UK. Elsewhere in the region, the Netherlands is poised to ease its nationwide COVID-19 lockdown beginning Saturday, according to local news sources. Establishments dealing in non-essential goods and services will be allowed to open, although a cap on customer numbers will be imposed. The self-isolation period for individuals testing positive for the coronavirus will be reduced in the UK, Switzerland, and Norway. Regarding the economy, the industrial output in the eurozone expanded 2.3% sequentially in November, well exceeding a consensus forecast of 0.5%.

In Japan, the stock market returns turned south for the week as the Nikkei 225 Index fell 1.24% and the broader TOPIX followed suit, losing 0.90%. The leading cause for the underperformance appeared to be investors’ worries about the U.S. Federal Reserve’s aggressive monetary policy tightening. This concern led investors to prefer value stocks rather than high-growth stocks, particularly technology counters. Investor confidence was also dampened by the extension of the ban by the Japanese government of nonresident foreigners’ entry into the country until the month’s end. There is also a possible sixth coronavirus wave likely to hit Tokyo, the country’s capital. The yield on the 10-year Japanese government bond (JGB) advanced to 0.15% from 0.12% in the week prior. The JGB yields broadly tracked the U.S. Treasury yields upward on concerns that the Fed may increase interest rates as soon as March in response to inflationary trends. This direction generally runs counter to the dovish signals by the Bank of Japan (BoJ) which continues to commit to monetary easing. The BoJ is not expected to raise its short-term interest rate in the near term. The rising JGB yields boosted the yen, strengthening it to JPY113.8 from the previous week’s JPY 115.6 against the U.S. dollar.

Chinese markets also followed Japan downwards during the week, with the Shanghai Composite Index losing 1.6% and the CSI 300 Index retreating 2% on the back of refinancing challenges faced by the country’s property sector. The largest banks have increasingly become more selective regarding the funding of real estate projects by local government financing vehicles. Some developers rushed to acquire the consent of their creditors for maturing extensions and exchange offers. Other developers have pursued more intensive fundraising campaigns since more traditional financing routes such as presales have become unsustainable. Yields on China’s 10-year government bonds dropped to 2.809% from the previous week’s 2.837%. The yuan closed in domestic trading at RMB 6.3435 per U.S. dollar, from the earlier week’s RMB 6.376. This was the currency’s strongest close since May 2018.

The Week Ahead

The LEI index, building permits and housing starts are among the important economic data being released this week.

Key Topics to Watch

- Empire State manufacturing index

- NAHB home builders index

- Building permits (SAAR)

- Housing starts (SAAR)

- Philadelphia Fed manufacturing survey

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Existing home sales (SAAR)

- Leading economic indicators

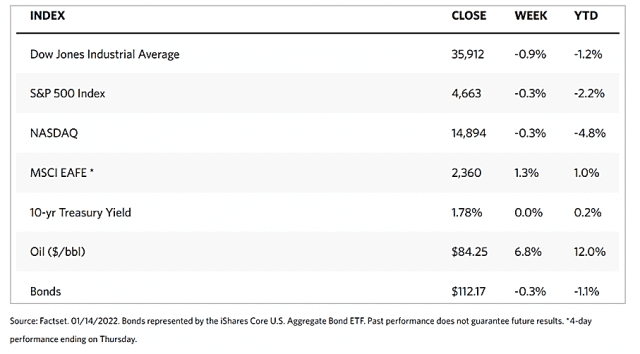

Markets Index Wrap Up