Many women aren’t financially prepared for retirement, according to a recent report from TransAmerica.

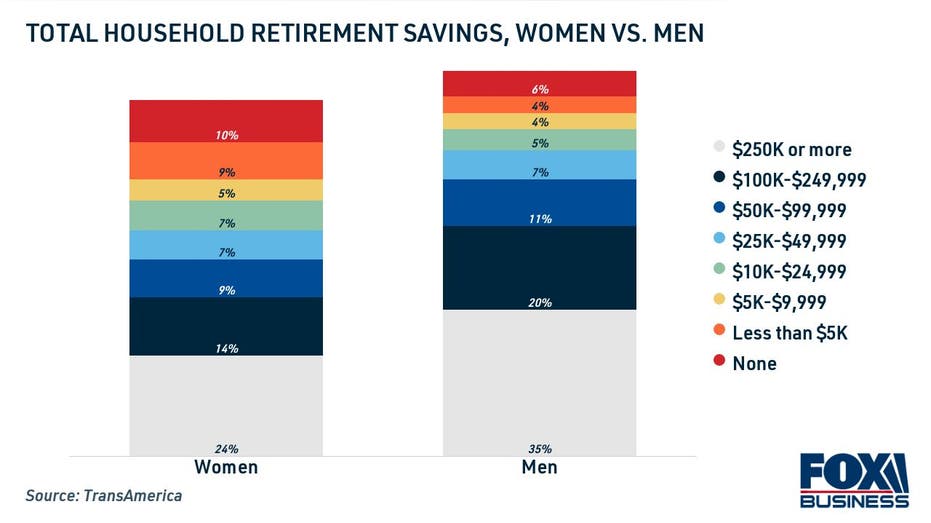

Men have about twice as much money saved for retirement ($118,000) than women do ($57,000). Of concern, nearly a quarter (24%) of women currently have less than $10,000 saved for retirement, compared to just 14% of men.

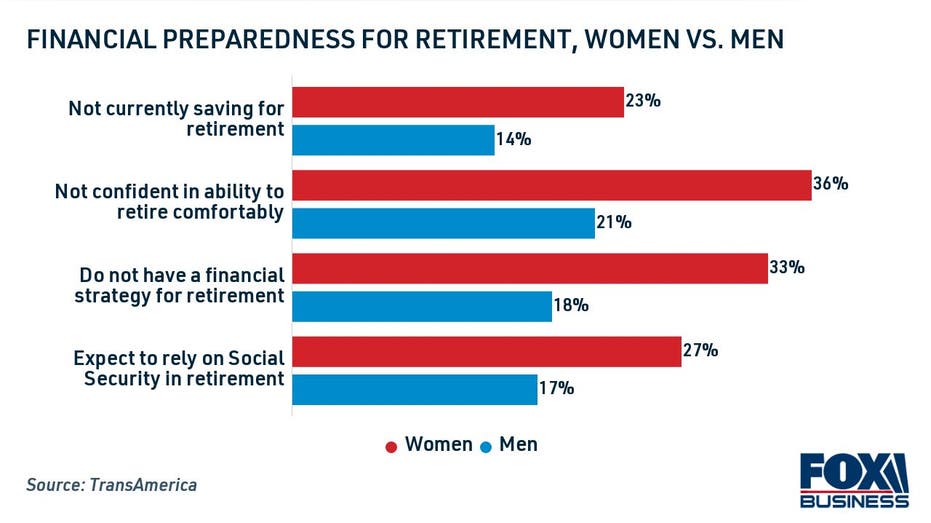

Seventy-nine percent of men are confident in their ability to fully retire with a comfortable lifestyle, compared to just 64% of women. Both men and women think that they’ll need to have saved $500,000 in order to retire comfortably.

A third (33%) of women do not have any retirement strategy at all, which is significantly more than the 18% of men. Women are also far less likely than men to be currently saving for retirement, at 77% and 86%, respectively.

Despite the fact that the vast majority of both men and women worry that Social Security will run out before they retire, 27% of women and 17% of men expect to rely on Social Security payments as their primary source of income during retirement.

Keep reading to learn the challenges women face when saving for retirement, as well as how women can better financially prepare to retire. If you’re searching for ways to improve your financial situation ahead of retirement, visit Credible to compare a variety of financial products from debt consolidation loans to high-yield savings accounts.

Women face unique challenges when preparing for retirement

There are a number of obstacles that women must overcome when saving money for retirement — starting with the gender wage gap, according to Stacy J. Miller, a Tampa, Fla.-based certified financial planner (CFP). Women typically earn less money than men, which results in lower retirement savings.

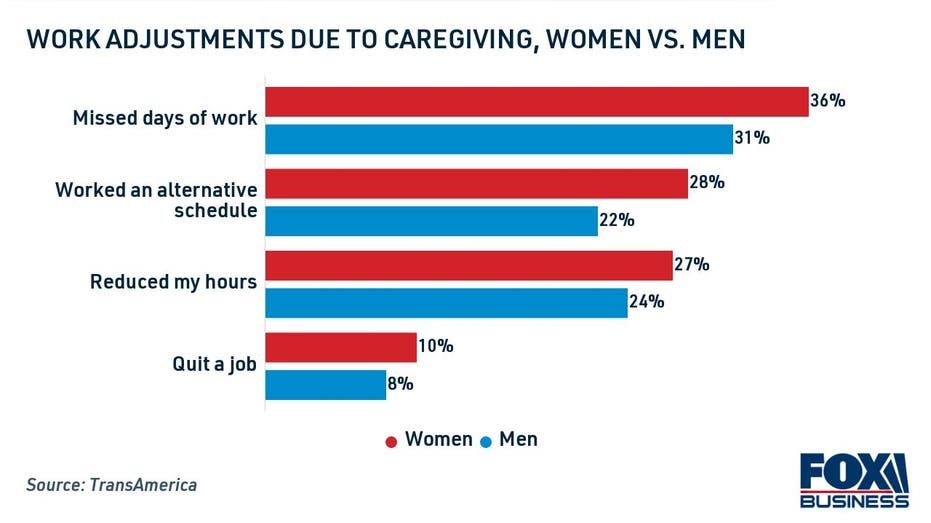

Miller said that because “women are often the caretakers in the family,” they may have to leave the workforce to care for children and aging parents. Missing periods of work can result in lower earnings over time and “fewer opportunities for pay raises and promotions.”

Most woman caregivers have had to make work adjustments, such as missing days of work (36%), working an alternative schedule (28%), reducing their hours (27%) and even quitting their jobs (10%), TransAmerica reports.

“Additionally, women statistically live longer than men, and therefore their retirement portfolio would need to be larger than men to last longer,” Miller said.

Without proper financial planning and adequate retirement savings, some retirees may become reliant on credit card spending to cover basic expenses. If you’re struggling to pay down high-interest credit card balances, you may be able to save money through debt consolidation. You can learn more about credit card consolidation on Credible to determine if this is the right financial strategy for you.

How women can better prepare for retirement

If you’re one of the many women with an insufficient retirement nest egg, there’s still time to save. Consider these tips from female financial advisors on how women can be more financially prepared for retirement:

- Maximize your retirement contributions

- Anticipate periods of reduced income

- Reach out to a financial advisor

Read more about each strategy in the sections below.

Maximize your retirement contributions

Both working women and self-employed caretakers should find a way to contribute the maximum amount to retirement plans, according to Kimberly Foss, a CFP in Roseville, Calif. — “especially in older women’s peak earning years, which often occur as they are nearing retirement.”

In 2022, employees can defer up to $20,500 of their annual income into their workplace retirement plan or 401(k). The current contribution limit across all individual retirement accounts (IRAs) is $6,000 per year.

Women who are near retirement age should take advantage of catch-up provisions to grow their account balances, Foss said. This allows individuals ages 50 and up to contribute an additional $6,500 annually to their 401(k) plans and an added $1,000 to their traditional IRAs and Roth IRAs.

Allocate your investments

Besides maximizing their contributions, women should also consider their how their retirement investments are allocated, according to Joyce Streithorst, a CFP in Melville, N.Y.

“Default investments make an impact on one’s long-term growth and returns,” Streithorst said. “Lifecycle or target date funds can help provide an allocation to equities and fixed income to attempt to align risk to your age and anticipated retirement year.”

Retirement savings accounts are typically invested in bonds as well as the stock market in the form of index funds and mutual funds. Investment allocations range between conservative, moderately conservative and moderate, depending on the risk tolerance.An investor’s retirement portfolio will typically vary based on market conditions. Since consumers have their own unique financial goals and obligations, it’s important to determine the right asset allocation strategy for your needs.

Reach out to a financial advisor

TransAmerica reports that while 43% of men use a financial advisor to help them manage their savings and investments, just 34% of women do. This could be due to a lack of female advisors, said Tess Zigo, a CFP in Palm Harbor, Fla.

“Because we don’t see many women in finance and as financial advisors, it doesn’t feel approachable or accessible,” Zigo said. “Many women feel more comfortable working with someone relatable.”

Retirement planning can at times be overwhelming, so you might consider enlisting a professional to help guide you through the process. You can search for advisory services in your area on the CFP website.

And if you’re searching for the right financial products to set yourself up for success in retirement, it’s important to shop around. You can visit Credible to compare interest rates on everything from personal loans to mortgages for free without impacting your credit score.