President Joe Biden plans Thursday to invoke Cold War powers to encourage domestic production of critical minerals for electric-vehicle and other types of batteries, according to people familiar with the matter.![]()

The White House is poised to add battery materials to the list of items covered by the 1950 Defense Production Act — the same authority wielded by Harry Truman to make steel for the Korean War and Donald Trump to spur mask production to tackle the coronavirus pandemic — the people said. They asked not to be identified because the details are not yet public.

Shares of MP Materials Corp., the sole U.S. company that produces rare earth metals needed for electric vehicles, rose 4.7% on Wednesday. Lithium Americas Corp., which runs a project in Nevada, headed for its biggest gain in more than 11 weeks, while Piedmont Lithium Inc., which runs a project in North Carolina, erased losses, rising as much as 8.7%.

Adding minerals like lithium, nickel, graphite, cobalt and manganese to the list could help mining companies access $750 million under the Defense Production Act’s Title III fund, the people said. The move also could aid recycling of battery materials, one of the people said.

Instead of loans or direct purchases for minerals, the directive would fund production at current operations, productivity and safety upgrades, and feasibility studies, the person said. In addition to EV batteries, the directive also would apply to large-capacity batteries.

Administration officials are working to ensure production will occur under strong environmental and labor standards, one of the people familiar said. Amid concerns from critics, including some Democratic members of Congress, aides are taking steps to make sure the presidential actions won’t skirt environmental reviews or permit regulations, the person said. Play Video

Several departments, including Energy and Interior, will oversee the effort, the person said.

The directive also would pave the way for Congress to allocate more resources to the effort, said Ben Steinberg, co-chair of the critical infrastructure group at D.C. lobbying firm Venn Strategies.

“The president’s signature is a big signal, but it’s incumbent on the Congress to appropriate dollars that are commensurate with the challenge,” Steinberg said. Funding available through the DPA is a “small piggy bank” considering it must cover sectors from aerospace and defense to the automotive industry, he said.

A bipartisan group of U.S. senators — Democrat Joe Manchin of West Virginia and Republicans Lisa Murkowski of Alaska, James Risch of Idaho and Bill Cassidy of Louisiana — wrote the Biden administration earlier this month urging the president to invoke the DPA to accelerate production of battery materials.

The Intercept reported last week that the Biden administration was drafting an executive order invoking the DPA aimed at increasing the supply of minerals for EV batteries. Biden’s directive will come in the form of a so-called “presidential determination,” according to the people familiar with the matter.

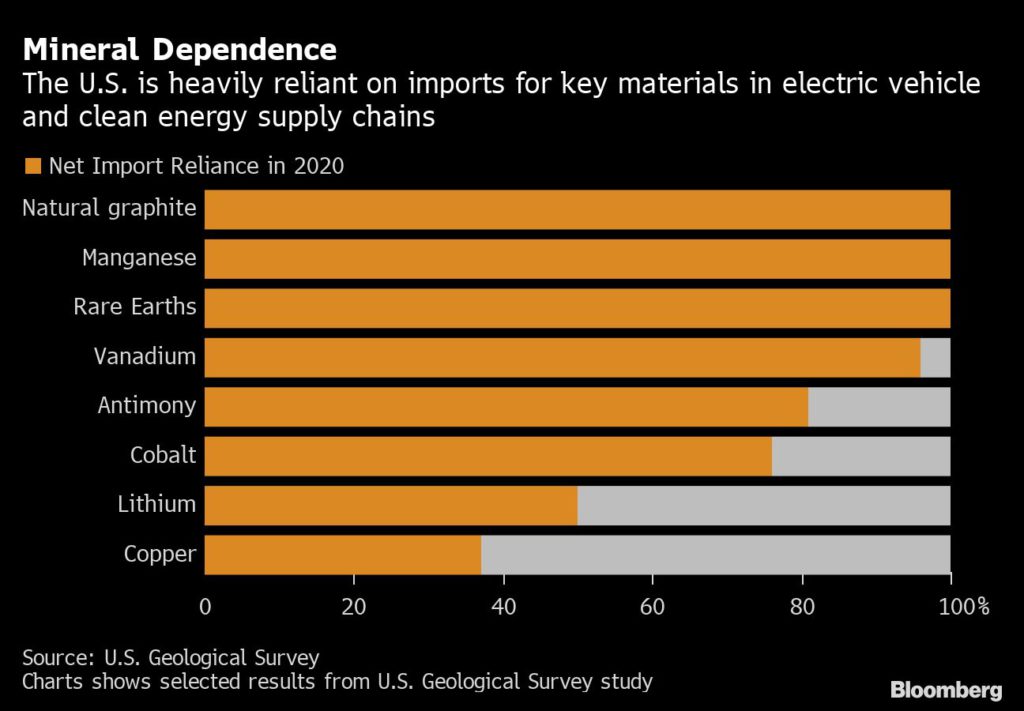

The Biden administration already has allocated vast amounts — including $6 billion as part of the infrastructure bill — aimed at developing a U.S. battery supply chain and weaning the auto industry off its reliance on China, the leading producer of lithium-ion cells. Energy independence advocates have also pushed the administration to focus further upstream on mining and on minerals processing, a key step in the EV sector that’s also largely dominated by China.

The number of mineral commodities, excluding fuels, for which the U.S. is reliant on imports for more than a quarter of demand has jumped to 58 products from 21 in 1954, the White House said in a July report on the nation’s supply chains.

Prices of battery minerals like nickel, lithium and cobalt have surged this year in the face of swelling global EV demand, supply chain disruptions and Russia’s invasion of Ukraine, which sent nickel prices soaring. The price swings are helping drive inflation while underscoring the U.S. industry’s vulnerability as it transitions to clean energy.

The move would serve as a sort of political olive branch to the mining industry, which feels it has been shunned amid the Biden administration’s push to embrace the green energy transition and on-shoring of domestic production capabilities.

While DPA would provide easier funding access to elevate battery metal projects, it does not speed up the permitting process to get mines approved.

Climate change advocates, environmental groups and indigenous groups have been vocal about the dirty hazards of mining, including its impacts on water supplies and nearby communities. A year ago, the U.S. Agriculture Department ordered the Forest Service to rescind two documents that finalized a land swap involving Native American land in Arizona that would have become North America’s largest copper mine.

Copper is largely seen as the most critical metal by volume needed to power electric vehicles and the energy transition. The decision last year to block the Resolution copper mine had followed vocal opposition from the local San Carlos Apache tribe that said the mine was located on a sacred and holy place.