Stock Markets

The major stock indexes closed mixed for the week. Despite the S&P 500 Index ending its best month since December, it has nevertheless closed its worst quarter since 2020 at a loss of 5%. It is optimistic, however, that the U.S. markets have recovered by 10% off their lows, despite numerous unresolved problems including high inflationary pressures, possibly increasingly aggressive monetary policy from the Fed, and the hostilities between Russia and Ukraine. Cyclically sensitive stocks registered their worst performance signaling investors’ expectations of a slowdown in growth stocks, particularly those in the financial services and industrial sectors. Concerns about interest rates moving higher in the future are reflected in the underperformance of the information technology sector. On the other hand, outperforming in the market were the usually defensive sectors such as consumer staples and utilities.

The past week’s volatility in stock prices was largely attributed to the fast-changing events in the Russian-Ukrainian war. Market performance was strong early in the week in response to reports that Russia was amenable to allowing Ukraine to join the European Union in return for a promise to stay out of NATO and the continuance of ceasefire talks. The four consecutive days of gains in the S&P 500 were only broken midweek when a Russian official stated no breakthroughs were foreseen in the talks with Ukraine and that Russia was regrouping its forces to complete the takeover of the eastern Donbas region. Sentiments turned more negative by Thursday when Ukrainian President Volodomyr Zelenskyy announced that Ukrainian forces are preparing for renewed Russian offensives.

U.S. Economy

During the week, reports were released tracking several closely-watched economic indicators. The economic developments were generally in line with consensus expectations. Foremost among these economic indicators was the March nonfarm payrolls that indicated that while the 431,000 newly created non-agricultural jobs fell below the expected 490,000 figure, the unemployment rate fell to 3.6%, a post-pandemic low, which is slightly more than expected. The monthly growth in average hourly earnings of 0.4% largely met forecasts, as did consumer income gains which were reported at 0.5%. Thursday’s personal spending report showed that consumer spending rose only by 0.2%, a lower-than-expected performance, although it may be taken to mean the increasing unwillingness to pay higher prices. The February job openings indicator was mostly unchanged and remained close to record highs. The labor force participation rate continues its upward trend and is now at 62.4%, indicative of the return to the workforce by the largely pandemic-sidelined labor supply. This signals a return to normality as the pandemic situation is seen to improve and the fiscal stimulus continues to wane.

Another noteworthy development is the resiliency seen in corporate balance sheets and earnings growth this year. Pending the first-quarter earnings season which will begin by mid-April, analysts continue to see earnings revisions for 2022 moving higher. In light of the headwinds posed by more restrictive monetary policy and the possible hike in interest rates, there have been no commensurate downward revisions in earnings growth that typically accompany such hawkish expectations. Instead, earnings are expected to rise above expectations, with the S&P 500 earnings growth now pegged at 9.1% rather than the 7.0% predicted on December 31 based on average historical growth rates. Although there may be some downward revision to these forecasts in the event of a deterioration of consumption patterns, positive earnings growth for the year is expected, which in turn will support market performance.

Metals and Mining

The global destabilization that the Russian invasion of Ukraine has created continues without mitigation and is beginning to have a significant impact on the global economy. Some economists have been so bold as to predict the impending end of globalization. Even if the conflict in Eastern Europe were to end soon, the lines between allies and opponents will not likely be easily undone. In this new environment, gold is seen to play an important role in the current weaponization of currencies and commodities. There appears to be a growing threat that Russia may weaponize its commodity markets as it demands “unfriendly nations” to pay for their energy in rubles. Russia has also indicated that it may accept gold and bitcoin as payment for its oil and gas. Should Russia decide to withhold its supply, Europe may inevitably fall into a full-blown recession. These developments, together with the implications of the geopolitical situation on the U.S. dollar, have made gold the most attractive asset at present because it is seen as a store of value without counter-party risk.

Over the past trading week, gold has corrected from its recent highs, closing at $1.925.68 per troy ounce from where it ended the previous week at $1,958.29, a dip of 1.67%. Silver followed the trend, moving down by 3.53% from $25.53 to the recent close at $24.63 per troy ounce. Platinum began at its previous close of $1,005.41 and recently ended at $989.57 per troy ounce, reflecting a price drop of 1.58%. Palladium also corrected by 2.18%, from $2,327.14 to $2,276.50. Base metals were somewhat more resilient. The three-month copper price previously at $10,267.00 gained slightly by 0.84% to close at $10,353.50 per metric tonne. Zinc, which previously ended at $4,066.50, closed this past week at $4,339.00 per metric tonne for a gain of 6.70%. Aluminum that traded the week earlier at $3,605.00 closed this past week at $3,450.00 per metric tonne, descending by 4.30%. Tin started the week at $42,283.00 and closed on Friday at $44,767.00 per metric tonne, for a week-on-week gain of 5.87%

Energy and Oil

During the past trading week, OPEC+ was seen implementing its latest production increases and the U.S. announced that it would undertake an unprecedented Strategic Petroleum Reserve (SPR) release, As expected, oil prices saw their most substantial weekly decline in more than two years in response to OPEC+ countries agreeing to add 432,000 barrels per day of production in May 2022. The OPEC+ decision was of course somewhat expected, given the circumstance, but few the effect of the Biden administration’s actions in trying to put runaway prices under control, which previously pushed Brent futures nearer the $100 per barrel level. Biden’s recent move, though large in scope and ambition, may not effectively keep the WTI (West Texas Intermediate) benchmark under $100 per barrel, as such a move cannot offset the sheer volume of potentially sanctioning Russian supply. The likely specter of Russia’s 3 million barrels per day seaborne flow being subject to sanction is still looms over the global oil markets. In the meantime, the Biden administration is contemplating the temporary removal of restriction on summer sales of higher-ethanol gasoline in attempting to temper fuel costs nationwide, This reverses a previous decision by the administration to ban E15 because it tends to contribute to smog during hot weather.

Natural Gas

For this report week, March 23 to March 30, natural gas spot prices ascended at most locations. The Henry Hub spot price increased from $5.26 per million British thermal units (MMBtu) on Wednesday, March 23, to $5.34/MMBtu by last Wednesday, March 30. In the international LNG market, Title Transfer Facility (TTF) prices averaged higher than East Asia spot prices for the first time since early March, as concerns about natural gas imports from Russia resulted in higher prices to attract flexible LNG cargoes. In the U.S., prices along the Gulf Coast rose in reaction to warming weather. The reverse appears to be taking place in the Midwest where prices rose in response to colder-than-normal temperatures. Prices in the West meanwhile increased in line with the general price trend across the U.S.A. The average gas supply over the country rose from all supply sources in the past week, and total consumption of natural gas likewise increased substantially over the U.S.A. The country’s exports increased by two vessels this recent week compared to the week before.

World Markets

European share prices rose in a volatile trading week as investors overcame concerns about the macroeconomic outlook among strong inflation concerns and uncertainties over the Russian-Ukraine hostilities. The pan-European STOXX Europe 600 Index gained 1.06% in local currency terms. Germany’s DAX Index ascended 0.98%, France’s CAC 49 Index gained 1.99%, and Italy’s FTSE MIB Index climbed 2.46%. In the same fashion, the UK’s FTSE 100 Index moved up 0.73%. Core eurozone bond yields fluctuated over the week but ended hardly changed from the week before. Expectations for even higher interest rate increases were boosted by the higher-than-expected inflation data, further driving yields higher. The trend reversed, however, when hopes for an early resolution to the East European conflict faded and European Central Bank (ECB) chief economist Philip Lane observed that the ECB should be prepared to revise its policy on the occasion that the macroeconomic conditions significantly worsen. Peripheral eurozone government bond yields broadly followed core markets. The UK gilt yields aligned with U.S. Treasuries, which declined due to geopolitical tensions and worries about a future recession.

In Japan, the stock markets fell week-on-week. The Nikkei 225 Index slipped downwards by 1.72% while the broader TOPIX Index lost 1.88%. Increasing pessimism about the peace talks between Ukraine and Russia compounded by concerns about the rising global inflation and likelihood of interest rate increases weighed down investor risk appetite. Big Japanese manufacturers registered declining sentiment in the first quarter for the first time since the pandemic began, as reflected by the Bank of Japan’s (BoJ’s)Tankan survey of business confidence. The yield on the 10-year Japanese government bond (JGB) dipped to 0.21% this past week from 0.24% the week before, as bond purchase operations by the BoJ pushed yields downward. The yen fell to its lowest level in more than six years, from JPY 122.08 the week earlier to JPY 122.66 versus the U.S. dollar in the week just concluded. The cause for the currency weakness was expectations of divergent monetary policy between the BoJ and other major central banks.

China’s stock markets gained over the past week as a result of investors anticipating that Beijing may intervene to support the country’s markets and economy. The broad, capitalization-weighted Shanghai Composite Index increased by 2.2%, and the CSI 300 Index climbed 2.4%, tracking the largest listed companies in Shanghai and Shenzhen. Technology stocks continued to be plagued by delisting concerns. Investors remain worried about the risk of dual-listed Chinese firms being forcibly removed from the U.S. stock exchanges. The U.S. Securities and Exchange Commission (SEC) on Wednesday announced the addition of five U.S.-listed Chinese internet companies to the growing list of companies facing possible delisting. The move is a result of China’s refusal to allow U.S. regulators to inspect their audits. Among those added to the list for possible delisting were China’s leading search engine Baidu and its video streaming unit iQiyi. These companies’ failure to comply with the audit requirements of the Holding Foreign Companies Accountability Act (HFCAA) for three straight years may render them liable for delisting from the U.S. exchanges.

The Week Ahead

Look forward to consumer credit, factory orders, and the foreign trade deficit being included among the important economic data to be released this week.

Key Topics to Watch

- Factory orders

- Core capital equipment orders

- Foreign trade deficit

- S&P Global (Markit) services PMI (final)

- ISM services index

- FOMC minutes

- Initial jobless claims

- Continuing jobless claims

- Consumer credit

- Wholesale inventories

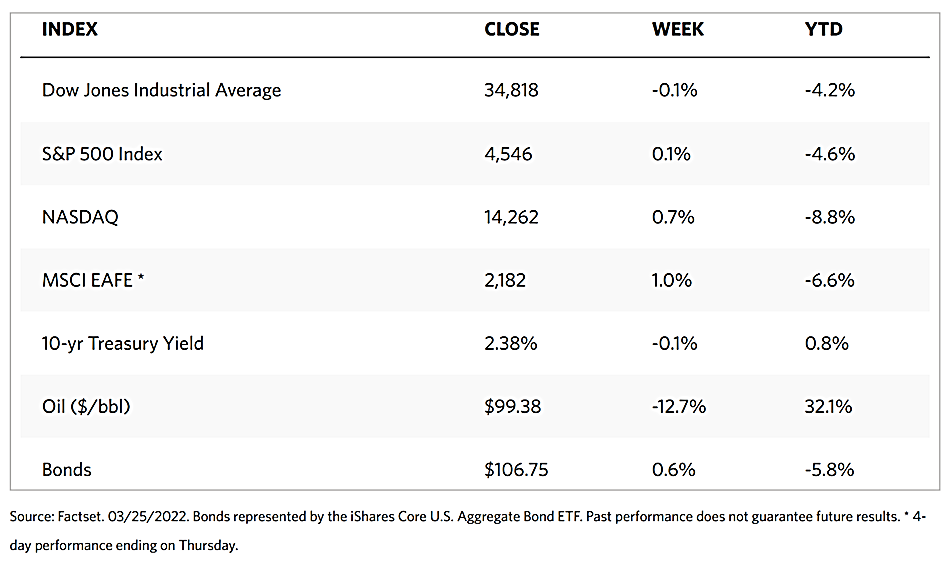

Markets Index Wrap Up