Stock Markets

Stock markets gained ground this week after seven straight weeks of losses. Every sector of the large-cap S&P 500 advanced, led by consumer discretionary and energy stocks which surged the most. Underperforming the rest was the health care sector. Even the tech-heavy Nasdaq Composite Index exhibited solid gains. The cross-sector strength seems to have materialized from the positive perception that the hitherto rising inflation may have already reached its peak. Several developments provided an impetus for the S&P 500 to rally from its lowest level in more than a year. These include selling exhaustion, positive retail earnings reports, and signs of flexibility in the Fed policy. The result is that the S&P 500 has successfully averted a plunge into bear territory that was widely anticipated last week when it descended 20% from its peak, a technical bear indication. Bond returns have improved, with fixed-income investments becoming more attractive and investors pricing in slower economic growth into the future.

U.S. Economy

The most recent economic and earnings reports appear to send mixed signals which, in turn, challenge the prevailing sentiment that a recession is imminent. Economic growth is still positive although slowing down, and several signals still point to the possibility of continued expansion. Although inflation is still of major concern, consumer spending remains robust and overall demand is resilient. Missed target earnings among some retailers were mostly due to rising costs rather than weakened consumer spending. Consumption increased in April at the fastest rate in three months when adjusted for inflation. This is further buoyed by stable job growth and accumulated savings.

Regarding the Fed’s tightening policy that many fear will cause a recession, the policymakers appear to be more flexible than originally thought after the possible large rate hikes in June and July. Moreover, high inflation, which is feared to be sustained for the rest of the year, appears to be slowing down. Even as the 40-year-high inflation rate keeps the Fed on the lookout for runaway increases in consumer prices, the annual rate of price increases appears to have peaked between March and April, Inflation expectations derived from the bond market have noticeably dropped over the past month. Inflation will likely maintain a path of gradual moderation until the end of 2022 as the rise in borrowing costs slows the housing market, demand for goods eases, and supply concerns are resolved.

Metals and Mining

Prices of precious metals are still impacted by inflationary pressures, but on Friday, good news from the U.S. Department of Commerce alleviated some of the market jitters. The agency announced that the Federal Reserve’s preferred measure of inflation, the core Personal Consumption Expenditures Index, rose 4.9% on an annual basis for the month of April. This is down from 5.2% seen last March. This is an indication that inflation has dropped for the last two months from its peak of 5.3% last February. The prospect of a recession is growing more distant and the economy appears poised for continued expansion, although at a slower pace. Gold will continue to face challenging headwinds due to rising interest rates that tend to draw investor attention away from non-yielding assets like gold. Nevertheless, because of the continuing threat of inflation, the role of gold as a safe-haven asset and a hedge against inflation continues to remain highly relevant in portfolio composition.

Gold moved sideways this week, gaining a modest 0.39% from the previous week’s close at $1,846.50 to end this week at $1,853.72 per troy ounce. Silver added 1.52% to its value, rising from $21.78 the week before to this week’s $22.11 per troy ounce. Platinum also inched up slightly from $957.17 the week earlier to this week’s $958.13 per troy ounce, an appreciation of 0.10%. Palladium began at $1,964.92 and closed the week at $2,067.44 per troy ounce, for a gain of 5.22%. The three-month prices for base metals also went through listless trading for the week. Copper, which ended at $9,422.00 one week earlier, closed this week at $9,459.00 per metric tonne for a gain of 39%. Zinc added on 3.68% from its week-ago price of $3,707.00 to this week’s close at $3,843.50 per metric tonne. Aluminum lost marginally by 2.53% from last week’s $2,946.00 to this week’s $2,871.50 per metric tonne. Tin also lost by 1.61% from its week-ago close at $34,665.00 to this week’s close at $34,106.00 per metric tonne.

Energy and Oil

Oil prices inched higher in light of the improving demand signals due to the further easing of pandemic lockdowns and restrictions. The lack of supply options in the global oil market has been further underscored, however, particularly if there materializes a drastic squeeze in Russian oil production. The European Union is feared to be approaching an outright ban on the importation of Russian oil, a step which it appears to be reluctant to take but does not rule out. The EU may reach a deal on Russian oil sanctions in the coming week’s leader summit scheduled for May 30-31.

U.S. gasoline and crude inventories are continuing in their decline; also, the possibility of a JCPOA breakthrough becomes more remote as the United States and Iran move further apart due to recent altercations between them. The antagonism between the two countries was further heightened when U.S. authorities seized two laden oil tankers in the Mediterranean, anchored in the territorial waters of Croatia and Greece. The cargoes allegedly consisted of smuggled oil for Iran’s Revolutionary Guard Corps. Analysts are not eliminating the possibility of another surge in oil prices to the $130-140 per barrel range this summer.

Natural Gas

Spot prices of natural gas increased at most locations this report week, May 18 to May 25. The Henry Hub spot price ascended to $9.30 per million British thermal units (MMBtu) from $8.45/MMBtu throughout the week. International natural gas spot prices took the opposite direction for the week, as the swap prices for liquefied natural gas (LNG) descended by $1.64/MMBtu to a weekly average of $21.88/MMBtu in East Asia. At the Title Transfer Facility (TTF) in the Netherlands, the day-ahead price fell by $2,20/MMBtu to a weekly average of $25.92/MMBtu. By comparison, the corresponding prices in East Asia and the TTF were $10.05/MMBtu and $9.04/MMBtu, respectively, for the same week last year (week ending May 26, 2021).

Domestic prices for natural gas along the Gulf Coast rose as demand growth in the Southeast and Texas outpaces supply growth. In the Midwest, prices increased with the national average as temperatures fluctuated. Prices across the West rose as the natural gas share of electricity generation increased in California. In the Northeast, natural gas prices increased as consumption increased across all sectors. U.S. natural gas supply decreased slightly week over week. Natural gas demand in the country rose slightly with mixed temperatures. The U.S. LNG exports increased by five vessels this past week compared to the week before.

World Markets

In Europe, equities took a break from inflation fears as shares rose and confidence returned. Investors’ sentiments took into account that inflation may be reaching its peak and that central banks will embark on a more gradual interest rate increase. Due to the holidays, market volumes were light, and the rebound may seek confirmation in the coming week’s resumption of trading. The pan-European STOXX Europe 600 Index closed the week higher by 2.98% over last week. The main market indexes likewise gained, with Italy’s FTSE MIB Index rising 2.25%, Germany’s DAX Index climbing 3.44%, and France’s CAC 40 Index advancing 3.67%. The UK’s FTSE 100 Index surged 2.65%. The core eurozone bonds were volatile but ended higher. After European Central Bank (ECB) President Christine Lagarde signaled the possibility of positive rates by the year’s end, yields moved up briefly. They retreated somewhat, however, upon the release of weaker-than-expected eurozone PMI data. Peripheral eurozone bonds yields fell while UK gilt yields broadly tracked core markets.

The Japanese stock markets began the week on a positive note but quickly turned southwards with three consecutive session losses. The market quickly reversed again by late Friday trading, however, making up for the losses but even ending higher to register week-on-week gains. The Nikkei 225 ended with a 0.16% gain in local currency terms, and the broader TOPIX registered 0.53% higher for the week. The late rally was sparked by Japanese equities taking their cue from Wall Street, which itself closed sharply higher overnight. As the Nikkei 225 neared the 27,000 resistance level, however, investors took profits and ultimately capped market gains. The yield on the 10-year Japanese government bond dipped as the yen strengthened against the U.S. dollar.

In China, the markets dipped on concerns that the economy is slowing down, weighed by the country’s zero-tolerance approach to fighting the coronavirus. The broad Shanghai Composite Index pulled back 0.5% while the blue-chip CSI 300 Index, which keeps track of the largest-listed companies in Shanghai and Shenzhen, lost 1.9%. Information released revealed that profits at China’s industrial firms receded at their fastest rate in two years in April, causing investor sentiment to wane. The yield on China’s 10-year government bond fell marginally to 2.756% from the previous week’s 2.836% due to expectations of policy support. The yuan weakened against the dollar, from CNY 6.68 per USD the week earlier to CNY 6.71 per USD this week. The trade-weighted currency descended below 100 for the first time in seven months. This is a reflection of expectations for further capital outflows from China since the Fed’s mounting interest rate increases in the U.S. has diminished the relative attractiveness of China’s assets to investors.

The Week Ahead

Productivity, unit labor costs, and unemployment figures are among the important economic data to be released this week.

Key Topics to Watch

- S&P Case-Shiller national home price index (year-over-year)

- FHFA national home price index (year-over-year)

- Chicago PMI

- Consumer confidence index

- S&P Global U.S. manufacturing PMI (final)

- ISM manufacturing index

- Job openings

- Quits

- Construction spending

- Beige book

- Motor vehicle sales (SAAR)

- ADP employment report

- Initial jobless claims

- Continuing jobless claims

- Productivity revision (SAAR)

- Unit labor costs revision (SAAR)

- Factory orders

- Core capital goods orders revision

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Labor force participation, ages 25-54

- S&P Global U.S. services PMI (final)

- ISM services index

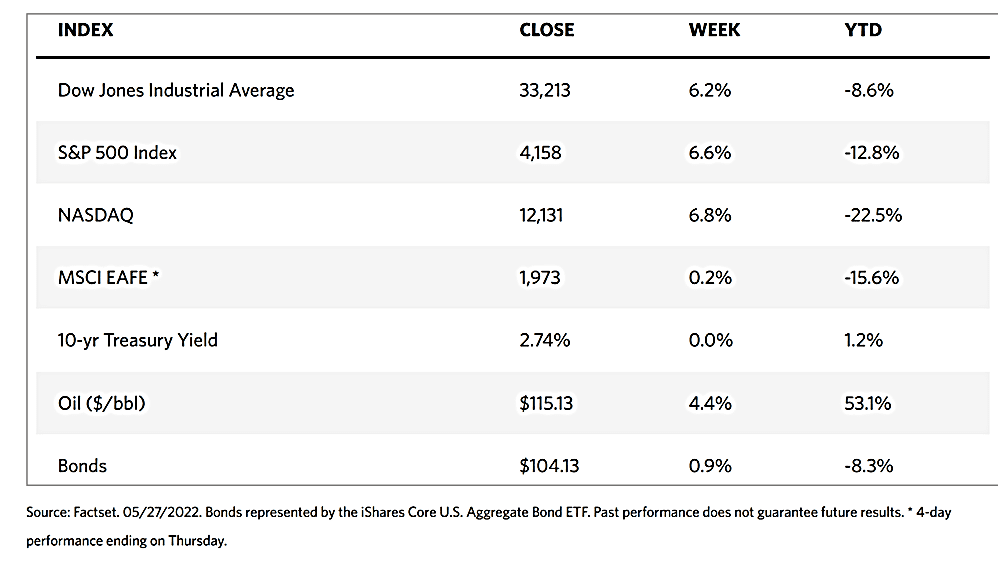

Markets Index Wrap Up