The markets are now signaling peak yields in the next three to six months, according to BofA Securities.

Yields are at new cyclical highs because there is no recession, there are new fiscal stimulus packages from the U.K. and Europe, there is a war and central banks are still tightening, strategist Michael Hartnett wrote in BofA’s weekly Flow Show note Friday.

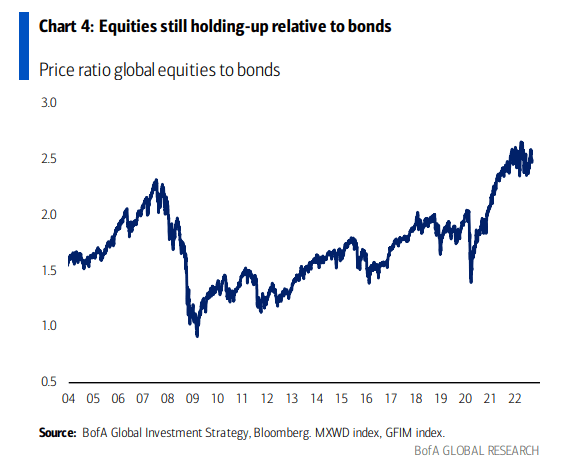

The 5-year Treasury yield (US5Y) of 3.4% is more than double that of the S&P 500 (SP500) (NYSEARCA:SPY) (SPYD) dividend yield of 1.65%, but equities have yet to break down vs. bonds, Harnett said.

Bonds (NYSEARCA:TBT) (NASDAQ:TLT) (NASDAQ:SHY) “hate inflation, equities hate recession,” he added.

Wall Street is also “malevolently trading ‘pain,'” with “the consensus long Apple (NASDAQ:AAPL) – long Exxon (XOM) ‘barbell’ getting smacked,” Harnett said.

BTIG strategist Jonathan Krinksy said this week that shares of Apple (AAPL) look vulnerable, along with Microsoft (MSFT) and Alphabet (GOOG) (GOOGL).

“Worth noting that Apple has now given up its recent relative strength vs. SPX, which brings it back to a very crucial level in both absolute and relative terms,” Krinsky said. “In absolute, it’s back to the late May highs around 150. In relative terms, it’s re-testing a two-year relative base.”

“It is expected to hold here, but a failure to do so would be very negative for the medium-term.”

Apple (AAPL) closed up 1.9% on Friday.