Stock Markets

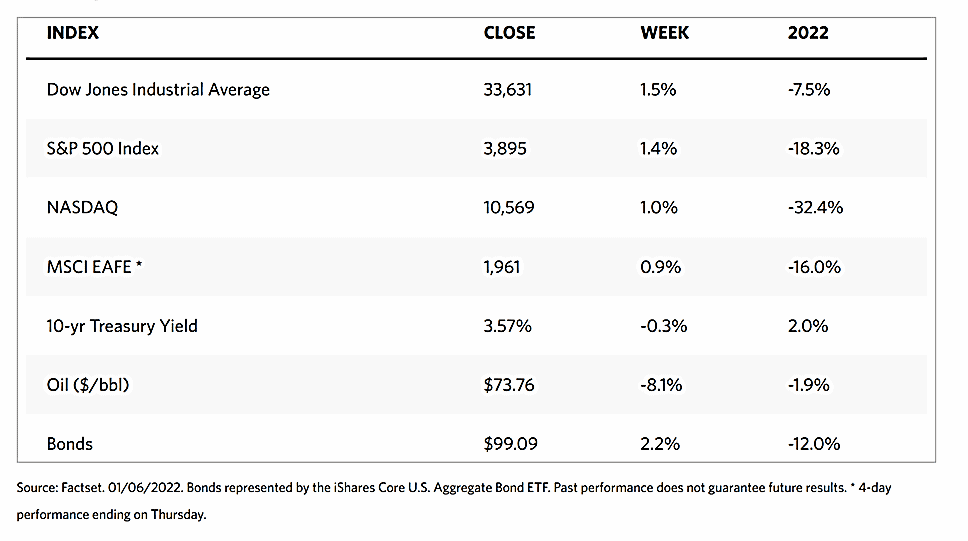

Over the past week, welcome economic news propped up the stock markets despite rising inflation and interest rate hikes. The stock markets rallied in reaction to an encouraging jobs report, sparking gains in the major indexes. According to the Wall Street Journal, the Dow Jones Industrial Average (DJIA) gained 1.46% while the total stock market index rose by 1.42%. The broad S&P 500 Index climbed by 1.45% and the technology-heavy Nasdaq Stock Market Composite increased by 0.98%. The NYSE Composite ascended by 2.34%. CBOE Volatility descended by 2.49%.

Outperforming the broad market are communication services stocks, helped by rallies in Netflix, Charter Communications, and Meta Platforms, the parent of Facebook. Trading volumes were noticeably low for this first trading week of the new year compared to the 2022 average volumes. The S&P 500 continued to traverse a relatively narrow band between 3,764 and 3,906 since December 16. The narrow trading may also be due to the shortened trading week, as the markets were closed on Monday in observance of the New Year holiday.

U.S. Economy

There were several closely watched reports during the week. Investors appear, through their reactions in the market, their preference for slowing growth and inflation rather than a robust economy. The Federal Reserve have signified its acceptance of such a trade-off. Reports released indicated a surprise increase in construction spending in December, which may partially explain the poor start of trading among the broad indexes on Tuesday. Tesla’s decline also played a role to weigh down the markets. The S&P 500 and Nasdaq 100 indexes also tumbled by 1% on Thursday morning due to payroll processing firm ADP’s tally of jobs in the private sector showing an increase of 235,000 in December. This number well exceeds expectations for approximately 150,000 and August’s recent low of 132,000. The weekly initial jobless claims likewise unexpectedly fell to 204,000, the lowest level this indicator has seen since September.

The official payrolls report released by the Labor Department on Friday seemed to reverse the negative sentiment in a positive direction. It raised the hopes that the economy may well be on its way to a so-called soft landing, or cooling inflation that avoids a significant recession. In December, non-farm payrolls increased by 223,000, the smallest increment in two years, but still above expectations. The separate household survey showed that the unemployment level returned to its post-pandemic low of 3.5% which was last recorded in September. The healthy job growth rate coincided with cooling growth in average hourly earnings, which rose by 0.3% in December, which is slightly below expectations. The November figure was revised lower; this brought the year-over-year increase down to 4.6%, its lowest level since September 2021. The labor participation rate climbed back to its recent high of 62.3%, indicating that the wage competition for workers might be easing. The level is still roughly a full percentage point below its pre-pandemic level of 67.3%, a peak reached in early 2000.

Metals and Mining

Gold prices returned to their six-month highs, thanks to the latest macro data out of the U.S., indicating that the economy is showing signs of cooling. At one point, the gold market was just $25 shy of its key $1,900 per ounce level on Friday, with the February Comex gold last at $1,873.40, for a weekly gain of 2.40%. The macroeconomic indicator that most impacted precious metals was the December U.S. job growth rate modestly slowing. Wage pressures coming down was the principal indicator that the economy was cooling and the significant driver for the strength in gold prices. The indicator was below the market’s expectation of 5% and dovetailed November’s downwardly revised 4.8% gain.

Week-on-week, precious metals spot prices were generally up. Gold came from the previous week’s price of $1,824.02 and ended this week at $1,865.69 per troy ounce for a gain of 28%. Silver suffered a slight loss of 0.50% as it made its way from the previous week’s close at $23.95 to this week’s close at $23.83 per troy ounce. Platinum gained 1.87% from its start at $1,074.29 to this week’s closing price of $1,094.33 per troy ounce. Palladium made its way from its week-ago price of $1,792.68 to this week’s closing price of $1,811.93 per troy ounce, gaining 1.07%. The three-month LME prices of base metals were also mostly up. Copper came from $8,418.00 to end this week at $8,589.50 per metric tonne, gaining 2.04%. Zinc gained 1.31% from its week-ago close at $2,984.50 to this week’s close at $3,023.50 per metric tonne. Aluminum lost 4.55% from the previous week’s price of $2,405.00 to this week’s price of $2,295.50 per metric tonne. Tin, which closed one week ago at $24,915.00, ended this week at $25,270.00 per metric tonne for a gain of 1.42%.

Energy and Oil

Oil prices are losing ground, and are projected for a 7% week-on-week decline on the back of fears of a recession in the U.S. and a problematic economic reopening in China due to rising coronavirus cases. Some of the downward pressure appears to have been offset by lower gasoline and distillate stocks in the U.S. brought about most likely by the recent bomb cyclone. These latest developments have not, however, been strong enough to push Brent prices back to levels above $80 per barrel. In the meantime, OPEC production has swelled as Nigerian oil production rebounded to lift OPEC’s collective oil output in December. The group added 120,000 barrels per day from levels in November, chalking up 29 million barrels per day which is still 800,000 barrels per day below its production quota.

Natural Gas

Tokyo Gas, Japan’s largest gas company, is reportedly at the end of negotiations for the $4.6 billion purchase of Rockcliff Energy, a U.S. natural gas producer. The deal includes debt, boosting its portfolio with 1 billion standard cubic feet (Bcf) of gas per day of production in the Haynesville shale play. In another part of the world, pipeline gas exports of Gazprom, Russia’s gas major, to the European continent decreased by more than 50% last year. Russia’s gas export to Europe totaled just 86.9 billion cubic meters (bcm). Future deliveries are expected to remain subdued in light of the Nord Stream explosions.

World Markets

European shares rallied on reports that the pace of inflation has slowed. The cost of natural gas has also receded to levels last seen before the Russian invasion of Ukraine. The pan-European STOXX Europe 600 Index closed the week higher by 4.6% week-on-week. Major stock indexes in the region also acquired significant gains. Italy’s FTSE MIB Index soared by 6.22%, France’s CAC 40 Index advanced by 5.98%, and Germany’s DAX Index climbed by 4.93%. The UK’s FTSE 100 gained 3.32%. Eurozone inflation descended below 10% for the first time in two months on the back of a decline in energy price increases. In December, consumer prices rose 9.2% year-over-year, which is below a FactSet consensus estimate of 9.7%. Nevertheless, core inflation (excluding volatile food, energy, alcohol, and tobacco prices) increased to 5.2% from only 5.0% in November.

Japanese stock returns turned southward for the week as the Nikkei Index slid by 0.46% and the broader TOPIX Index descended by 0.84%. Investors are worried about the global monetary policy tightening cycle and how this could lead to a recession. Sentiments were weighed down by the future trajectory of the Bank of Japan’s (BoJ’s) monetary policy, considering the surprise modification to its yield curve control announced in late December. Japanese authorities, meanwhile, continued to emphasize the importance of wage growth coming through, as Prime Minister Fumio Kishida urged companies to increase employees’ pay above the rate of inflation. Nominal wage growth in November was well below consensus expectations, drawing attention to the risks associated with inflation outpacing wage growth. This included the erosion of households’ purchasing power in an environment of low economic growth. Pay raises comprise a key pillar of the government’s “New Capitalism” agenda aimed at better distributing the fruits of economic growth.

Chinese stocks rallied amid reports that Hong Kong’s borders will reopen to the mainland and that Beijing was contemplating relaxing curbs on borrowing for the troubled property sector. The Shanghai Composite Index gained 2.21% while the blue-chip CSI 300 advanced by 2.82%, the highest index gains in weeks. Further support for property developers pushed investor sentiment after news emerged that Beijing may ease its stringent “three red lines” policy. Allegedly, the rule featured prominently in the government’s crackdown on the real estate sector in 2020. The policy included a series of debt thresholds that aimed at curbing leverage among developers intent on increasing borrowing. To boost demand, China is also considering a nationwide cap between 2.0% and 2.5% on real estate commissions. In a separate move, the People’s Bank of China announced that, if new home prices fall for three consecutive months, first-time homebuyers will be offered lower mortgage rates. To underscore its focus on prioritizing economic growth, the government has stepped up calls to expand fiscal spending while softening its policy stance for various industries, including internet platforms and coal imports.

The Week Ahead

Among the important economic data expected to be released this week are the CPI, hourly earnings growth, and initial and continuing jobless claims.

Key Topics to Watch

- NY Fed 1-year inflation expectations

- NY Fed 5-year inflation expectations

- Atlanta Fed President Raphael Bostic speaks

- Consumer credit

- NFIB small-business index

- Fed Chair Jerome Powell speaks to Sweden

- Wholesale inventories (revision)

- Philadelphia Fed President Patrick Harker speaks

- St Louis Fed President James Bullard speaks

- Consumer price index

- Core CPI

- CPI (year-over-year)

- Core CPI (year-over-year)

- CPI excluding shelter (3-month SAAR)

- Initial jobless claims

- Continuing jobless claims

- Federal budget

- Import price index

- UMich consumer sentiment index (early)

- UMich 1-year consumer inflation expectations

- UMich 5-year consumer inflation expectations

Markets Index Wrap Up