Stocks inched lower, with the S&P 500 declining 0.3% last week. The index is now up 6.2% year to date, up 14% from its October 12 closing low of 3,577.03, and down 15% from its January 3, 2022 closing high of 4,796.56.

“The bear market is over, but it is not the great reflation,“ Chris Harvey, head of equity strategy at Wells Fargo Securities, wrote on Monday. “We see neither a bull nor a bear market, just a market.“

Calling it a “‘just-a-market’ market,” Harvey said he expected “some giveback, but not a sharp near-term reversal.”

Indeed, we are hearing less from those who had previously forecast a big sell-off in the stock market in the early part of the year.

And while Harvey’s characterization of the stock market is a bit ambiguous, it isn’t paradoxical in the way many are viewing the economy.

An economy so good it’s bad

In last Sunday’s TKer, I discussed how bearish attitudes toward the economy were shifting bullish in the wake of strong economic data, noting that “it could take a few more weeks of resilient economic data before more economists officially revise their forecasts to the upside.“

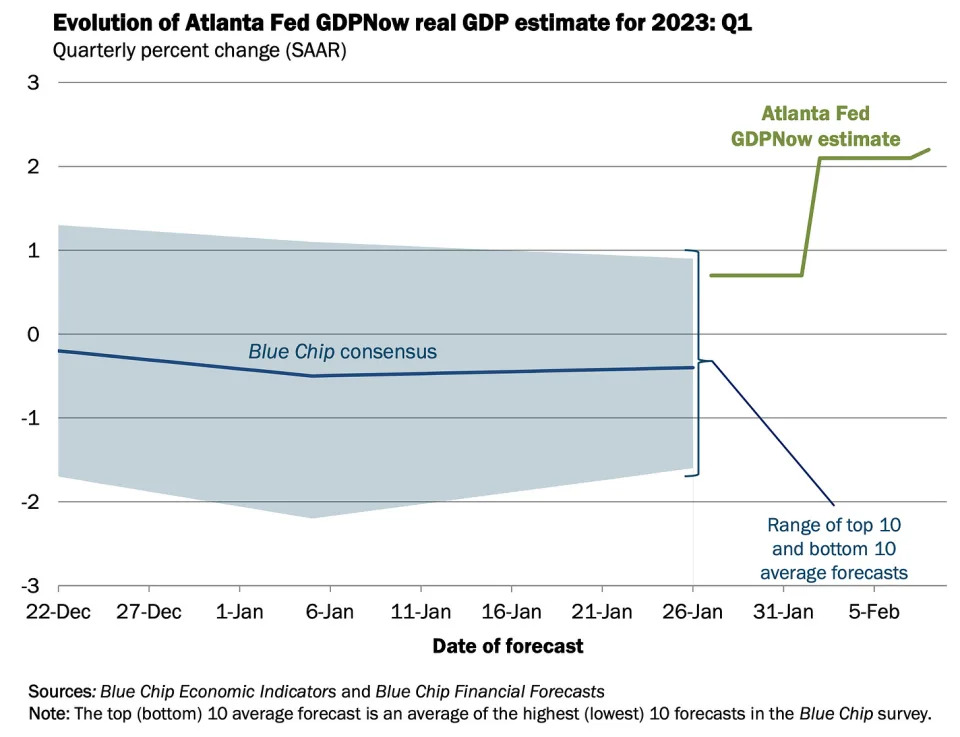

Well, those revisions are already coming in. Following Wednesday’s strong retail sales report, JPMorgan, Bank of America, and Deutsche Bank were among firms joining Goldman Sachs in revising up their near-term GDP forecasts or putting off their expectations for a recession.

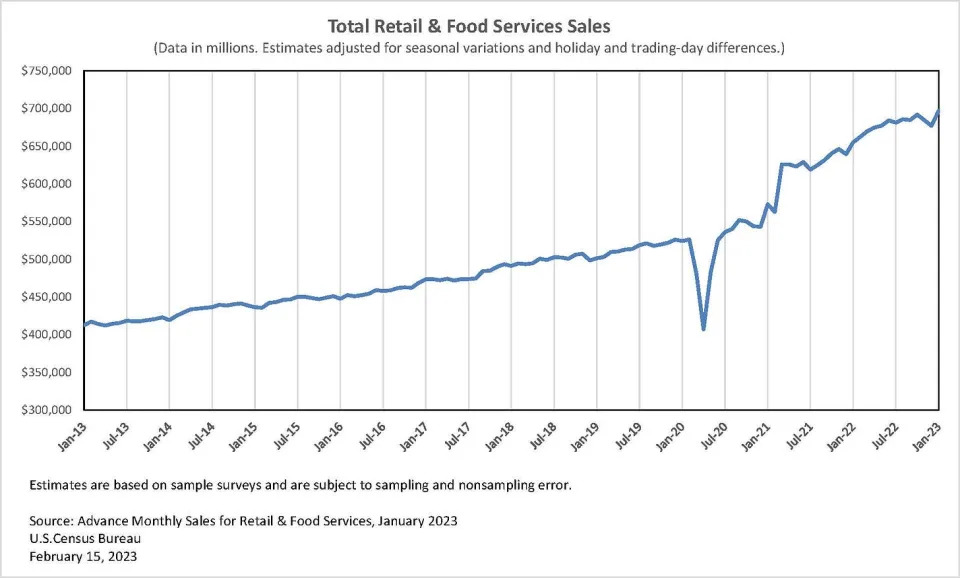

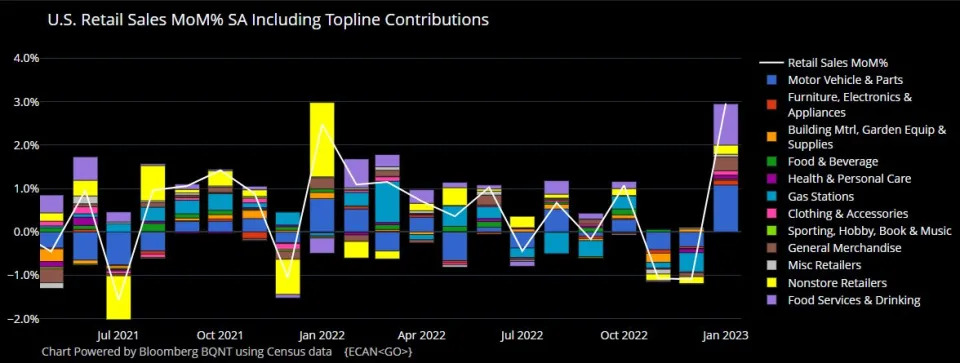

According to Census Bureau data, retail sales in January jumped 3.0% to a record $697 billion. This was the largest gain since March 2021, and it was much stronger than the 2.0% increase economists expected.

Excluding autos and gasoline, sales climbed an impressive 2.6% with gains in all retail categories.

The results were in line with Bank of America credit and debit card data released earlier this month showing an acceleration in spending.

After the retail sales report came out, the Atlanta Fed’s GDPNow model saw real GDP growth climbing at a 2.4% rate in Q1. This is up from 2.2% last week, and up considerably from its initial estimate of 0.7% growth as of January 27.

And it’s not just the hard data that’s looking rosier. The soft data seems to be reflecting a less pessimistic tone as well.

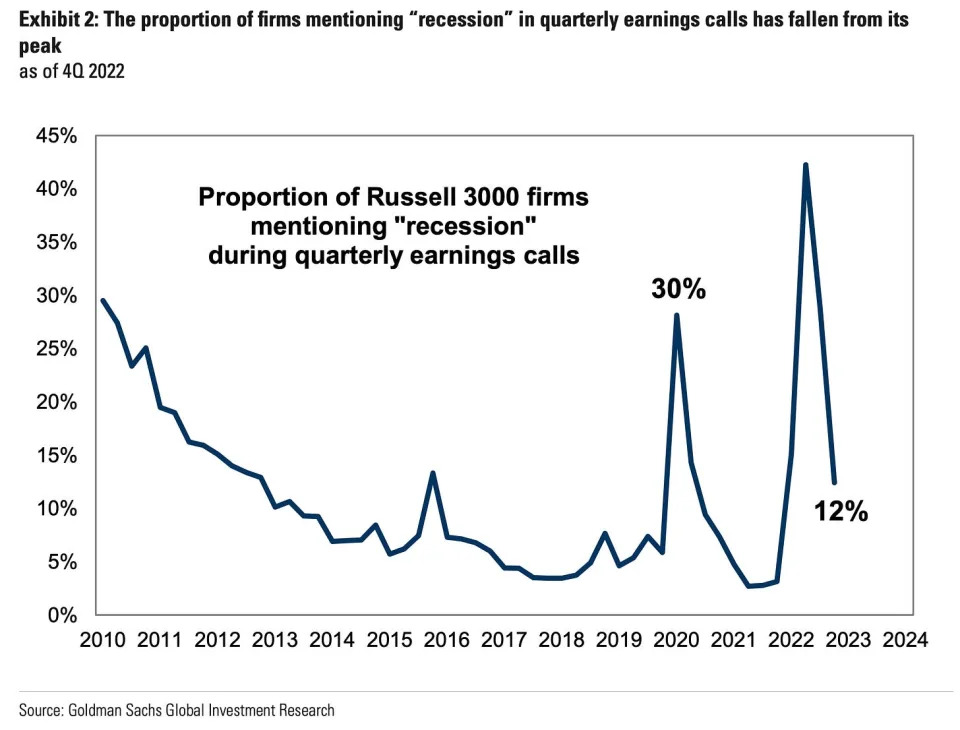

According to Goldman Sachs research published Tuesday, mentions of “recession” on quarterly earnings calls have fallen sharply.

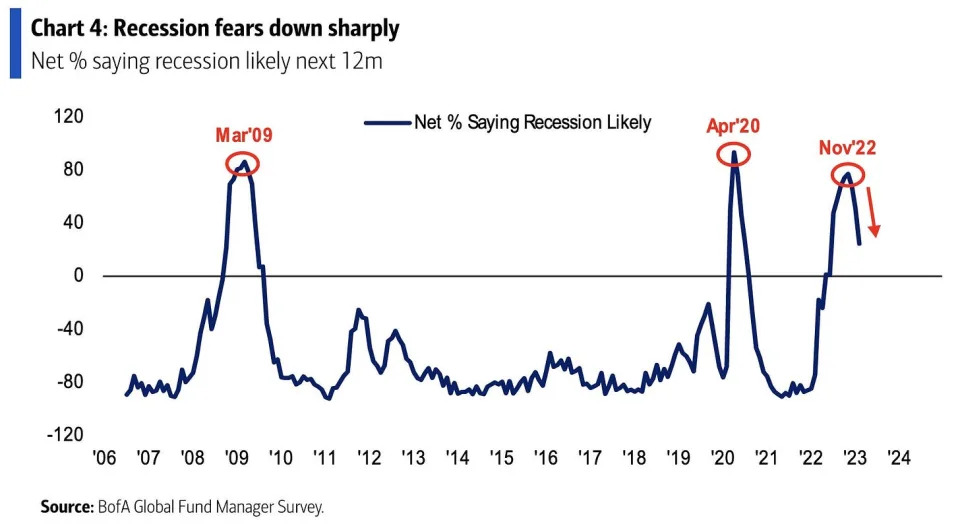

According to Bank of America’s Global Fund Manager Survey published Wednesday, “Recession odds peaked in Nov’22 at 77% and have since declined to 24% this month (down 27ppt MoM), lowest since Jun’22.“

Indeed, attitudes about economic growth have shifted to the upside.

To be fair, it’s difficult to quantify precisely what the economy will do in the very near future. But the confluence of data — including strong consumer finances and robust demand for workers — has been suggesting there was bias to the upside. For more, read: 9 reasons to be optimistic about the economy and markets

Unfortunately, many economists aren’t exactly thrilled as it puts at risk ongoing efforts to bring inflation.

Here’s the problem with all of this

The notion that good news about the economy is bad news for inflation has been renewed in the wake of very strong data on the labor market and consumer spending.

“My new take is good news is good news, great news is bad news,” Conor Sen, a columnist for Bloomberg Opinion, tweeted last week.

Accompanying many economists’ upward revisions to their economic growth forecasts were hawkish revisions to their expectations for the path of monetary policy: Deutsche Bank, UBS, Bank of America, and Goldman Sachs were among firms warning that the Fed would hike interest rates by more than previously anticipated as it extends its fight to bring down inflation.

And hawkish monetary policy represents headwinds for both the economy and the financial markets.