Bitcoin (BTC) climbed past $28,000 on Tuesday as the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) started its two-day monetary policy meeting to decide on whether to increase the interest rate again.

The CME FedWatch Tool shows currently that over 87% of traders are predicting a 25 basis point (bps) rate hike on Wednesday, which would set the federal funds target rate range to between 4.75% and 5%.

BTC, the largest cryptocurrency by market capitalization, was recently trading at about $28,050, roughly flat over the past 24 hours, although a brief midday jump had the BTC/U.S. dollar trading pair reaching as high as $28,605 on crypto exchange Coinbase – its highest point since June, data from TradingView showed.

“Risk appetite is rallying on optimism the Fed is almost done with tightening and that they will help prevent financial stability concerns from getting out of hand,” Edward Moya, senior market analyst at foreign exchange market maker Oanda, wrote in a Tuesday note.

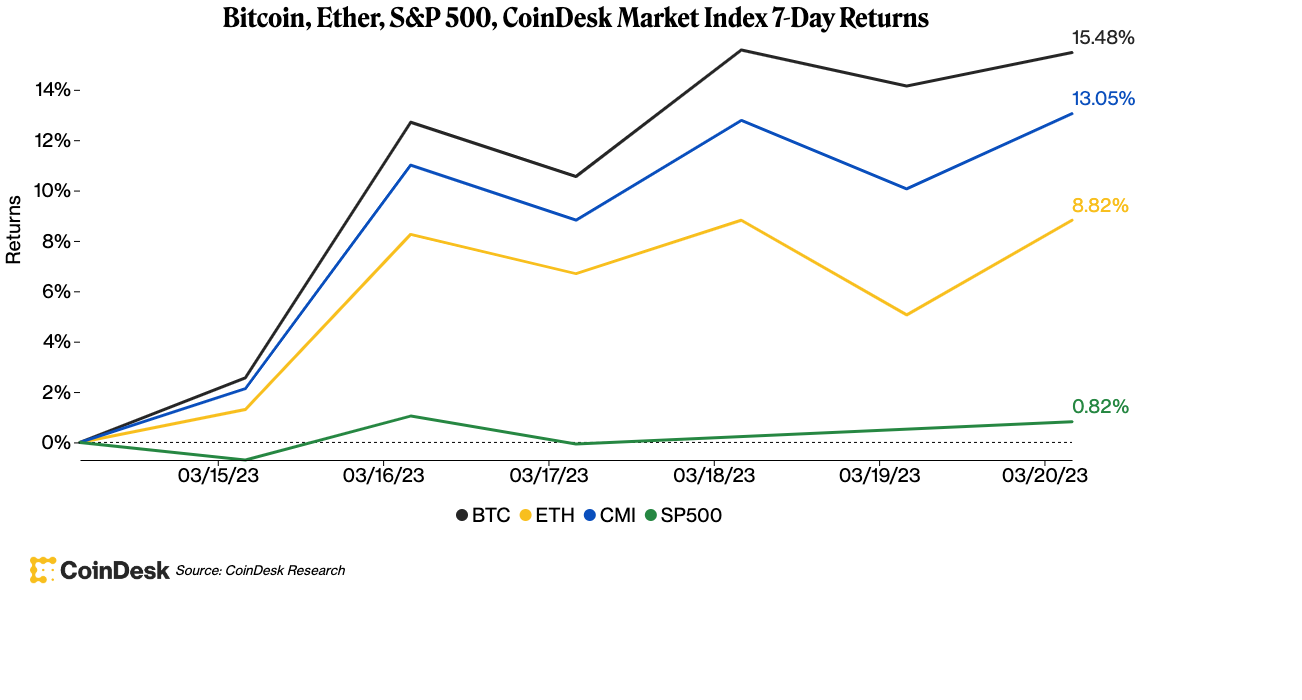

Bitcoin has surged more than 15% over the past seven days and 69% so far this year. A Galaxy Research report Monday noted that on a risk-adjusted basis, BTC outdid a range of securities, indices and commodity assets and is 2023’s best-performing asset.

Traditional markets also turned green amid a banking rally and improved investor optimism. The S&P 500 closed up 1.3%. The tech-heavy Nasdaq and the Dow Jones Industrial Average (DJIA) rose 1.5% and 0.9%, respectively.

Regional banking stocks rebounded amid at least a temporary easing of investor fears about the banking sector’s stability. Shares of First Republic Bank (FRC) closed up 29% after a Wall Street Journal report that JPMorgan CEO Jamie Dimon was working with other bankers to stabilize the embattled California-based institution. On Monday, First Republic Bank’s stock sank 47% and was downgraded for the second time in a week by S&P Global. Shares of Western Alliance Bancorporation (WAL) and Truist Financial Corp (TFC) jumped nearly 15% and 9%, respectively.

Beniamin Mincu, CEO of MultiversX, said in stressful times such as the current, banking near-meltdown, more people may “turn to viable alternatives that really exist.”

“It is precisely in this type of crisis that the necessities of a new type of money that is digital, fast, secure, transparent and accessible to everyone in the world become evident,” Mincu told CoinDesk via a Telegram message.

Yet, James Lavish, managing partner at Bitcoin Opportunity Fund, doesn’t think investors are ready to treat bitcoin as a safety asset.

“In reality, bitcoin continues to trade like a leading risk-on asset,” Lavish told CoinDesk in an email.

With many observers taking heart from UBS’s purchase of troubled rival Credit Suisse on Monday for $3.2 billion and a potential dovish turn by the Fed, “this has stopped a ton of shorts” of BTC and the price has “benefitted from that,” he added.

Singapore-based crypto options trading firm QCP Capital wrote in a Telegram broadcast Tuesday that if the Fed does “cede to market pricing and start forecasting cuts this year,” equities and crypto will “certainly continue their rally.”

“However, if they stick to their guns, trusting their ring-fencing to take care of the liquidity issue and choosing to ignore potential credit issues to come, then we will likely see a premature top for this BTC rally tomorrow,” QCP Capital added.

Ether (ETH), the second-largest cryptocurrency by market value, rose by nearly 2% to recently trade near $1,795. The CoinDesk Market Index, which measures the overall crypto market performance, was up 1.8% for the day.