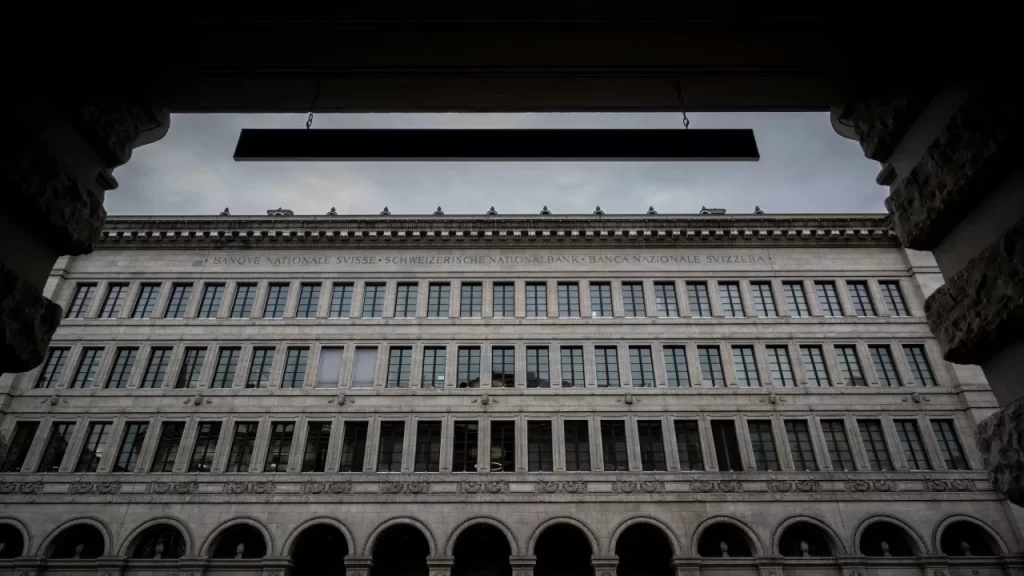

Switzerland’s banking crisis has been halted, the country’s central bank said Thursday as it hiked interest rates for the fourth time in a bid to contain inflation.

Together with the Swiss government and financial market regulator FINMA, the Swiss National Bank (SNB) helped orchestrate the emergency takeover of Credit Suisse (CS) by UBS (UBS)on Sunday to prevent the collapse of the country’s second-biggest bank.

“The measures announced at the weekend … have put a halt to the crisis,” the central bank said in a statement. “The SNB is providing large amounts of liquidity assistance in Swiss francs and foreign currencies. These loans are backed by collateral and subject to interest.”

Thursday’s half-a-percentage point hike takes Swiss interest rates to 1.5%, and was in line with the majority of forecasts in a Reuters poll of economists.

Swiss inflation stands at 3.4%, far above the Swiss National Bank’s target range of 0-2%.

“The latest rise in inflation is principally due to higher prices for electricity, tourism services and food. However, prices increases are now broad-based,” the SNB said in its statement. “It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term.”

The outlook for the Swiss economy was highly uncertain, however, given the risk of a global downturn and “adverse effects of the turmoil in the global financial sector.”

Credit Suisse was on the brink of collapse last week before the Swiss authorities stepped in, first with an emergency loan of central bank cash, followed by the initiation of frantic negotiations to secure a deal for the bank to be bought by its bigger rival.

The Sunday night rescue may have prevented the banking crisis from escalating, but it also left Swiss taxpayers on the hook for potential losses, and the SNB committed to providing huge loans should further help be required.

It also tarnished Switzerland’s reputation among some investors after FINMA agreed to wipe out the entire value of Credit Suisse’s riskier “alternative tier one” bonds, or AT1s, while allowing the bank’s shareholders to walk away with something from the deal.

Usually, equity holders are penalized before bondholders when a bank fails, and some investors are now considering legal action.

“The repercussions for Switzerland are terrible,” Arturo Bris, a professor of finance at Swiss business school IMD, told CNN. “For a start, the reputation of Switzerland has been damaged forever.”

FINMA defended its actions in a statement Thursday, saying they were based on the contractual terms of the bonds and an emergency law adopted by the Swiss government on Sunday.

The terms of Credit Suisse’s AT1 bonds stated that they would be completely written down in a “viability event,” and in particular if extraordinary government support was granted, it added.

“On Sunday, a solution could be found to protect clients, the financial center and the markets,” FINMA CEO Urban Angehrn said. “In this context, it is important that CS’s banking business continues to function smoothly and without interruption. That is now the case.”