A 14-month monetary tightening cycle that included 10 consecutive interest rate increases by the U.S. Federal Reserve has taken the federal funds rate to 5.25%, a level considered its probable stopping point.

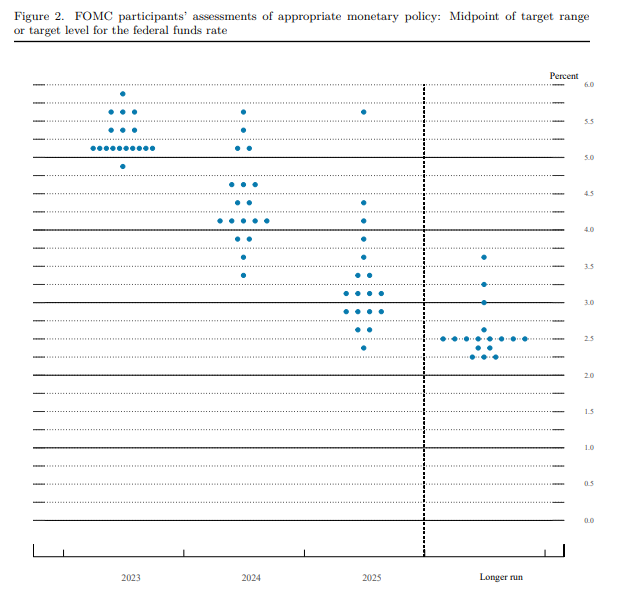

While some market observers expect interest rates to increase another 25-50 basis points in future, the Federal Open Market Committee (FOMC) “participants’ assessment of appropriate monetary policy” (aka the “Dot-Plot”), implies that 5.25% is appropriate.

The question for crypto markets is, “What’s next”?

Investors are ultimately concerned with the future value of the assets they own, more so than what affected that value in the past. Here are a few points worth considering.

First, volumes for BTC and ETH have been declining and trail their 20-day moving averages. The reduced activity implies that investors are staying on the sideline to a certain extent. As such, singular economic data points are having a muted impact on digital assets. Reduced activity also implies that BTC and ETH may trade within a range, absent asset specific catalyst. This scenario won’t provide a lot of immediate alpha, but also not a lot of downside misery.

Second, bitcoin and ether have largely decoupled from traditional assets. While bitcoin started 2023 with a daily correlation coefficient near 0.90 with the S&P 500, Nasdaq and Dow Jones Industrial Average (DJIA), those have all since declined to close to zero.

The lack of correlation between BTC and traditional assets implies that investors are viewing the impact of monetary policy differently for digital assets than for stocks, at least for the moment. BTC’s correlation with copper, the U.S. dollar and gold has declined as well.

It’s not abundantly evident what would cause such widespread decoupling, or how long it will remain. The re-emergence of BTC as an alternative to fiat currency debasement and ETH’s continued contracting supply are factors that may explain their separation from traditional assets.

Third, perpetual funding rates for BTC and ETH remain positive, an indication of bullishness. With the exception of sharp decline on the day of Silicon Valley Bank’s collapse, funding rates have been positive for the better part of 2023 for both cryptocurrencies.

Finally, “whales” are accumulating both bitcoin and ether. Their paths are different, but the supply held by addresses with more than 100,000 BTC and 100,000 ETH are moving higher. An interpretation of this trend is that entities with the most capital to deploy in crypto are allocating to both assets.

The trajectory for ETH appears to be a measured one, with a decline that began in September seemingly bottoming out on April 20. Bitcoin whales’ movements have been more dramatic, with sharp moves higher followed by declines.

All told, digital assets appear to have branched out on their own. While today’s economic news will have some impact on prices, the extent to which it does will likely differ from traditional financial assets.