Bitcoin (BTC) has chalked up a more than 20% price gain since last Thursday. The exuberant rally may now take a customary breather.

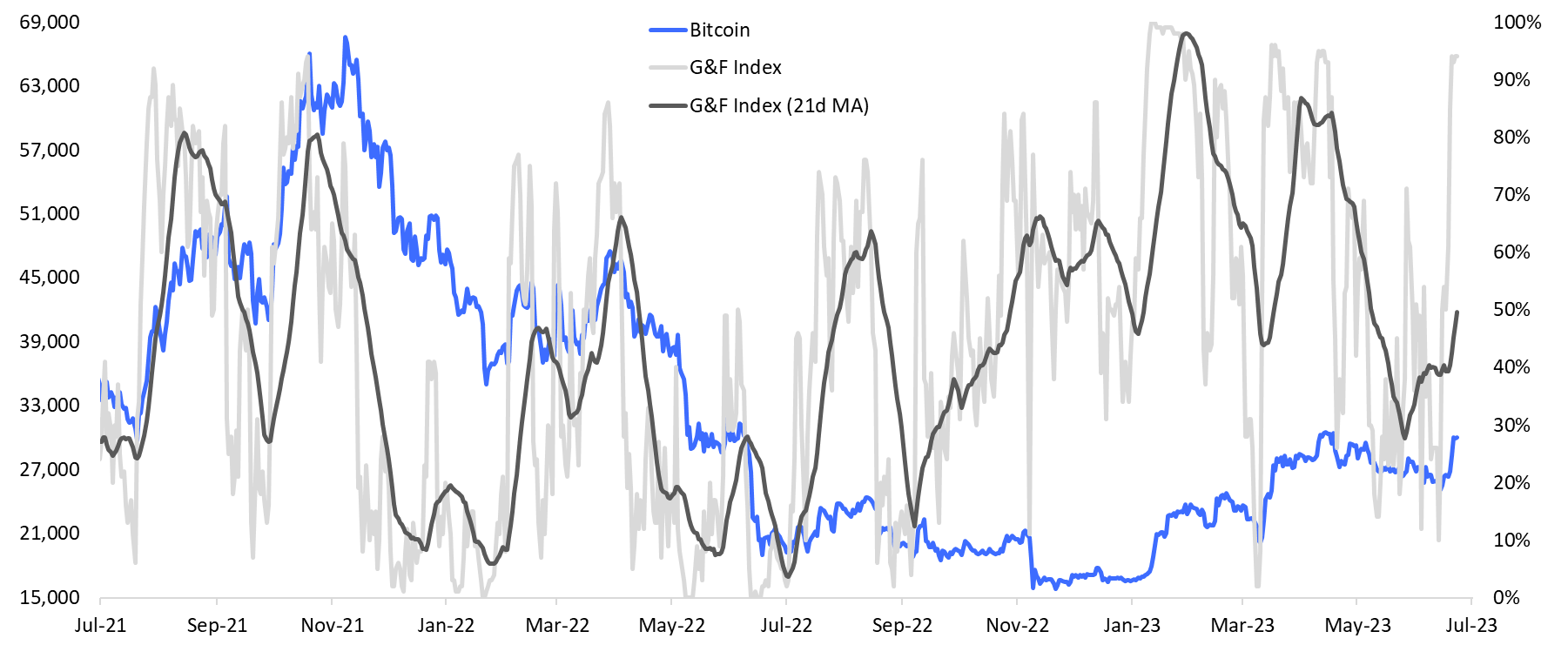

That’s the message from crypto services provider Matrixport’s bitcoin Greed & Fear Index (GFI), which has jumped from under 10% to 93% in roughly one week.

The index attempts to track the overriding market emotions, with above 90% readings signaling greed or excess optimism and below 10% figures representing extreme fear or pessimism.

“Our Bitcoin Greed & Fear Index has reached exuberant levels in record time. It could be well advised to lock in some gains for short-term traders,” Markus Thielen, head of research and strategy at Matrixport, said in an email.

Historically, an above 90% reading has coincided with interim bitcoin price tops and below 10% print has presaged price rallies.

The 21-day simple moving average of the index is well short of the 90% mark, which means the overall path of least resistance for the cryptocurrency remains on the higher side.

“The fact that the 21-day moving average (black line) is still rising could signal that bitcoin prices have more upside after the current phase of exuberant momentum is worked off with some consolidation,” Thielen added.

Some chart analysts suggest scope for a rally to $35,000 and higher.

“Price successfully bounced on that throwback area and completed the falling wedge setup. We have both the prior inverted head and shoulders target zone as well as the new falling wedge target zone. Additionally, we’ve got overhead pivot resistance around $38,000,” market analyst Josh Olszewicz told CoinDesk.

“So I expect prices to attempt a move towards the mid $30k range with heavy resistance and a reconsolidation before any move higher,” Olszewicz added.

Bitcoin’s pullback from the mid-April high of $31,000 to the former resistance-turned-support of $25,200 early this month represented a “throwback”. The pattern often accelerates the price rally, as it has in the past few days.

Bitcoin changed hands at $30,065 at press time, according to CoinDesk data.

Ether (ETH), the second-largest cryptocurrency by market value, has gained 15.9% since last Thursday, underperforming bitcoin by a notable margin. Ether’s GFI index is yet to reach 90%, meaning it could continue to rise, while bitcoin takes a breather.