- Wall Street firms have eased recession calls recently, but a mild downturn may actually be good for the housing market.

- A recession would likely push the Fed to ease monetary policy, and mortgage rates would fall.

- A mild recession could also bring down home prices as more supply becomes available.

A downturn typically hurts the economy across the board, but a mild recession could actually alleviate some of the recent pain Americans have been feeling in the historically expensive, competitive housing market.

For many Americans, buying a home hasn’t been affordable since the pandemic. With mortgage rates hovering near 7%, current owners are unwilling to part ways with the low rates they secured previously, exacerbating the home inventory shortage

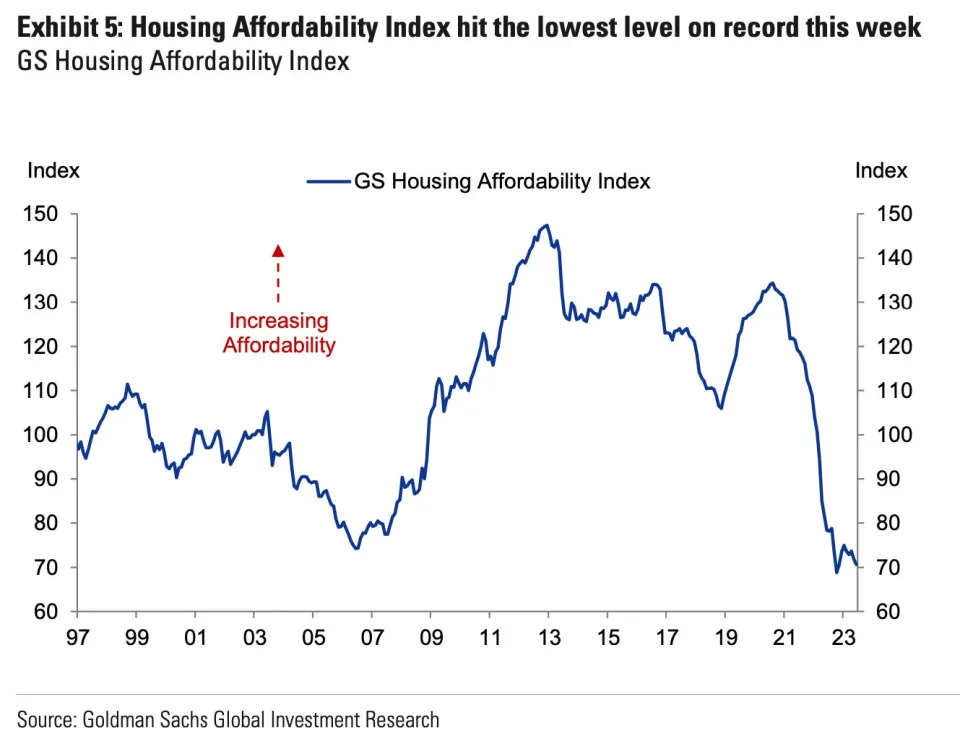

In June, the median sale price for the typical starter home reached an all-time high of $243,000. And in August, Goldman Sachs’ Housing Affordability Index hit a record-low.

Looser Fed policy

The Federal Reserve’s aggressive policy-tightening campaign has kept many homebuyers sidelined, with 11 interest rate hikes in the last 18 months.

In a mild recession scenario, however, central bankers would likely start moving in reverse with rate cuts, which could lead to lower mortgage rates and more affordable homes.

To be sure, home-buying demand could increase if the Fed cuts rates so swiftly that mortgage rates see a rapid decline. A flood of homebuyers looking to capitalize on lower rates could end up keeping prices elevated.

Home sales

In a recession, some Americans would lose their jobs as unemployment rises, which could lead many to sell their homes or face foreclosures. More available supply for house hunters could bring list prices down and minimize bidding wars.

It’s worth noting, too, that homeowners today are more financially resilient than in 2008, a time when anyone could secure a mortgage. This could help buoy home values enough to prevent a dramatic crash.

But avoiding a recession entirely would likely keep home demand strong and inventory tight — meaning the market stays unaffordable.

Jacob Channel, LendingTree’s senior economist, told Insider in a recent interview that the supply and demand dynamics of the current market are distorted, but it’s possible demand surges if mortgage rates dropped to about 5%.

“On one hand, more demand puts upward pressure on home prices,” he said. “But housing supply has decreased significantly, and that’s also because it’s become more costly to build and harder to get materials. But now supply chains are better and raw materials are decreasing in price. So we have two possible forces — demand could come back as rates decline, and supply could improve as building comes back.”